Liquidity mining involves providing cryptocurrency assets to decentralized finance (DeFi) platforms to earn rewards, enhancing market depth and trading efficiency. Arbitrage exploits price differences of the same asset across multiple exchanges, allowing traders to profit from market inefficiencies with minimal risk. Explore our detailed guide to understand how liquidity mining and arbitrage strategies can optimize your trading portfolio.

Why it is important

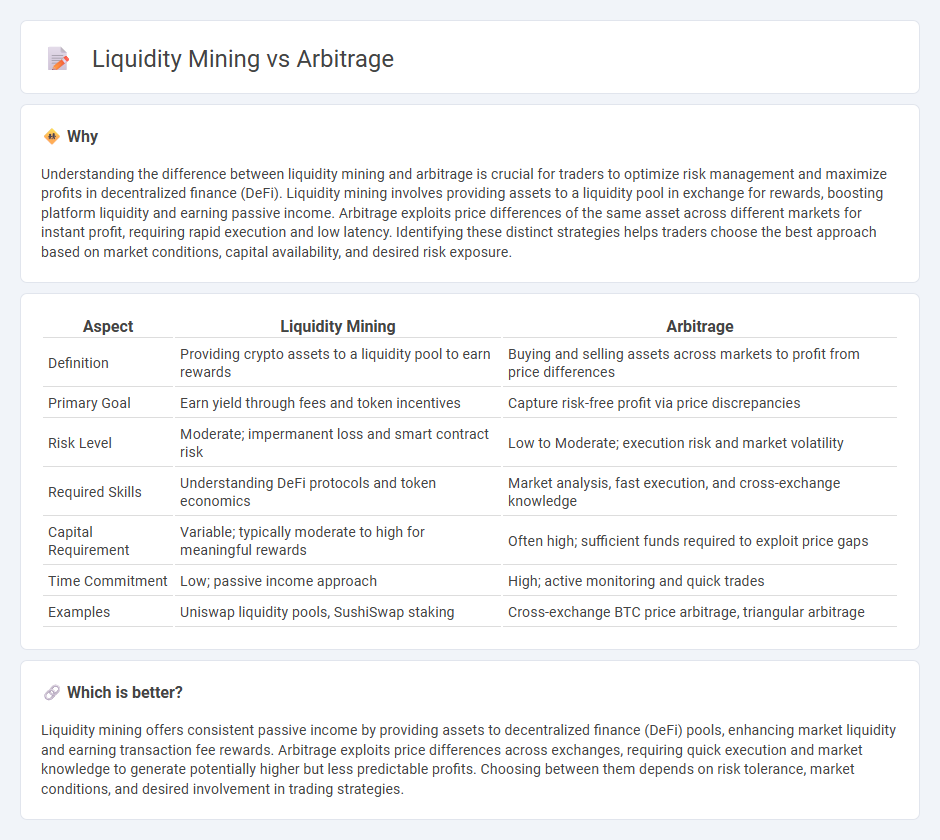

Understanding the difference between liquidity mining and arbitrage is crucial for traders to optimize risk management and maximize profits in decentralized finance (DeFi). Liquidity mining involves providing assets to a liquidity pool in exchange for rewards, boosting platform liquidity and earning passive income. Arbitrage exploits price differences of the same asset across different markets for instant profit, requiring rapid execution and low latency. Identifying these distinct strategies helps traders choose the best approach based on market conditions, capital availability, and desired risk exposure.

Comparison Table

| Aspect | Liquidity Mining | Arbitrage |

|---|---|---|

| Definition | Providing crypto assets to a liquidity pool to earn rewards | Buying and selling assets across markets to profit from price differences |

| Primary Goal | Earn yield through fees and token incentives | Capture risk-free profit via price discrepancies |

| Risk Level | Moderate; impermanent loss and smart contract risk | Low to Moderate; execution risk and market volatility |

| Required Skills | Understanding DeFi protocols and token economics | Market analysis, fast execution, and cross-exchange knowledge |

| Capital Requirement | Variable; typically moderate to high for meaningful rewards | Often high; sufficient funds required to exploit price gaps |

| Time Commitment | Low; passive income approach | High; active monitoring and quick trades |

| Examples | Uniswap liquidity pools, SushiSwap staking | Cross-exchange BTC price arbitrage, triangular arbitrage |

Which is better?

Liquidity mining offers consistent passive income by providing assets to decentralized finance (DeFi) pools, enhancing market liquidity and earning transaction fee rewards. Arbitrage exploits price differences across exchanges, requiring quick execution and market knowledge to generate potentially higher but less predictable profits. Choosing between them depends on risk tolerance, market conditions, and desired involvement in trading strategies.

Connection

Liquidity mining incentivizes traders to provide capital to decentralized exchanges, enhancing market depth and enabling smoother asset swaps. Arbitrage exploits price discrepancies across different platforms, relying on sufficient liquidity to execute rapid trades profitably. The symbiotic relationship between liquidity mining and arbitrage ensures efficient price discovery and optimal market functioning in decentralized finance ecosystems.

Key Terms

**Arbitrage:**

Arbitrage involves exploiting price differences of the same asset across different markets to generate risk-free profits by simultaneously buying low and selling high. This strategy requires rapid execution and monitoring of real-time market data to capitalize on temporary inefficiencies before they vanish. Discover how arbitrage can optimize your trading portfolio and enhance returns.

Price discrepancy

Arbitrage exploits price discrepancies between different markets by simultaneously buying low on one exchange and selling high on another, capturing risk-free profits. Liquidity mining involves providing assets to decentralized pools, earning rewards but facing impermanent loss due to price volatility and slippage. Explore the nuances between arbitrage and liquidity mining strategies to optimize returns in decentralized finance.

Spread

Arbitrage capitalizes on price discrepancies across different markets to earn profits by exploiting spreads, while liquidity mining involves providing assets to decentralized platforms to facilitate trading and earn rewards. The spread in arbitrage represents the gap between bid and ask prices, which directly influences potential returns, whereas in liquidity mining, spreads impact swap fees and the efficiency of asset swaps within liquidity pools. Explore deeper insights into how spread dynamics affect profitability and risks in both strategies.

Source and External Links

Arbitrage - Wikipedia - Arbitrage is the practice of taking advantage of price differences of the same or similar assets in two or more markets, involving simultaneous buying and selling to generate risk-free profit, typically used in financial markets by arbitrageurs.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy where an investor simultaneously buys and sells an asset in different markets to exploit price differences, with common types including pure arbitrage, merger arbitrage, and convertible arbitrage.

What is arbitrage and how does it work in financial markets - Arbitrage strategies include pure arbitrage, merger arbitrage, and triangular arbitrage, all involving exploiting price differences in various markets or currency pairs for profit.

dowidth.com

dowidth.com