Funded account programs offer traders access to capital backed by proprietary firms, enabling them to trade with real money while minimizing personal financial risk. Robo-advisors employ algorithm-driven strategies to manage investments automatically, providing low-cost, hands-off portfolio management tailored to individual risk profiles. Explore the key differences and benefits of funded account programs versus robo-advisors to determine the best solution for your trading goals.

Why it is important

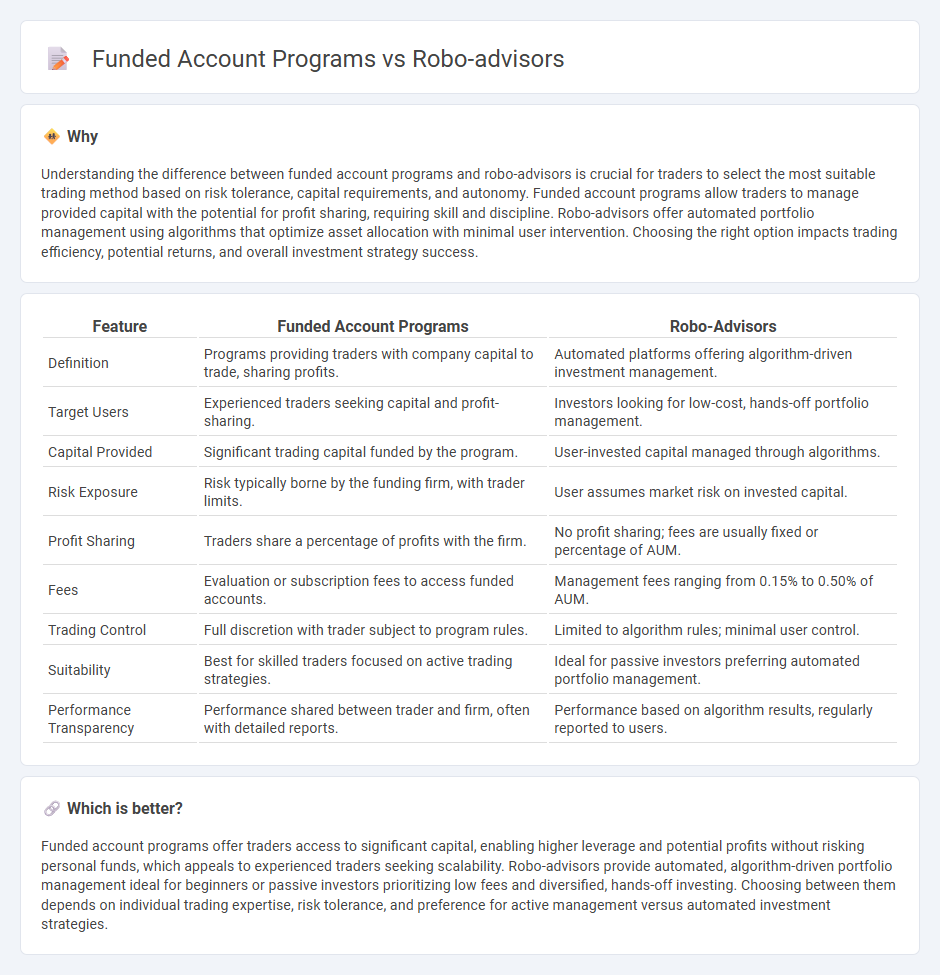

Understanding the difference between funded account programs and robo-advisors is crucial for traders to select the most suitable trading method based on risk tolerance, capital requirements, and autonomy. Funded account programs allow traders to manage provided capital with the potential for profit sharing, requiring skill and discipline. Robo-advisors offer automated portfolio management using algorithms that optimize asset allocation with minimal user intervention. Choosing the right option impacts trading efficiency, potential returns, and overall investment strategy success.

Comparison Table

| Feature | Funded Account Programs | Robo-Advisors |

|---|---|---|

| Definition | Programs providing traders with company capital to trade, sharing profits. | Automated platforms offering algorithm-driven investment management. |

| Target Users | Experienced traders seeking capital and profit-sharing. | Investors looking for low-cost, hands-off portfolio management. |

| Capital Provided | Significant trading capital funded by the program. | User-invested capital managed through algorithms. |

| Risk Exposure | Risk typically borne by the funding firm, with trader limits. | User assumes market risk on invested capital. |

| Profit Sharing | Traders share a percentage of profits with the firm. | No profit sharing; fees are usually fixed or percentage of AUM. |

| Fees | Evaluation or subscription fees to access funded accounts. | Management fees ranging from 0.15% to 0.50% of AUM. |

| Trading Control | Full discretion with trader subject to program rules. | Limited to algorithm rules; minimal user control. |

| Suitability | Best for skilled traders focused on active trading strategies. | Ideal for passive investors preferring automated portfolio management. |

| Performance Transparency | Performance shared between trader and firm, often with detailed reports. | Performance based on algorithm results, regularly reported to users. |

Which is better?

Funded account programs offer traders access to significant capital, enabling higher leverage and potential profits without risking personal funds, which appeals to experienced traders seeking scalability. Robo-advisors provide automated, algorithm-driven portfolio management ideal for beginners or passive investors prioritizing low fees and diversified, hands-off investing. Choosing between them depends on individual trading expertise, risk tolerance, and preference for active management versus automated investment strategies.

Connection

Funded account programs provide traders with capital to trade live markets, while robo-advisors use algorithm-driven strategies to manage investments automatically. Both rely on advanced technology and data analytics to optimize trading decisions and risk management. Integration of robo-advisory tools in funded account programs enhances performance monitoring and strategy automation for professional and retail traders.

Key Terms

Algorithmic Trading

Robo-advisors leverage algorithmic trading to automate portfolio management using pre-set rules and machine learning models, enabling cost-effective and efficient investment strategies. Funded account programs utilize algorithmic trading primarily through proprietary traders who execute strategies on capital provided by the firm, emphasizing performance-based risk management. Explore the nuances of algorithmic trading in both to optimize your investment approach.

Minimum Deposit

Robo-advisors typically require a minimum deposit ranging from $500 to $5,000, making them accessible for beginner investors seeking automated portfolio management. Funded account programs often demand higher minimum deposits, sometimes exceeding $10,000, as they involve active trading strategies managed by professionals. Explore the differences in deposit requirements and features to determine which investment approach aligns best with your financial goals.

Portfolio Management

Robo-advisors leverage advanced algorithms and AI-driven analytics to offer personalized portfolio management with lower fees and automatic rebalancing, making them ideal for hands-off investors seeking cost efficiency. Funded account programs provide professional portfolio management with human expertise, often tailored to specific investment goals and risk profiles, but usually involve higher fees and minimum deposit requirements. Explore the distinctions in portfolio management approaches to determine which solution aligns best with your financial objectives.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are automated financial advisers that provide personalized investment management online through algorithms crafted by experts, offering cost-effective portfolio allocation mainly in ETFs with minimal human intervention.

What is a robo advisor? | Robo advisory services - Fidelity Investments - Robo-advisors use technology to automate investing strategies based on investor's risk tolerance and financial goals, providing affordable digital financial advice and ongoing portfolio rebalancing.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors blend automated algorithmic asset allocation with some financial planning tools and optional human advisor access, aiming to deliver tailored portfolios at lower fees than traditional wealth management.

dowidth.com

dowidth.com