Order flow analysis provides real-time insights into buying and selling pressure by examining individual transactions on the order book, enabling traders to gauge market sentiment and potential price movements. Market profile organizes price and volume data into a time-based distribution, highlighting key support and resistance levels to identify value areas and market trends. Explore in-depth strategies and applications of order flow analysis versus market profile to enhance your trading precision.

Why it is important

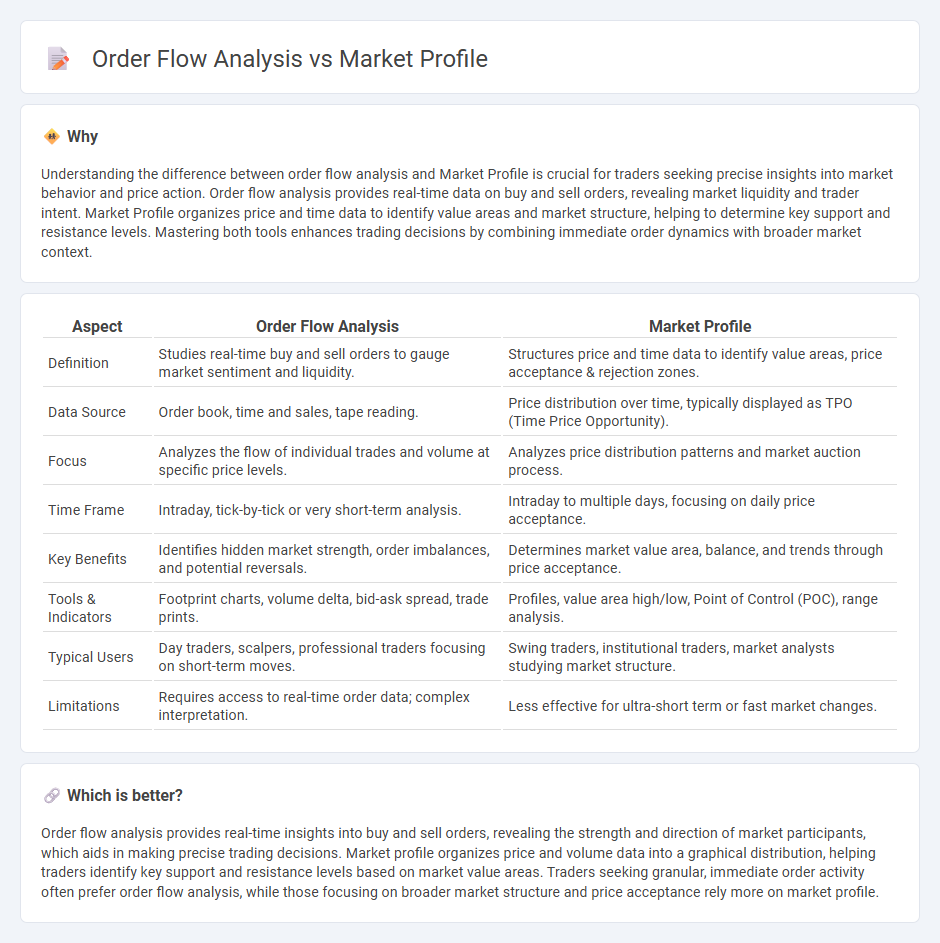

Understanding the difference between order flow analysis and Market Profile is crucial for traders seeking precise insights into market behavior and price action. Order flow analysis provides real-time data on buy and sell orders, revealing market liquidity and trader intent. Market Profile organizes price and time data to identify value areas and market structure, helping to determine key support and resistance levels. Mastering both tools enhances trading decisions by combining immediate order dynamics with broader market context.

Comparison Table

| Aspect | Order Flow Analysis | Market Profile |

|---|---|---|

| Definition | Studies real-time buy and sell orders to gauge market sentiment and liquidity. | Structures price and time data to identify value areas, price acceptance & rejection zones. |

| Data Source | Order book, time and sales, tape reading. | Price distribution over time, typically displayed as TPO (Time Price Opportunity). |

| Focus | Analyzes the flow of individual trades and volume at specific price levels. | Analyzes price distribution patterns and market auction process. |

| Time Frame | Intraday, tick-by-tick or very short-term analysis. | Intraday to multiple days, focusing on daily price acceptance. |

| Key Benefits | Identifies hidden market strength, order imbalances, and potential reversals. | Determines market value area, balance, and trends through price acceptance. |

| Tools & Indicators | Footprint charts, volume delta, bid-ask spread, trade prints. | Profiles, value area high/low, Point of Control (POC), range analysis. |

| Typical Users | Day traders, scalpers, professional traders focusing on short-term moves. | Swing traders, institutional traders, market analysts studying market structure. |

| Limitations | Requires access to real-time order data; complex interpretation. | Less effective for ultra-short term or fast market changes. |

Which is better?

Order flow analysis provides real-time insights into buy and sell orders, revealing the strength and direction of market participants, which aids in making precise trading decisions. Market profile organizes price and volume data into a graphical distribution, helping traders identify key support and resistance levels based on market value areas. Traders seeking granular, immediate order activity often prefer order flow analysis, while those focusing on broader market structure and price acceptance rely more on market profile.

Connection

Order flow analysis provides real-time insight into buying and selling pressure by tracking executed trades, while Market Profile organizes this data into a structured time-price framework revealing value areas and market equilibrium. Combining order flow with Market Profile enables traders to identify key support and resistance levels and anticipate market moves based on volume distribution and trade aggressiveness. This integration enhances decision-making by offering a detailed view of market dynamics beyond traditional price charts.

Key Terms

Volume at Price (Market Profile)

Volume at Price within Market Profile provides a visual representation of traded volume distribution across price levels, revealing key value areas and price acceptance zones. Order Flow Analysis complements this by examining real-time transaction data to interpret trader behavior and market sentiment at each price point. Explore how integrating both techniques can enhance your trading precision and market insights.

Bid-Ask Spread (Order Flow)

Market profile offers a visual distribution of price over time, highlighting market structure but lacks real-time insight into liquidity dynamics. Order flow analysis, emphasizing the bid-ask spread, reveals immediate buying and selling pressure by tracking actual order execution and depth of market. To dive deeper into how bid-ask spreads influence trading strategies, explore comprehensive order flow tools and techniques.

Time Price Opportunity (TPO)

Market Profile uses Time Price Opportunity (TPO) to visually represent price and time distribution, helping traders identify value areas, points of control, and market sentiment. Order Flow Analysis focuses on the real-time dynamics of buy and sell orders, revealing the underlying supply and demand to gauge momentum and potential reversals. Explore deeper insights on how TPO enhances trading strategies by integrating Market Profile with Order Flow Analysis.

Source and External Links

What Is Market Profile? - NinjaTrader - Market Profile is a charting tool that plots the volume of transactions at each price level to reveal supply and demand interactions, helping traders identify key support and resistance levels as well as market sentiment on both short- and long-term time frames.

What is the Market Profile? - Jim Dalton Trading - Market Profile organizes auction market data into a distribution that compares price and time, using TPOs (time-price opportunities) to graphically show market activity and the two-way auction process driving price movements.

Market Profile Trading: Understanding its Power and Impact - Market Profile Trading offers a detailed view of market structure, price distribution, and trading activity over time to provide insights into trends, risk management, and market sentiment, making it popular among both institutional and retail traders.

dowidth.com

dowidth.com