Order flow analysis focuses on real-time market transactions to gauge supply and demand dynamics, enabling traders to anticipate price movements with precision. Value investing emphasizes evaluating a company's fundamentals and intrinsic worth to identify undervalued assets for long-term growth. Explore how mastering both strategies can enhance your trading performance and investment decisions.

Why it is important

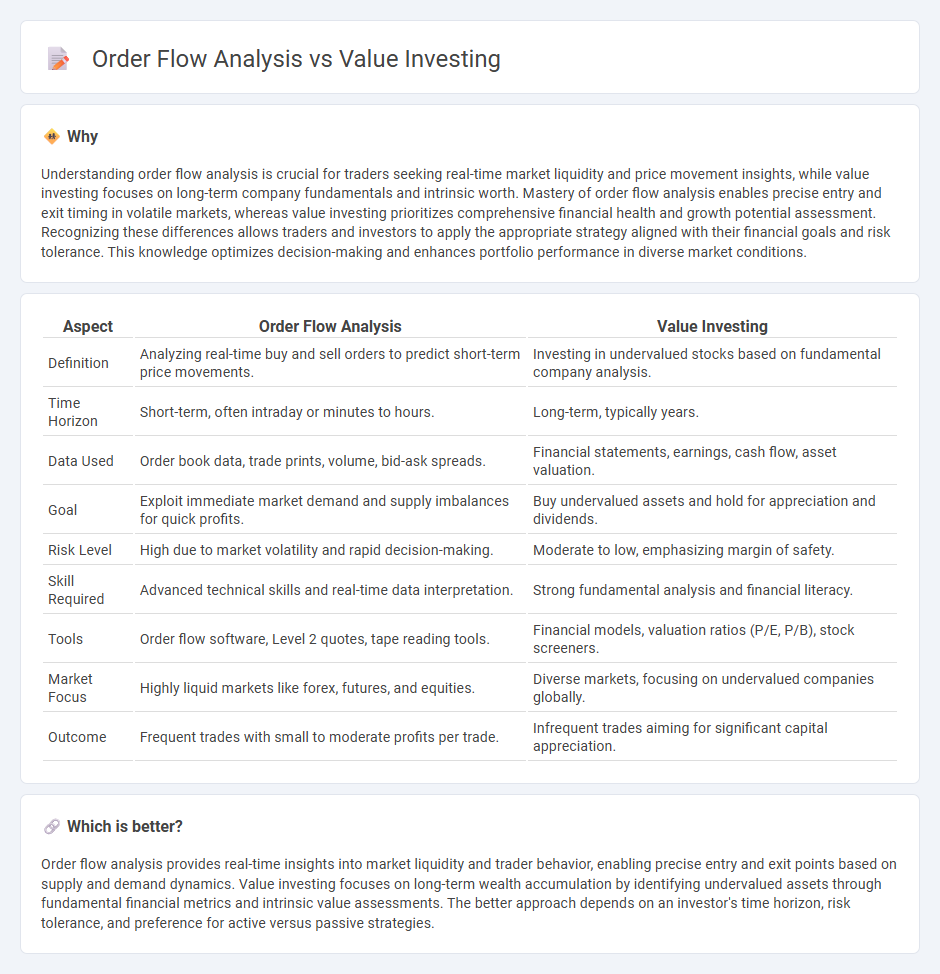

Understanding order flow analysis is crucial for traders seeking real-time market liquidity and price movement insights, while value investing focuses on long-term company fundamentals and intrinsic worth. Mastery of order flow analysis enables precise entry and exit timing in volatile markets, whereas value investing prioritizes comprehensive financial health and growth potential assessment. Recognizing these differences allows traders and investors to apply the appropriate strategy aligned with their financial goals and risk tolerance. This knowledge optimizes decision-making and enhances portfolio performance in diverse market conditions.

Comparison Table

| Aspect | Order Flow Analysis | Value Investing |

|---|---|---|

| Definition | Analyzing real-time buy and sell orders to predict short-term price movements. | Investing in undervalued stocks based on fundamental company analysis. |

| Time Horizon | Short-term, often intraday or minutes to hours. | Long-term, typically years. |

| Data Used | Order book data, trade prints, volume, bid-ask spreads. | Financial statements, earnings, cash flow, asset valuation. |

| Goal | Exploit immediate market demand and supply imbalances for quick profits. | Buy undervalued assets and hold for appreciation and dividends. |

| Risk Level | High due to market volatility and rapid decision-making. | Moderate to low, emphasizing margin of safety. |

| Skill Required | Advanced technical skills and real-time data interpretation. | Strong fundamental analysis and financial literacy. |

| Tools | Order flow software, Level 2 quotes, tape reading tools. | Financial models, valuation ratios (P/E, P/B), stock screeners. |

| Market Focus | Highly liquid markets like forex, futures, and equities. | Diverse markets, focusing on undervalued companies globally. |

| Outcome | Frequent trades with small to moderate profits per trade. | Infrequent trades aiming for significant capital appreciation. |

Which is better?

Order flow analysis provides real-time insights into market liquidity and trader behavior, enabling precise entry and exit points based on supply and demand dynamics. Value investing focuses on long-term wealth accumulation by identifying undervalued assets through fundamental financial metrics and intrinsic value assessments. The better approach depends on an investor's time horizon, risk tolerance, and preference for active versus passive strategies.

Connection

Order flow analysis provides real-time insights into market supply and demand dynamics, revealing the intentions of large institutional traders. Value investing relies on identifying undervalued assets based on fundamental metrics such as price-to-earnings ratio and intrinsic value. Combining order flow analysis with value investing enhances decision-making by aligning qualitative fundamentals with quantitative market behavior signals.

Key Terms

Fundamental Analysis

Value investing centers on analyzing a company's intrinsic value using financial statements, earnings reports, and macroeconomic factors to identify undervalued stocks with long-term growth potential. Order flow analysis examines real-time buy and sell orders to gauge market sentiment and short-term price movements, primarily focusing on liquidity and supply-demand dynamics. Explore the key differences and practical applications of these strategies to optimize your investment approach.

Trade Volume

Trade volume plays a crucial role in order flow analysis by providing real-time insights into market liquidity and trader behavior, helping identify potential price movements and trading opportunities. In contrast, value investing emphasizes intrinsic value and fundamental analysis of assets rather than short-term trade volume fluctuations. Explore deeper differences and practical applications between these strategies for a comprehensive understanding.

Intrinsic Value

Value investing emphasizes intrinsic value by analyzing fundamental financial metrics such as earnings, cash flow, and book value to identify undervalued stocks with long-term growth potential. Order flow analysis, on the other hand, concentrates on real-time market data, including trade volumes and liquidity, to gauge short-term price movements and market sentiment. Explore more to understand how combining intrinsic value assessment with order flow insights can enhance investment strategies.

Source and External Links

Value investing - Wikipedia - Value investing is an investment approach focused on buying securities undervalued according to fundamental analysis, rooted in the philosophy of Benjamin Graham and David Dodd, emphasizing buying stocks below their intrinsic value with a margin of safety to reduce risk.

What is value investing? | iShares - BlackRock - Value investing targets companies that are cheap compared to their true worth, using metrics such as price-to-book, forward price-to-earnings, and enterprise value to cash flow to identify undervalued stocks, and can be accessed via ETFs for diversified exposure.

Value Investing History | Columbia Business School - Developed by Benjamin Graham and David Dodd at Columbia Business School in the 1920s, value investing is based on estimating the intrinsic value of securities to buy stocks priced significantly below that value, with the expectation market price will eventually reflect true worth.

dowidth.com

dowidth.com