Market microstructure examines the mechanisms and processes that facilitate trading in financial markets, focusing on how order flow, trading protocols, and information asymmetry impact price formation and liquidity. The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, serving as a key indicator of market liquidity and transaction costs. Explore the interplay between market microstructure and bid-ask spreads to enhance your understanding of trading dynamics and optimize your trading strategies.

Why it is important

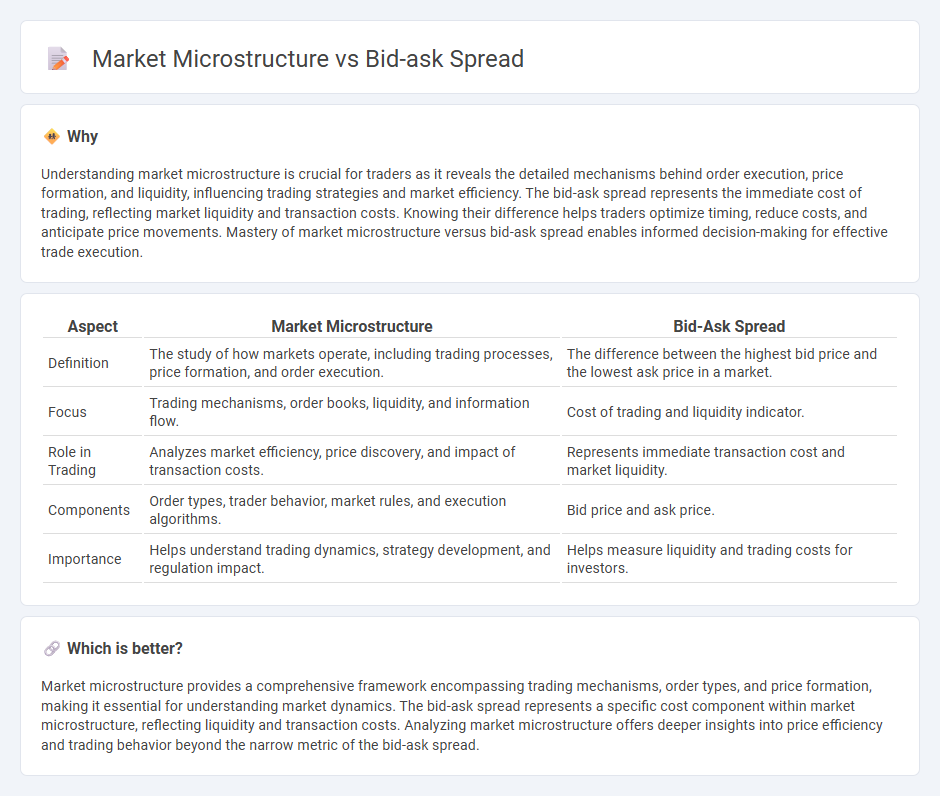

Understanding market microstructure is crucial for traders as it reveals the detailed mechanisms behind order execution, price formation, and liquidity, influencing trading strategies and market efficiency. The bid-ask spread represents the immediate cost of trading, reflecting market liquidity and transaction costs. Knowing their difference helps traders optimize timing, reduce costs, and anticipate price movements. Mastery of market microstructure versus bid-ask spread enables informed decision-making for effective trade execution.

Comparison Table

| Aspect | Market Microstructure | Bid-Ask Spread |

|---|---|---|

| Definition | The study of how markets operate, including trading processes, price formation, and order execution. | The difference between the highest bid price and the lowest ask price in a market. |

| Focus | Trading mechanisms, order books, liquidity, and information flow. | Cost of trading and liquidity indicator. |

| Role in Trading | Analyzes market efficiency, price discovery, and impact of transaction costs. | Represents immediate transaction cost and market liquidity. |

| Components | Order types, trader behavior, market rules, and execution algorithms. | Bid price and ask price. |

| Importance | Helps understand trading dynamics, strategy development, and regulation impact. | Helps measure liquidity and trading costs for investors. |

Which is better?

Market microstructure provides a comprehensive framework encompassing trading mechanisms, order types, and price formation, making it essential for understanding market dynamics. The bid-ask spread represents a specific cost component within market microstructure, reflecting liquidity and transaction costs. Analyzing market microstructure offers deeper insights into price efficiency and trading behavior beyond the narrow metric of the bid-ask spread.

Connection

Market microstructure directly influences the bid-ask spread by determining the trading mechanisms, order types, and information flow that affect liquidity and price discovery. Tight bid-ask spreads signal high market liquidity and efficient order matching within the microstructure framework, while wider spreads reflect higher transaction costs and informational asymmetries. Understanding how market microstructure elements like order book depth and trader behavior impact bid-ask spreads is essential for optimizing trading strategies and minimizing execution costs.

Key Terms

Liquidity

The bid-ask spread is a crucial indicator of market liquidity, representing the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Market microstructure examines the processes and mechanisms through which securities prices are formed, emphasizing how liquidity providers and market participants influence the bid-ask spread. Explore deeper insights into how liquidity dynamics shape price efficiency and trading costs in market microstructure.

Order Flow

The bid-ask spread serves as a crucial indicator within market microstructure, reflecting the cost of trading and liquidity influenced by order flow dynamics. Order flow, representing the sequence of buy and sell orders, directly impacts the spread by affecting price discovery and market depth. Explore how analyzing order flow enhances understanding of bid-ask spreads and market efficiency.

Price Discovery

The bid-ask spread serves as a critical indicator within market microstructure, reflecting transaction costs and liquidity levels which directly influence price discovery mechanisms. Narrow spreads typically suggest a more efficient market with higher liquidity, aiding accurate price formation, while wider spreads indicate potential informational asymmetry or lower liquidity. Explore how interplay between bid-ask spreads and market microstructure shapes the precision of price discovery in varying trading environments.

Source and External Links

Bid-Ask Spread | Formula + Calculator - Wall Street Prep - The bid-ask spread is the difference between the lowest asking price set by a seller and the highest bid price offered by a buyer; it reflects market supply and demand, and can be calculated by subtracting the bid price from the ask price.

Bid-ask spread - Wikipedia - The bid-ask spread measures the liquidity and transaction cost of securities, representing the difference between immediate sale (ask) and purchase (bid) prices, with liquidity suppliers earning the spread and demanders paying it.

Bid-Ask Spread: How It Works In Trading | Bankrate - The bid-ask spread is the difference between the highest price a buyer will pay and the lowest price a seller will accept, serving as a transaction cost benefiting market makers and indicating liquidity, with wider spreads common for less liquid securities.

dowidth.com

dowidth.com