High-frequency scalp bots execute rapid trades to capitalize on small price movements, leveraging algorithms that analyze market data within milliseconds to maximize profits. Position trading bots, in contrast, hold assets for extended periods, relying on trend analysis and fundamental data to make strategic decisions. Explore the key differences and benefits of these trading bots to optimize your investment strategy.

Why it is important

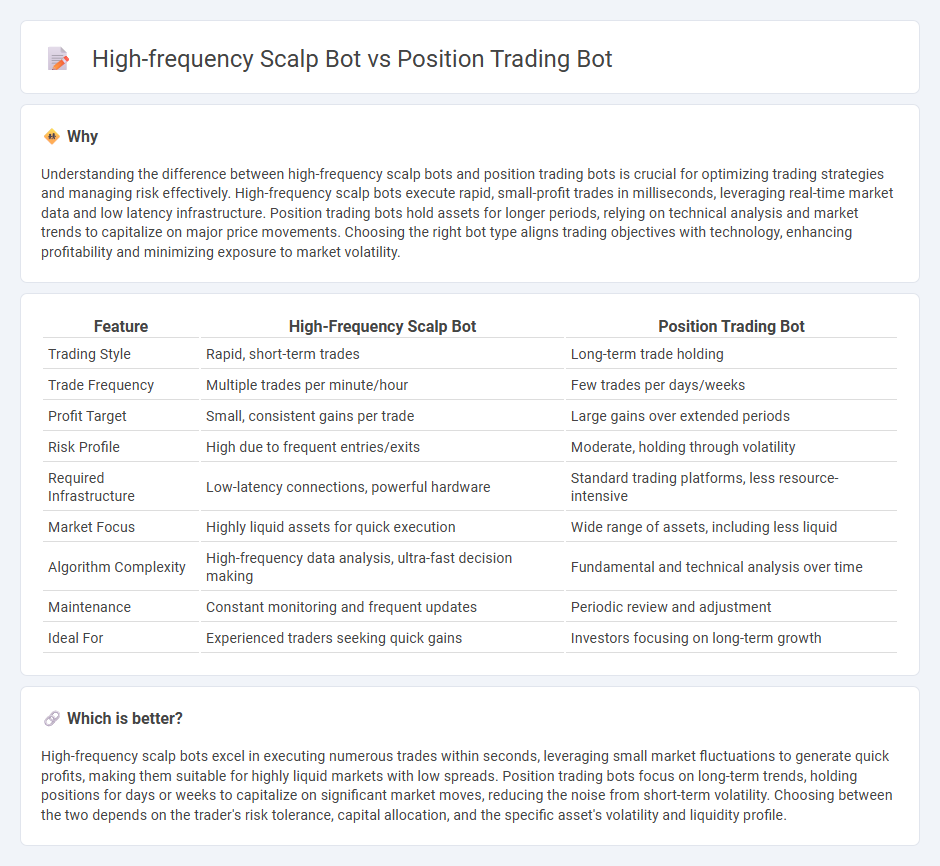

Understanding the difference between high-frequency scalp bots and position trading bots is crucial for optimizing trading strategies and managing risk effectively. High-frequency scalp bots execute rapid, small-profit trades in milliseconds, leveraging real-time market data and low latency infrastructure. Position trading bots hold assets for longer periods, relying on technical analysis and market trends to capitalize on major price movements. Choosing the right bot type aligns trading objectives with technology, enhancing profitability and minimizing exposure to market volatility.

Comparison Table

| Feature | High-Frequency Scalp Bot | Position Trading Bot |

|---|---|---|

| Trading Style | Rapid, short-term trades | Long-term trade holding |

| Trade Frequency | Multiple trades per minute/hour | Few trades per days/weeks |

| Profit Target | Small, consistent gains per trade | Large gains over extended periods |

| Risk Profile | High due to frequent entries/exits | Moderate, holding through volatility |

| Required Infrastructure | Low-latency connections, powerful hardware | Standard trading platforms, less resource-intensive |

| Market Focus | Highly liquid assets for quick execution | Wide range of assets, including less liquid |

| Algorithm Complexity | High-frequency data analysis, ultra-fast decision making | Fundamental and technical analysis over time |

| Maintenance | Constant monitoring and frequent updates | Periodic review and adjustment |

| Ideal For | Experienced traders seeking quick gains | Investors focusing on long-term growth |

Which is better?

High-frequency scalp bots excel in executing numerous trades within seconds, leveraging small market fluctuations to generate quick profits, making them suitable for highly liquid markets with low spreads. Position trading bots focus on long-term trends, holding positions for days or weeks to capitalize on significant market moves, reducing the noise from short-term volatility. Choosing between the two depends on the trader's risk tolerance, capital allocation, and the specific asset's volatility and liquidity profile.

Connection

High-frequency scalp bots and position trading bots are connected through their complementary roles in trading strategies, where scalp bots execute rapid trades to capitalize on small price movements and position bots manage longer-term market positions for sustained gains. Both bots utilize algorithmic trading techniques and real-time market data analysis to optimize trade entries and exits, enhancing overall portfolio performance. Integrating these bots allows traders to balance short-term liquidity exploitation with long-term market exposure, maximizing profitability in dynamic trading environments.

Key Terms

Timeframe

Position trading bots operate on longer timeframes, often holding trades for days, weeks, or even months, capitalizing on broader market trends and minimizing the impact of short-term volatility. High-frequency scalp bots execute numerous trades within seconds to minutes, exploiting minor price fluctuations and relying on ultra-fast order execution and low latency. Discover how different timeframes influence bot strategies and performance by exploring detailed comparisons.

Trade Frequency

Position trading bots execute fewer trades by holding assets over extended periods, capitalizing on long-term market trends and reducing transaction costs. High-frequency scalp bots perform numerous trades within seconds or minutes, exploiting small price fluctuations to generate rapid profits but incurring higher fees. Discover the optimal trading bot strategy tailored to your investment goals and market conditions.

Holding Period

A position trading bot maintains trades over days or weeks, capitalizing on long-term market trends and reducing the impact of short-term volatility, while a high-frequency scalp bot executes numerous trades within seconds or minutes to exploit minimal price fluctuations. Position trading bots prioritize robust market analysis and trend indicators, contrasting with scalp bots that rely on rapid execution, low latency, and tight bid-ask spreads. Discover more about optimizing trading strategies through comparative bot performance and risk management.

Source and External Links

LOOP Bot: Smart Position Trading with Profit Reinvestment - Bitsgap - LOOP Bot is designed for position trading over 2+ week horizons, combining automatic profit reinvestment and dual-currency earnings to build wealth steadily with fewer trades and dynamic risk management.

AI Crypto Trading Bots for Position Exchange (POSI) - CryptoRobotics - An AI-powered automated trading bot for Position Exchange (POSI) that trades cryptocurrencies using artificial intelligence to manage trades on uptrends and downtrends with multiple subscription plans.

Bots | Automated Trading from Option Alpha - A no-code trading bot platform for automated strategies in stocks and options, letting users control risk and test strategies with cloud-based automation tools and pre-built bot templates.

dowidth.com

dowidth.com