Liquidity mining involves earning rewards by providing cryptocurrency assets to decentralized finance (DeFi) protocols, boosting market liquidity and receiving native tokens as incentives. Copy trading allows individuals to replicate the strategies of experienced traders automatically, offering a hands-off approach to investment diversification and risk management. Explore deeper insights into these trading methods to enhance your portfolio strategy.

Why it is important

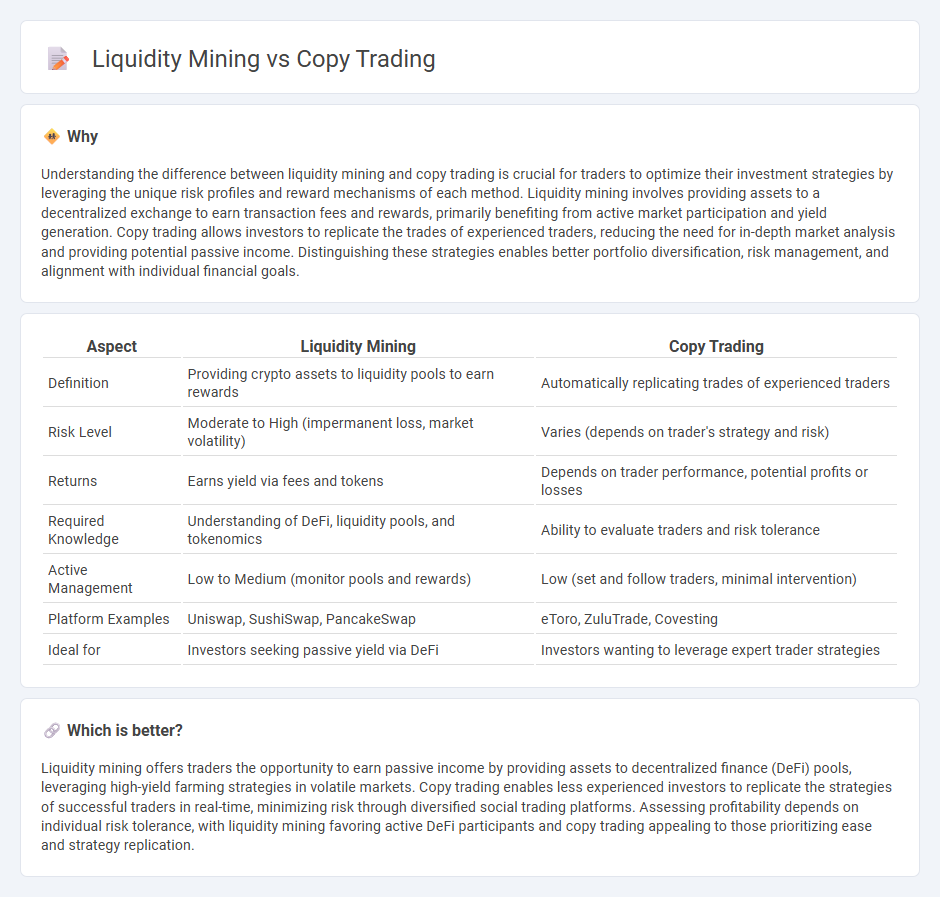

Understanding the difference between liquidity mining and copy trading is crucial for traders to optimize their investment strategies by leveraging the unique risk profiles and reward mechanisms of each method. Liquidity mining involves providing assets to a decentralized exchange to earn transaction fees and rewards, primarily benefiting from active market participation and yield generation. Copy trading allows investors to replicate the trades of experienced traders, reducing the need for in-depth market analysis and providing potential passive income. Distinguishing these strategies enables better portfolio diversification, risk management, and alignment with individual financial goals.

Comparison Table

| Aspect | Liquidity Mining | Copy Trading |

|---|---|---|

| Definition | Providing crypto assets to liquidity pools to earn rewards | Automatically replicating trades of experienced traders |

| Risk Level | Moderate to High (impermanent loss, market volatility) | Varies (depends on trader's strategy and risk) |

| Returns | Earns yield via fees and tokens | Depends on trader performance, potential profits or losses |

| Required Knowledge | Understanding of DeFi, liquidity pools, and tokenomics | Ability to evaluate traders and risk tolerance |

| Active Management | Low to Medium (monitor pools and rewards) | Low (set and follow traders, minimal intervention) |

| Platform Examples | Uniswap, SushiSwap, PancakeSwap | eToro, ZuluTrade, Covesting |

| Ideal for | Investors seeking passive yield via DeFi | Investors wanting to leverage expert trader strategies |

Which is better?

Liquidity mining offers traders the opportunity to earn passive income by providing assets to decentralized finance (DeFi) pools, leveraging high-yield farming strategies in volatile markets. Copy trading enables less experienced investors to replicate the strategies of successful traders in real-time, minimizing risk through diversified social trading platforms. Assessing profitability depends on individual risk tolerance, with liquidity mining favoring active DeFi participants and copy trading appealing to those prioritizing ease and strategy replication.

Connection

Liquidity mining boosts market liquidity by incentivizing users to provide assets, creating more opportunities for traders to execute strategies effectively. Copy trading relies on this enhanced liquidity to replicate trades with minimal slippage and faster order execution. Together, they create a synergistic environment that improves market efficiency and trader profitability.

Key Terms

Copy Trading:

Copy trading enables investors to automatically replicate the trades of experienced traders, offering a hands-free approach to market participation and risk management. This method leverages social trading platforms and advanced algorithms to optimize portfolio performance based on real-time market data. Explore how copy trading can diversify your investment strategy and enhance returns by following industry experts closely.

Signal Provider

Signal providers play a crucial role in copy trading by offering expert trading signals that followers replicate to achieve similar returns. In liquidity mining, the emphasis shifts to users providing liquidity to decentralized exchanges, earning rewards based on their contribution rather than trading expertise. Discover more about how signal providers influence these strategies and optimize investment outcomes.

Social Trading Platform

Copy trading allows investors to automatically replicate the trades of experienced traders on social trading platforms, offering a hands-free investment approach. Liquidity mining involves providing funds to decentralized finance (DeFi) pools to earn rewards, focusing on enhancing market liquidity rather than direct trade replication. Explore our in-depth analysis to understand which strategy aligns best with your investment goals on social trading platforms.

Source and External Links

Copy trading - Wikipedia - Copy trading allows individuals to automatically copy the trades opened and managed by other selected traders, with copy traders' funds linked proportionally to the copied investors' actions, enabling a delegated portfolio management style.

Copy Trading | Copy the Best Traders in 2025 | AvaTrade - Copy trading automates replicating the trades of more experienced traders, providing beginners a hands-off, time-saving way to enter markets while offering customization and control over which traders to follow and how much capital to allocate.

What is Copy Trading, How Does it Work and How to ... - PrimeXBT - Copy trading enables automatic replication of top traders' actions in your account, allowing you to select traders based on performance and risk tolerance, with control over capital allocated and risk limits per trade.

dowidth.com

dowidth.com