Liquidity mining involves users staking or providing tokens to decentralized finance (DeFi) protocols in exchange for rewards, usually in the form of additional tokens. Liquidity pools are pools of tokens locked in smart contracts, enabling decentralized trading and facilitating market making without intermediaries. Explore the differences and benefits of liquidity mining and liquidity pools to optimize your trading strategies.

Why it is important

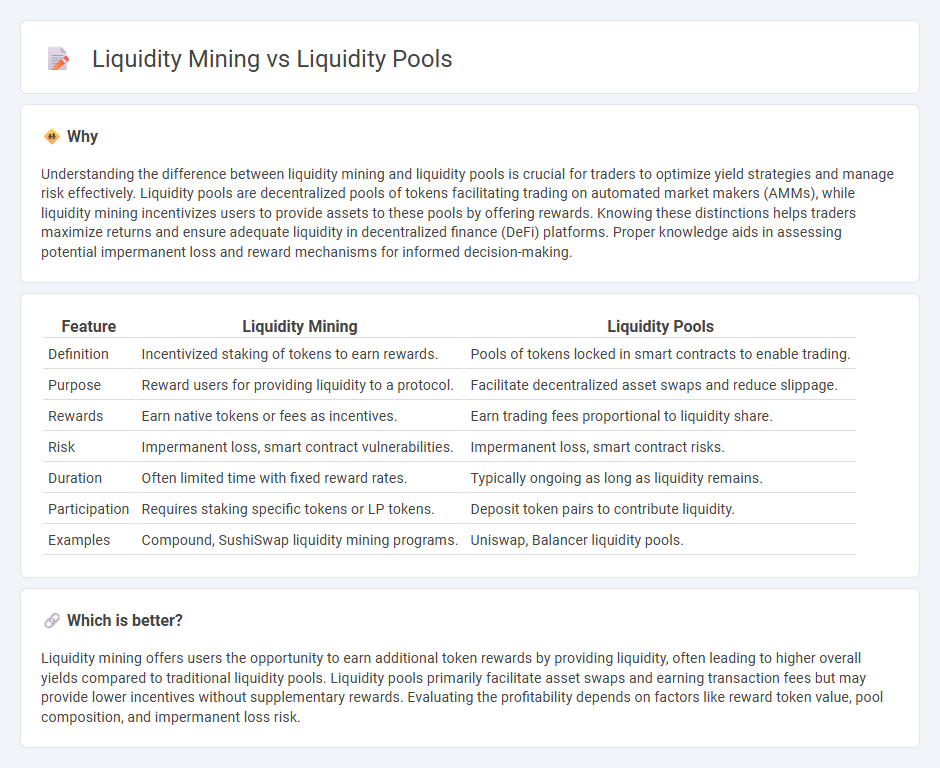

Understanding the difference between liquidity mining and liquidity pools is crucial for traders to optimize yield strategies and manage risk effectively. Liquidity pools are decentralized pools of tokens facilitating trading on automated market makers (AMMs), while liquidity mining incentivizes users to provide assets to these pools by offering rewards. Knowing these distinctions helps traders maximize returns and ensure adequate liquidity in decentralized finance (DeFi) platforms. Proper knowledge aids in assessing potential impermanent loss and reward mechanisms for informed decision-making.

Comparison Table

| Feature | Liquidity Mining | Liquidity Pools |

|---|---|---|

| Definition | Incentivized staking of tokens to earn rewards. | Pools of tokens locked in smart contracts to enable trading. |

| Purpose | Reward users for providing liquidity to a protocol. | Facilitate decentralized asset swaps and reduce slippage. |

| Rewards | Earn native tokens or fees as incentives. | Earn trading fees proportional to liquidity share. |

| Risk | Impermanent loss, smart contract vulnerabilities. | Impermanent loss, smart contract risks. |

| Duration | Often limited time with fixed reward rates. | Typically ongoing as long as liquidity remains. |

| Participation | Requires staking specific tokens or LP tokens. | Deposit token pairs to contribute liquidity. |

| Examples | Compound, SushiSwap liquidity mining programs. | Uniswap, Balancer liquidity pools. |

Which is better?

Liquidity mining offers users the opportunity to earn additional token rewards by providing liquidity, often leading to higher overall yields compared to traditional liquidity pools. Liquidity pools primarily facilitate asset swaps and earning transaction fees but may provide lower incentives without supplementary rewards. Evaluating the profitability depends on factors like reward token value, pool composition, and impermanent loss risk.

Connection

Liquidity mining incentivizes users to provide capital to liquidity pools by rewarding them with tokens, increasing the pools' overall liquidity. Liquidity pools aggregate funds from multiple participants to facilitate seamless trading on decentralized exchanges without relying on order books. This interconnected mechanism enhances market efficiency, reduces slippage, and drives user engagement in decentralized finance (DeFi) ecosystems.

Key Terms

Liquidity Provision

Liquidity pools are decentralized token reserves enabling seamless trading on Automated Market Makers (AMMs) by maintaining liquidity for users without traditional order books. Liquidity mining involves incentivizing liquidity providers with rewards, often tokens, to encourage capital supply to these pools and enhance market depth. Explore further to understand how liquidity provision drives decentralized finance ecosystems and benefits participants.

Yield Farming

Liquidity pools are decentralized finance (DeFi) protocols where users provide crypto assets to facilitate trading and earn fees, forming the foundation for yield farming. Liquidity mining involves incentivizing users to supply liquidity by rewarding them with additional tokens, boosting potential returns within yield farming strategies. Explore deeper insights into how liquidity pools and mining drive yield farming rewards and DeFi ecosystems.

Automated Market Maker (AMM)

Liquidity pools in Automated Market Makers (AMMs) enable decentralized trading by allowing users to deposit tokens into a shared pool, providing the necessary liquidity for seamless asset swaps. Liquidity mining incentivizes participants by rewarding them with native tokens for supplying liquidity, thereby increasing pool depth and boosting AMM efficiency. Explore the mechanisms behind liquidity pools and mining to understand how they drive DeFi ecosystem growth.

Source and External Links

Liquidity Pools Explained: How They Work, Key Risks & Security - A liquidity pool is a collection of cryptocurrency tokens locked in a smart contract that enables decentralized trading, offering benefits like decentralization, continuous liquidity, and efficient price discovery through automated market makers (AMMs).

Liquidity Pools for Beginners: DeFi 101 - tastycrypto - Liquidity pools in DeFi allow users to deposit paired assets to facilitate trading and earn fees, which incentivizes liquidity provision and supports decentralized finance applications such as yield farming and lending.

The role of liquidity pools in cryptocurrency markets - Kraken - Liquidity pools allow decentralized exchanges (DEXs) to operate without intermediaries by pooling cryptocurrencies into smart contracts for seamless trading and allow liquidity providers to earn fees, though risks like impermanent loss exist.

dowidth.com

dowidth.com