Trade journaling software captures detailed records of individual trades, including entry and exit points, emotions, and market conditions, enhancing trader self-awareness and decision-making. Backtesting software analyzes historical market data to evaluate the effectiveness of trading strategies, allowing traders to optimize approaches before risking real capital. Explore the key differences and benefits to determine which tool best supports your trading success.

Why it is important

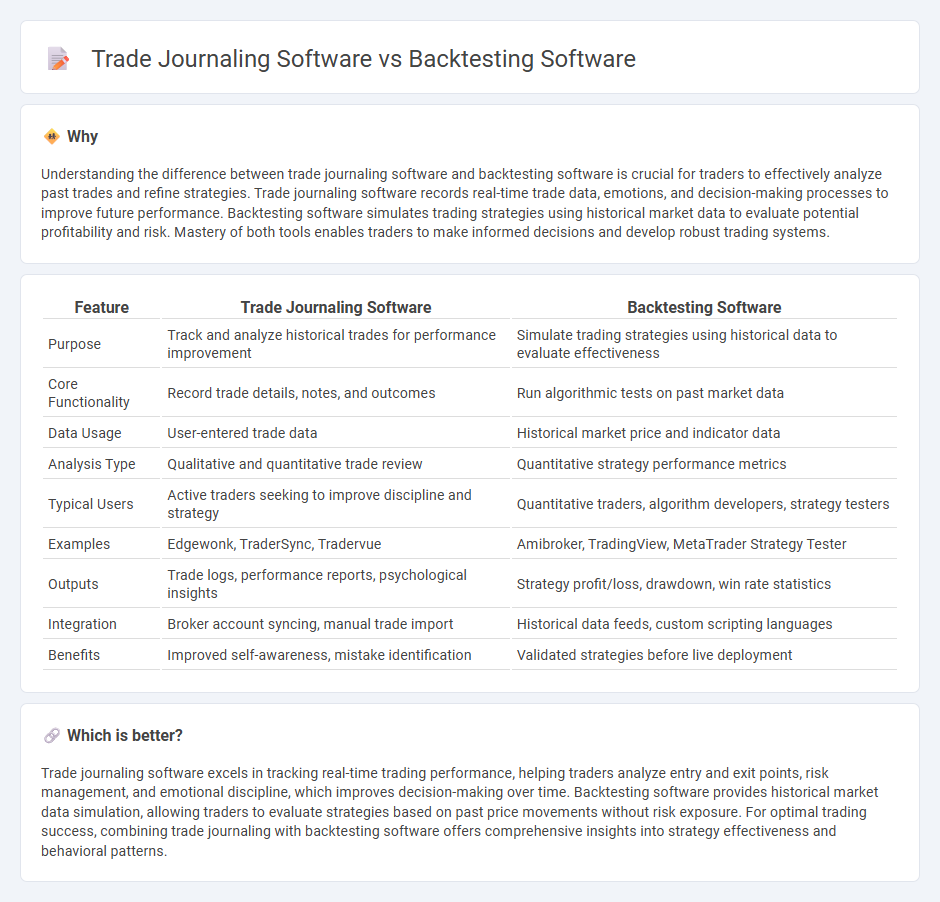

Understanding the difference between trade journaling software and backtesting software is crucial for traders to effectively analyze past trades and refine strategies. Trade journaling software records real-time trade data, emotions, and decision-making processes to improve future performance. Backtesting software simulates trading strategies using historical market data to evaluate potential profitability and risk. Mastery of both tools enables traders to make informed decisions and develop robust trading systems.

Comparison Table

| Feature | Trade Journaling Software | Backtesting Software |

|---|---|---|

| Purpose | Track and analyze historical trades for performance improvement | Simulate trading strategies using historical data to evaluate effectiveness |

| Core Functionality | Record trade details, notes, and outcomes | Run algorithmic tests on past market data |

| Data Usage | User-entered trade data | Historical market price and indicator data |

| Analysis Type | Qualitative and quantitative trade review | Quantitative strategy performance metrics |

| Typical Users | Active traders seeking to improve discipline and strategy | Quantitative traders, algorithm developers, strategy testers |

| Examples | Edgewonk, TraderSync, Tradervue | Amibroker, TradingView, MetaTrader Strategy Tester |

| Outputs | Trade logs, performance reports, psychological insights | Strategy profit/loss, drawdown, win rate statistics |

| Integration | Broker account syncing, manual trade import | Historical data feeds, custom scripting languages |

| Benefits | Improved self-awareness, mistake identification | Validated strategies before live deployment |

Which is better?

Trade journaling software excels in tracking real-time trading performance, helping traders analyze entry and exit points, risk management, and emotional discipline, which improves decision-making over time. Backtesting software provides historical market data simulation, allowing traders to evaluate strategies based on past price movements without risk exposure. For optimal trading success, combining trade journaling with backtesting software offers comprehensive insights into strategy effectiveness and behavioral patterns.

Connection

Trade journaling software systematically records and analyzes past trades, providing valuable data for performance evaluation. Backtesting software utilizes this historical trade data to simulate and evaluate trading strategies against historical market conditions. Together, these tools enable traders to refine strategies by learning from recorded trades and testing them for future reliability.

Key Terms

**Backtesting software:**

Backtesting software enables traders to simulate trading strategies using historical market data, providing insights into potential performance and risk before real capital is deployed. Advanced platforms incorporate features like customizable indicators, automated strategy testing, and detailed analytics to optimize decision-making and strategy refinement. Explore our comprehensive guide to discover the best backtesting tools and elevate your trading efficiency.

Historical data

Backtesting software leverages extensive historical market data to simulate trades and evaluate trading strategies' performance under past conditions, providing critical insights into potential profitability and risk. Trade journaling software primarily records and analyzes actual trade executions and outcomes, offering detailed reflections on trader behavior and decision-making patterns without simulating hypothetical scenarios. Explore the differences in data utilization and benefits to optimize your trading approach.

Strategy simulation

Backtesting software enables traders to simulate and evaluate trading strategies against historical market data, providing statistical metrics like profitability, drawdown, and win rate for robust strategy validation. Trade journaling software primarily records live trades and performance, offering insights into trader behavior and decision-making patterns but lacks the comprehensive simulation capabilities of backtesting tools. Explore detailed comparisons to understand which software best fits your strategy development needs.

Source and External Links

7 Best Stock Backtesting Platforms of 2025 - FinMasters - This article lists top backtesting software like TrendSpider, TradingView, Trade Ideas, and Backtrader, detailing prices, coding requirements, and best uses for each platform.

The Best Backtesting Software For Traders In 2025 - NewTrading.io - This guide explains key criteria for backtesting software selection and reviews platforms such as MetaTrader 5, NinjaTrader, QuantConnect, and MultiCharts, focusing on market accuracy, flexibility, and ease of use.

Top Backtesting Software for Forex Traders: A Comprehensive Guide - A thorough overview of forex-focused backtesting tools including FX Replay, MetaTrader 4 & 5, and TradingView, highlighting their features, limitations, and target users.

dowidth.com

dowidth.com