Order flow analysis focuses on real-time market data to track the exact buying and selling activity, offering traders precise insights into supply and demand dynamics. Swing trading relies on identifying medium-term price patterns and trends over days or weeks to capitalize on market momentum. Explore the key differences and advantages of both strategies to enhance your trading performance.

Why it is important

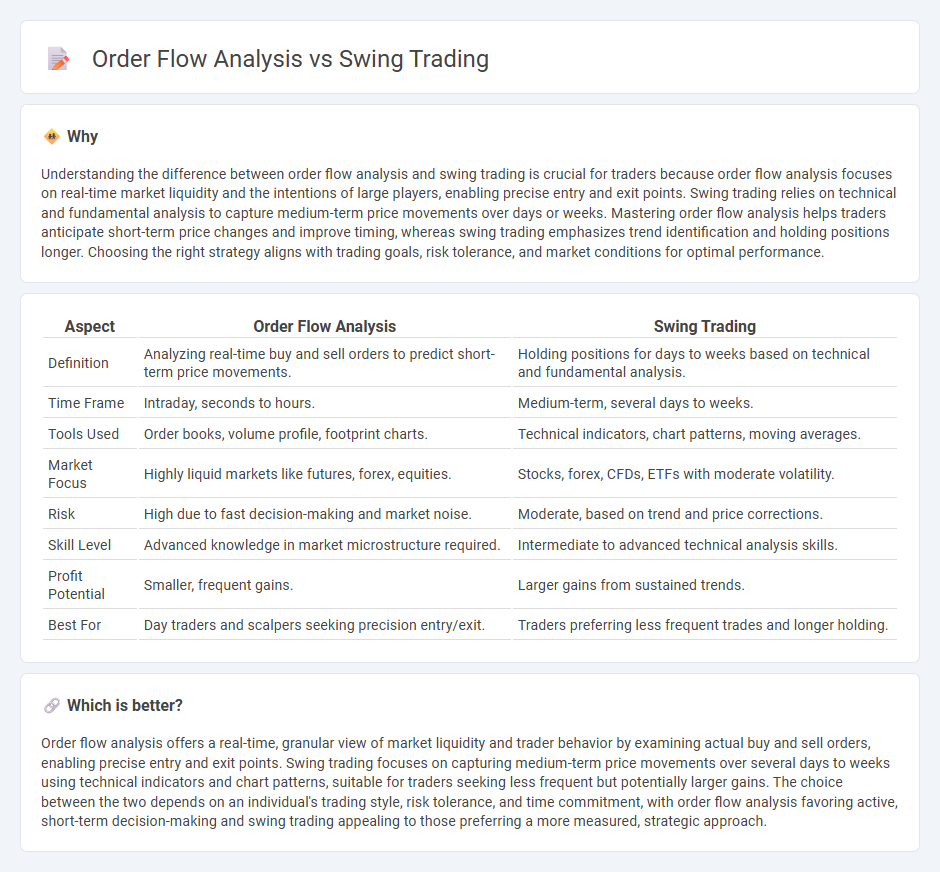

Understanding the difference between order flow analysis and swing trading is crucial for traders because order flow analysis focuses on real-time market liquidity and the intentions of large players, enabling precise entry and exit points. Swing trading relies on technical and fundamental analysis to capture medium-term price movements over days or weeks. Mastering order flow analysis helps traders anticipate short-term price changes and improve timing, whereas swing trading emphasizes trend identification and holding positions longer. Choosing the right strategy aligns with trading goals, risk tolerance, and market conditions for optimal performance.

Comparison Table

| Aspect | Order Flow Analysis | Swing Trading |

|---|---|---|

| Definition | Analyzing real-time buy and sell orders to predict short-term price movements. | Holding positions for days to weeks based on technical and fundamental analysis. |

| Time Frame | Intraday, seconds to hours. | Medium-term, several days to weeks. |

| Tools Used | Order books, volume profile, footprint charts. | Technical indicators, chart patterns, moving averages. |

| Market Focus | Highly liquid markets like futures, forex, equities. | Stocks, forex, CFDs, ETFs with moderate volatility. |

| Risk | High due to fast decision-making and market noise. | Moderate, based on trend and price corrections. |

| Skill Level | Advanced knowledge in market microstructure required. | Intermediate to advanced technical analysis skills. |

| Profit Potential | Smaller, frequent gains. | Larger gains from sustained trends. |

| Best For | Day traders and scalpers seeking precision entry/exit. | Traders preferring less frequent trades and longer holding. |

Which is better?

Order flow analysis offers a real-time, granular view of market liquidity and trader behavior by examining actual buy and sell orders, enabling precise entry and exit points. Swing trading focuses on capturing medium-term price movements over several days to weeks using technical indicators and chart patterns, suitable for traders seeking less frequent but potentially larger gains. The choice between the two depends on an individual's trading style, risk tolerance, and time commitment, with order flow analysis favoring active, short-term decision-making and swing trading appealing to those preferring a more measured, strategic approach.

Connection

Order flow analysis enhances swing trading by providing real-time insight into market liquidity and trader intentions, enabling swing traders to identify optimal entry and exit points within price swings. By examining the volume and aggressiveness of buy and sell orders, swing traders can confirm trend strength or anticipate reversals, increasing trade accuracy. Integrating order flow data with swing trading strategies improves timing and risk management, leading to more informed decisions and higher profitability.

Key Terms

Entry & Exit Points

Swing trading relies on identifying price patterns and trends across several days to weeks to determine optimal entry and exit points. Order flow analysis examines real-time buy and sell orders to gauge market sentiment and momentum, allowing traders to pinpoint precise moments for trade execution. Discover how combining these strategies can enhance your trading accuracy and profitability.

Volume Profile

Volume Profile offers a detailed visualization of trading activity at various price levels, enhancing swing trading decisions by identifying key support and resistance zones. Order flow analysis complements this by revealing real-time transaction data, confirming market sentiment and potential reversals. Explore the synergy between Volume Profile and order flow analysis to refine your swing trading strategy.

Trade Duration

Swing trading typically involves holding positions from several days to weeks, capitalizing on medium-term market trends, whereas order flow analysis focuses on real-time transaction data to make short-term trading decisions often within minutes or hours. Trade duration in swing trading allows traders to exploit broader price movements using technical and fundamental analysis, while order flow traders rely on the immediate dynamics of supply and demand reflected in order book activity. Explore deeper into how these timeframes impact strategy performance and risk management.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where assets are held for days to weeks to profit from price swings, using technical analysis or fundamental analysis for buy and sell signals, with a focus on momentum and rule-based trading systems to manage entries and exits.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading involves profiting from short-term price changes by buying on dips and shorting on rises, relying mainly on technical and some fundamental analysis, and suits investors who can actively adjust positions over days to weeks.

Swing Trading Stocks: Strategies and Indicators - Charles Schwab - Swing traders use support and resistance, price patterns, and technical indicators like moving averages and oscillators to determine trade entry, exit, and size, often trading with the broader trend and managing trades actively.

dowidth.com

dowidth.com