Proprietary trading firms often face challenges such as strict risk management rules, high performance targets, and limited capital access, which can hinder trader growth. Trade allocation programs provide an alternative by distributing trades across multiple accounts, reducing individual risk and increasing capital exposure for traders. Explore the key differences and advantages to determine the best fit for your trading career.

Why it is important

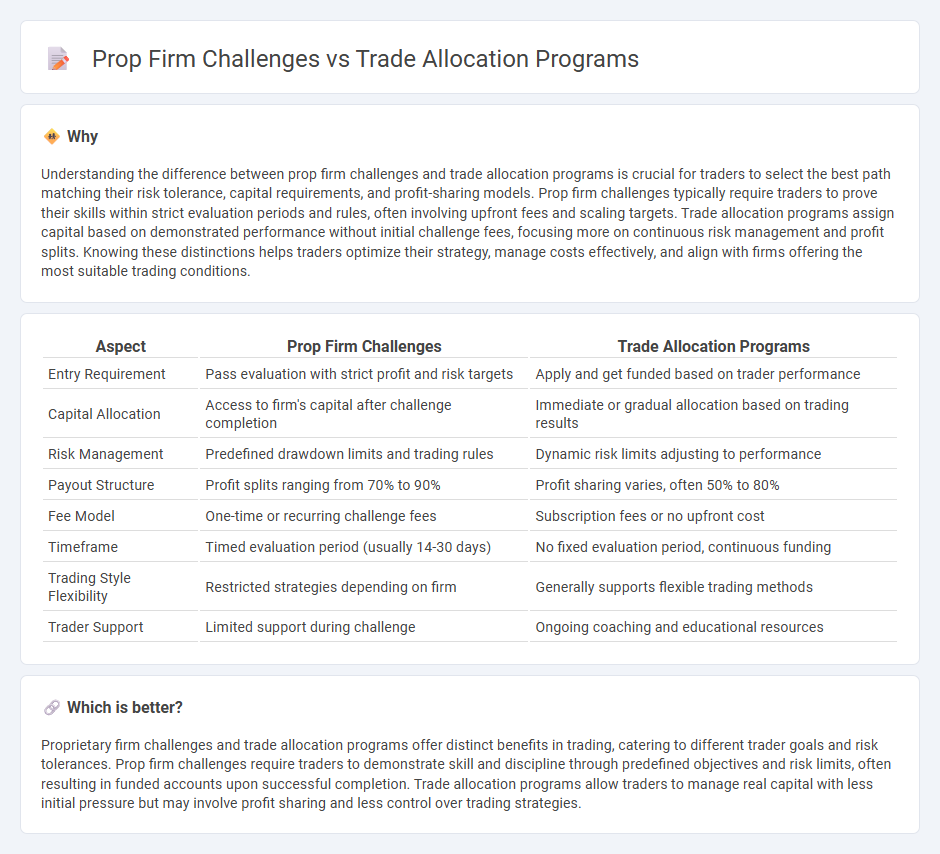

Understanding the difference between prop firm challenges and trade allocation programs is crucial for traders to select the best path matching their risk tolerance, capital requirements, and profit-sharing models. Prop firm challenges typically require traders to prove their skills within strict evaluation periods and rules, often involving upfront fees and scaling targets. Trade allocation programs assign capital based on demonstrated performance without initial challenge fees, focusing more on continuous risk management and profit splits. Knowing these distinctions helps traders optimize their strategy, manage costs effectively, and align with firms offering the most suitable trading conditions.

Comparison Table

| Aspect | Prop Firm Challenges | Trade Allocation Programs |

|---|---|---|

| Entry Requirement | Pass evaluation with strict profit and risk targets | Apply and get funded based on trader performance |

| Capital Allocation | Access to firm's capital after challenge completion | Immediate or gradual allocation based on trading results |

| Risk Management | Predefined drawdown limits and trading rules | Dynamic risk limits adjusting to performance |

| Payout Structure | Profit splits ranging from 70% to 90% | Profit sharing varies, often 50% to 80% |

| Fee Model | One-time or recurring challenge fees | Subscription fees or no upfront cost |

| Timeframe | Timed evaluation period (usually 14-30 days) | No fixed evaluation period, continuous funding |

| Trading Style Flexibility | Restricted strategies depending on firm | Generally supports flexible trading methods |

| Trader Support | Limited support during challenge | Ongoing coaching and educational resources |

Which is better?

Proprietary firm challenges and trade allocation programs offer distinct benefits in trading, catering to different trader goals and risk tolerances. Prop firm challenges require traders to demonstrate skill and discipline through predefined objectives and risk limits, often resulting in funded accounts upon successful completion. Trade allocation programs allow traders to manage real capital with less initial pressure but may involve profit sharing and less control over trading strategies.

Connection

Prop firm challenges serve as qualification benchmarks for traders to demonstrate their skills and risk management abilities, securing access to funded accounts. Trade allocation programs then distribute trading capital among qualified traders based on their performance in these challenges, optimizing profit potential and risk distribution. This connection ensures that only proficient traders receive significant capital, aligning incentives and increasing firm profitability.

Key Terms

Risk Management

Trade allocation programs efficiently distribute investment capital across multiple traders or strategies, minimizing individual risk exposure and enhancing portfolio diversification. Prop firm challenges emphasize rigorous risk management rules, often requiring traders to demonstrate consistent profitability and adherence to predefined drawdown limits. Explore detailed strategies to optimize risk control in both setups and enhance trading performance.

Capital Allocation

Trade allocation programs distribute capital across multiple traders or strategies to optimize portfolio performance and risk management, ensuring efficient use of funds and balanced exposure. Prop firm challenges focus on evaluating individual trader performance under specific conditions, determining eligibility for capital allocation within the firm's proprietary trading pool. Explore how these models impact capital allocation efficiency and trader opportunities to understand which suits your trading goals.

Performance Metrics

Trade allocation programs emphasize equitable distribution of trades across multiple accounts to ensure consistent execution and risk management, optimizing overall portfolio performance. Proprietary firm challenges prioritize rigorous performance metrics such as profit targets, drawdown limits, and risk-to-reward ratios to evaluate traders' abilities under real-market conditions. Explore detailed comparisons of these approaches to enhance your trading strategy effectiveness.

Source and External Links

Trade Allocation Manager - Genesis Global - A centralized multi-asset class solution automating trade allocations, fee management, and settlement costs to reduce manual inefficiencies and operational risks, enabling compliance with T+1 settlement requirements.

Managing Risks in Trade Allocation - ICI Mutual Insurance Company - Discusses risk management programs ensuring trade allocation decisions adhere to fiduciary principles, including methodologies like pro rata allocation tailored for fairness across client types.

Fixed Income Allocation: Tech Enables Equitable Bond Trades - IMTC - Describes technology that facilitates equitable fixed income trade allocations, enabling portfolio managers and compliance teams to optimize, audit, and automate allocation workflows with integration into trading platforms and custodians.

dowidth.com

dowidth.com