Quantitative backtesting evaluates a trading strategy's performance using historical market data to measure its effectiveness and robustness. Optimization fine-tunes the parameters of a trading model to enhance returns and reduce risks while avoiding overfitting. Explore deeper insights on how quantitative backtesting and optimization collectively improve trading strategy development.

Why it is important

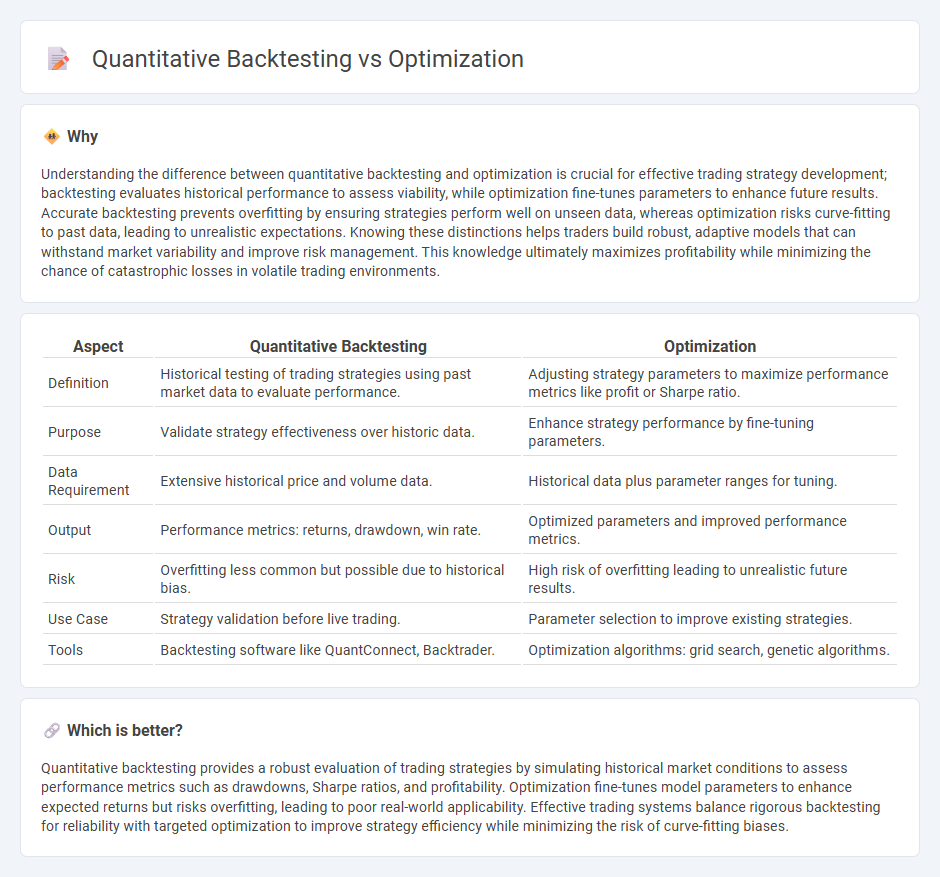

Understanding the difference between quantitative backtesting and optimization is crucial for effective trading strategy development; backtesting evaluates historical performance to assess viability, while optimization fine-tunes parameters to enhance future results. Accurate backtesting prevents overfitting by ensuring strategies perform well on unseen data, whereas optimization risks curve-fitting to past data, leading to unrealistic expectations. Knowing these distinctions helps traders build robust, adaptive models that can withstand market variability and improve risk management. This knowledge ultimately maximizes profitability while minimizing the chance of catastrophic losses in volatile trading environments.

Comparison Table

| Aspect | Quantitative Backtesting | Optimization |

|---|---|---|

| Definition | Historical testing of trading strategies using past market data to evaluate performance. | Adjusting strategy parameters to maximize performance metrics like profit or Sharpe ratio. |

| Purpose | Validate strategy effectiveness over historic data. | Enhance strategy performance by fine-tuning parameters. |

| Data Requirement | Extensive historical price and volume data. | Historical data plus parameter ranges for tuning. |

| Output | Performance metrics: returns, drawdown, win rate. | Optimized parameters and improved performance metrics. |

| Risk | Overfitting less common but possible due to historical bias. | High risk of overfitting leading to unrealistic future results. |

| Use Case | Strategy validation before live trading. | Parameter selection to improve existing strategies. |

| Tools | Backtesting software like QuantConnect, Backtrader. | Optimization algorithms: grid search, genetic algorithms. |

Which is better?

Quantitative backtesting provides a robust evaluation of trading strategies by simulating historical market conditions to assess performance metrics such as drawdowns, Sharpe ratios, and profitability. Optimization fine-tunes model parameters to enhance expected returns but risks overfitting, leading to poor real-world applicability. Effective trading systems balance rigorous backtesting for reliability with targeted optimization to improve strategy efficiency while minimizing the risk of curve-fitting biases.

Connection

Quantitative backtesting evaluates trading strategies using historical market data to measure performance and risk, providing a statistically sound basis for decision-making. Optimization refines these strategies by systematically adjusting parameters to maximize metrics like return, Sharpe ratio, or drawdown tolerance. Together, backtesting and optimization enable traders to develop robust, data-driven models with higher confidence in their real-world effectiveness.

Key Terms

Performance Metrics

Optimization in trading models enhances parameters to maximize specific performance metrics such as Sharpe ratio, drawdown, and win rate. Quantitative backtesting rigorously tests strategies against historical data to validate these metrics and identify realistic performance outcomes. Explore detailed analyses to understand how both approaches impact strategy reliability and risk management.

Parameter Tuning

Parameter tuning in optimization involves systematically adjusting model inputs to enhance performance metrics, often using algorithms such as grid search or gradient descent. Quantitative backtesting evaluates these parameter sets against historical market data to assess strategy robustness and profitability. Explore further insights on balancing optimization techniques with backtesting accuracy.

Historical Data

Optimization leverages historical data to fine-tune parameters for trading strategies, aiming to enhance performance metrics while avoiding overfitting. Quantitative backtesting uses historical data sets to simulate and evaluate strategy viability across varying market conditions, providing a robust statistical foundation. Explore further to understand how these methodologies improve trading precision and risk management.

Source and External Links

What Is Optimization Modeling? - IBM - Optimization modeling is a mathematical approach to finding the best solution from a set of choices by maximizing or minimizing an objective function under given constraints, widely used in industries like finance, logistics, and engineering to improve decision-making and efficiency.

Mathematical optimization - Wikipedia - Mathematical optimization involves selecting the best element with respect to some criteria from available alternatives, with subfields including discrete and continuous optimization, and uses algorithms such as the simplex method and evolutionary algorithms to find optimal or near-optimal solutions.

1. WHAT IS OPTIMIZATION? - University of Washington - Optimization is the process of maximizing or minimizing a function relative to choices available, focusing on problem modeling, analysis of solutions, and numerical methods to find and characterize optimal solutions under various conditions.

dowidth.com

dowidth.com