Smart Money Concepts focus on identifying institutional trading patterns and market manipulation, providing insights into price movements driven by large players. Fibonacci Retracement utilizes key ratios derived from the Fibonacci sequence to predict potential support and resistance levels in price trends. Explore these strategies further to enhance your trading analysis and decision-making skills.

Why it is important

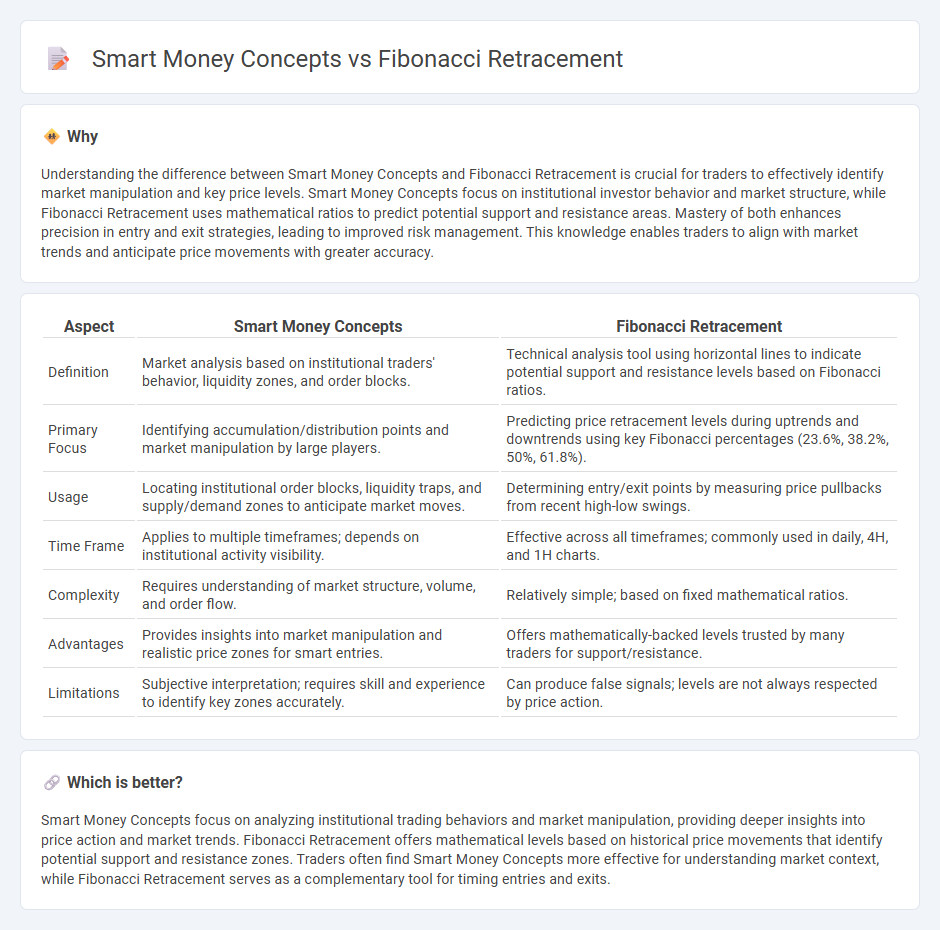

Understanding the difference between Smart Money Concepts and Fibonacci Retracement is crucial for traders to effectively identify market manipulation and key price levels. Smart Money Concepts focus on institutional investor behavior and market structure, while Fibonacci Retracement uses mathematical ratios to predict potential support and resistance areas. Mastery of both enhances precision in entry and exit strategies, leading to improved risk management. This knowledge enables traders to align with market trends and anticipate price movements with greater accuracy.

Comparison Table

| Aspect | Smart Money Concepts | Fibonacci Retracement |

|---|---|---|

| Definition | Market analysis based on institutional traders' behavior, liquidity zones, and order blocks. | Technical analysis tool using horizontal lines to indicate potential support and resistance levels based on Fibonacci ratios. |

| Primary Focus | Identifying accumulation/distribution points and market manipulation by large players. | Predicting price retracement levels during uptrends and downtrends using key Fibonacci percentages (23.6%, 38.2%, 50%, 61.8%). |

| Usage | Locating institutional order blocks, liquidity traps, and supply/demand zones to anticipate market moves. | Determining entry/exit points by measuring price pullbacks from recent high-low swings. |

| Time Frame | Applies to multiple timeframes; depends on institutional activity visibility. | Effective across all timeframes; commonly used in daily, 4H, and 1H charts. |

| Complexity | Requires understanding of market structure, volume, and order flow. | Relatively simple; based on fixed mathematical ratios. |

| Advantages | Provides insights into market manipulation and realistic price zones for smart entries. | Offers mathematically-backed levels trusted by many traders for support/resistance. |

| Limitations | Subjective interpretation; requires skill and experience to identify key zones accurately. | Can produce false signals; levels are not always respected by price action. |

Which is better?

Smart Money Concepts focus on analyzing institutional trading behaviors and market manipulation, providing deeper insights into price action and market trends. Fibonacci Retracement offers mathematical levels based on historical price movements that identify potential support and resistance zones. Traders often find Smart Money Concepts more effective for understanding market context, while Fibonacci Retracement serves as a complementary tool for timing entries and exits.

Connection

Smart money concepts leverage Fibonacci Retracement levels to identify key areas where institutional traders enter or exit positions, enhancing market timing and decision-making accuracy. These retracement levels highlight potential support and resistance zones that align with smart money accumulation and distribution patterns. Understanding this connection helps traders anticipate price reversals and align trades with market-moving forces.

Key Terms

Support and Resistance (Fibonacci Retracement)

Fibonacci Retracement identifies support and resistance levels by measuring key price points based on Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 78.6%), providing potential reversal zones within trending markets. Smart Money Concepts analyze order flow, liquidity zones, and institutional trading behavior to pinpoint dynamic support and resistance influenced by large market participants. Explore how combining Fibonacci retracement with smart money techniques enhances precision in detecting critical market levels and trade setups.

Liquidity (Smart Money Concepts)

Liquidity in Smart Money Concepts highlights areas where institutional traders seek to trigger stop-loss orders and accumulate positions, differing from Fibonacci Retracement which relies on mathematically derived levels to predict price reversals. Smart Money Concepts identify liquidity pools around key structural levels like previous highs, lows, and order blocks, providing more dynamic insights into market behavior. Explore deeper to understand how liquidity zones enhance precision in trading strategies beyond traditional Fibonacci techniques.

Order Blocks (Smart Money Concepts)

Fibonacci Retracement levels identify potential support and resistance zones based on key percentages derived from the Fibonacci sequence, whereas Smart Money Concepts emphasize Order Blocks as critical market areas where institutional traders accumulate or distribute positions, highlighting high-probability reversal points. Order Blocks represent areas of liquidity and price consolidation used by smart money to influence market direction, offering insights beyond the static Fibonacci levels by incorporating market structure and institutional behavior. Explore deeper into how combining Fibonacci Retracement with Order Blocks can enhance trading strategies for improved accuracy and timing.

Source and External Links

What Is A Fibonacci Retracement? - Fidelity Investments - Fibonacci retracement is a technical analysis tool that plots percentage retracement lines (0.0%, 23.6%, 38.2%, 50%, 61.8%, 100%) between two extreme points on a chart to identify potential support and resistance levels based on the Fibonacci sequence relationships.

The Fibonacci Retracements - Varsity by Zerodha - Fibonacci retracement helps identify price levels where a stock or asset may pull back or bounce during a trend, commonly retracing to key Fibonacci percentages like 38.2% or 61.8% before continuing in the original trend direction.

How to Use Fibonacci Retracements - Babypips.com - Fibonacci retracement levels are horizontal lines that indicate possible support and resistance where the price may reverse, and are most effective in trending markets to assist traders in timing entries on retracements within an ongoing trend.

dowidth.com

dowidth.com