Trade journaling software enhances trading performance by systematically recording trades, analyzing strategies, and tracking emotional patterns for improved decision-making. Market scanners provide real-time data filtering, identifying potential trading opportunities based on specific criteria such as price movements, volume, and technical indicators. Explore the benefits of integrating these tools to elevate your trading success.

Why it is important

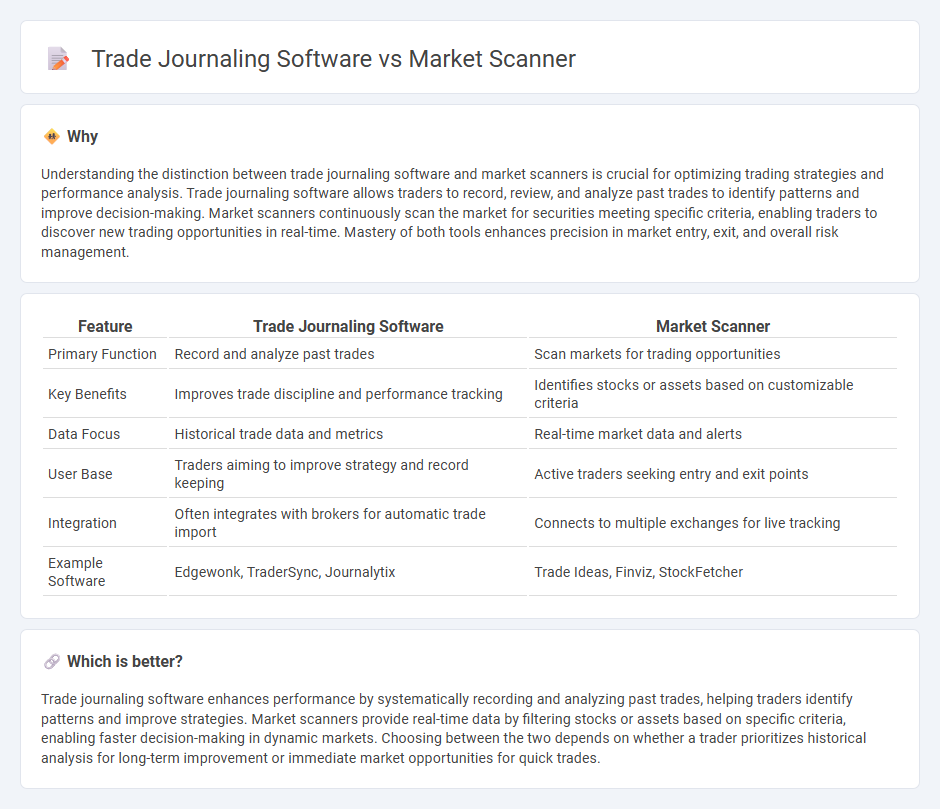

Understanding the distinction between trade journaling software and market scanners is crucial for optimizing trading strategies and performance analysis. Trade journaling software allows traders to record, review, and analyze past trades to identify patterns and improve decision-making. Market scanners continuously scan the market for securities meeting specific criteria, enabling traders to discover new trading opportunities in real-time. Mastery of both tools enhances precision in market entry, exit, and overall risk management.

Comparison Table

| Feature | Trade Journaling Software | Market Scanner |

|---|---|---|

| Primary Function | Record and analyze past trades | Scan markets for trading opportunities |

| Key Benefits | Improves trade discipline and performance tracking | Identifies stocks or assets based on customizable criteria |

| Data Focus | Historical trade data and metrics | Real-time market data and alerts |

| User Base | Traders aiming to improve strategy and record keeping | Active traders seeking entry and exit points |

| Integration | Often integrates with brokers for automatic trade import | Connects to multiple exchanges for live tracking |

| Example Software | Edgewonk, TraderSync, Journalytix | Trade Ideas, Finviz, StockFetcher |

Which is better?

Trade journaling software enhances performance by systematically recording and analyzing past trades, helping traders identify patterns and improve strategies. Market scanners provide real-time data by filtering stocks or assets based on specific criteria, enabling faster decision-making in dynamic markets. Choosing between the two depends on whether a trader prioritizes historical analysis for long-term improvement or immediate market opportunities for quick trades.

Connection

Trade journaling software integrates with market scanners by capturing real-time trade signals and market data, enabling traders to analyze entry and exit points effectively. This connection enhances the ability to track performance metrics and refine trading strategies based on scanned market opportunities. By synchronizing scanned alerts with detailed journal entries, traders gain deeper insights into market trends and improve decision-making accuracy.

Key Terms

**Market Scanner:**

Market scanner software analyzes real-time market data to identify trading opportunities based on user-defined criteria such as price movements, volume, and technical indicators. It enables traders to filter stocks, forex pairs, or cryptocurrencies quickly, streamlining decision-making and maximizing potential profits. Explore the key features and benefits of market scanners to enhance your trading strategy today.

Filters

Market scanners use advanced filters such as price range, volume, technical indicators, and sector to identify potential trading opportunities across multiple markets faster. Trade journaling software features filters that categorize trades by entry/exit dates, trade types, performance metrics, and risk factors to enhance post-trade analysis and strategy improvement. Explore detailed comparisons to understand which filtering options best support your trading workflow.

Alerts

Market scanners provide real-time alerts by continuously monitoring numerous securities based on customizable criteria such as price movements, volume spikes, and technical indicators. Trade journaling software, on the other hand, may offer alert functionalities centered on trade performance, risk management thresholds, and post-trade analysis insights. Discover how integrating both tools can enhance your trading strategy by managing alerts more effectively.

Source and External Links

Market Scanner - IBKR Guides - The Market Scanner tool helps find instruments based on price, volume, and other criteria, allowing you to trade, view, or monitor assets by adding them to a Watchlist with customizable filters and real-time scanning options.

Market Scanner for finding trading opportunities | MultiCharts - MultiCharts offers a Market Scanner that scans unlimited symbols for trading opportunities on-demand or at set intervals, letting you filter assets based on custom indicators and monitor them in real-time.

Market Scanner - Fidelity Investments - Fidelity's Market Scanner allows traders to find securities with options showing unique opportunities through key variables like price movement and volatility, with both pre-built and customizable scans available.

dowidth.com

dowidth.com