Statistical arbitrage exploits pricing inefficiencies between correlated securities using statistical models and mean reversion strategies, focusing on short-term market anomalies. Quantitative trading employs algorithm-driven strategies based on mathematical models, big data analysis, and historical market patterns to make systematic investment decisions across multiple asset classes. Discover how these data-driven approaches transform modern trading strategies.

Why it is important

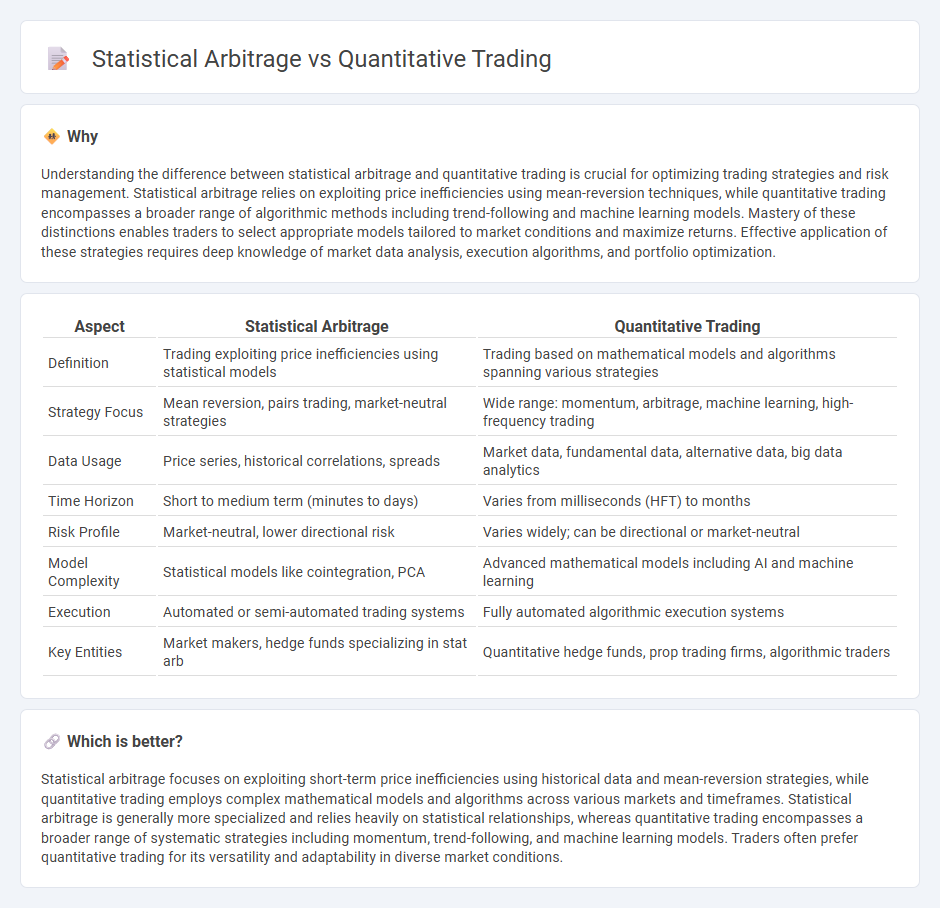

Understanding the difference between statistical arbitrage and quantitative trading is crucial for optimizing trading strategies and risk management. Statistical arbitrage relies on exploiting price inefficiencies using mean-reversion techniques, while quantitative trading encompasses a broader range of algorithmic methods including trend-following and machine learning models. Mastery of these distinctions enables traders to select appropriate models tailored to market conditions and maximize returns. Effective application of these strategies requires deep knowledge of market data analysis, execution algorithms, and portfolio optimization.

Comparison Table

| Aspect | Statistical Arbitrage | Quantitative Trading |

|---|---|---|

| Definition | Trading exploiting price inefficiencies using statistical models | Trading based on mathematical models and algorithms spanning various strategies |

| Strategy Focus | Mean reversion, pairs trading, market-neutral strategies | Wide range: momentum, arbitrage, machine learning, high-frequency trading |

| Data Usage | Price series, historical correlations, spreads | Market data, fundamental data, alternative data, big data analytics |

| Time Horizon | Short to medium term (minutes to days) | Varies from milliseconds (HFT) to months |

| Risk Profile | Market-neutral, lower directional risk | Varies widely; can be directional or market-neutral |

| Model Complexity | Statistical models like cointegration, PCA | Advanced mathematical models including AI and machine learning |

| Execution | Automated or semi-automated trading systems | Fully automated algorithmic execution systems |

| Key Entities | Market makers, hedge funds specializing in stat arb | Quantitative hedge funds, prop trading firms, algorithmic traders |

Which is better?

Statistical arbitrage focuses on exploiting short-term price inefficiencies using historical data and mean-reversion strategies, while quantitative trading employs complex mathematical models and algorithms across various markets and timeframes. Statistical arbitrage is generally more specialized and relies heavily on statistical relationships, whereas quantitative trading encompasses a broader range of systematic strategies including momentum, trend-following, and machine learning models. Traders often prefer quantitative trading for its versatility and adaptability in diverse market conditions.

Connection

Statistical arbitrage leverages quantitative trading by using mathematical models and algorithms to identify pricing inefficiencies across related securities. Quantitative trading relies on vast historical data analysis to develop strategies that systematically exploit short-term market anomalies observed in statistical arbitrage. This synergy enables traders to execute high-frequency trades driven by statistical signals, optimizing portfolio returns through risk-adjusted metrics.

Key Terms

Algorithmic Models

Quantitative trading employs algorithmic models that leverage vast datasets and sophisticated mathematical techniques to identify market inefficiencies, aiming for systematic profit generation. Statistical arbitrage focuses specifically on exploiting temporary price discrepancies between correlated assets using mean-reversion and pair-trading strategies within algorithmic frameworks. Discover how these algorithmic models differ and their unique applications in modern financial markets.

Mean Reversion

Quantitative trading employs algorithmic models to execute trades based on a wide variety of data patterns, while statistical arbitrage specifically exploits pricing inefficiencies between correlated securities using mean reversion strategies. Mean reversion assumes that asset prices will revert to their historical averages, enabling traders to capitalize on temporary mispricings through dynamic portfolio adjustments. Explore detailed methodologies and performance metrics to understand the nuances between these closely related trading approaches.

Market Inefficiencies

Quantitative trading leverages mathematical models and algorithms to identify patterns and execute trades at high speed, while statistical arbitrage specifically targets market inefficiencies by exploiting price discrepancies between related securities through mean-reversion strategies. Statistical arbitrage relies heavily on historical data and statistical methods to detect short-term mispricings, offering opportunities for profit in inefficient markets. Explore more to understand how these strategies can enhance portfolio returns through systematic modeling and market anomaly detection.

Source and External Links

Quantitative Trading Firms Explained | Hunter Bond - Quantitative trading firms use advanced mathematical models, statistics, and algorithms--rather than human intuition--to make rapid, data-driven trading decisions, often leveraging automation and high-frequency strategies to capitalize on market inefficiencies.

How To Become a Quantitative Trader in 4 Steps (With Skills) - Indeed - A quantitative trader analyzes large financial datasets, develops trading algorithms, and implements strategies to identify and exploit profitable opportunities, requiring strong mathematical skills and continuous innovation due to the dynamic nature of markets.

Quantitative analysis (finance) - Wikipedia - Quantitative analysis in finance applies mathematical and statistical methods to investment management, covering areas like algorithmic trading, risk management, and derivatives pricing, with professionals ("quants") specializing in finding patterns and correlations in large datasets.

dowidth.com

dowidth.com