Copy trading allows investors to mirror the trades of experienced traders, leveraging human insights and strategies in real-time market conditions. Algorithmic trading relies on pre-programmed algorithms and complex mathematical models to execute trades at high speed and volume, reducing emotional bias. Explore the key differences and discover which approach aligns with your trading goals.

Why it is important

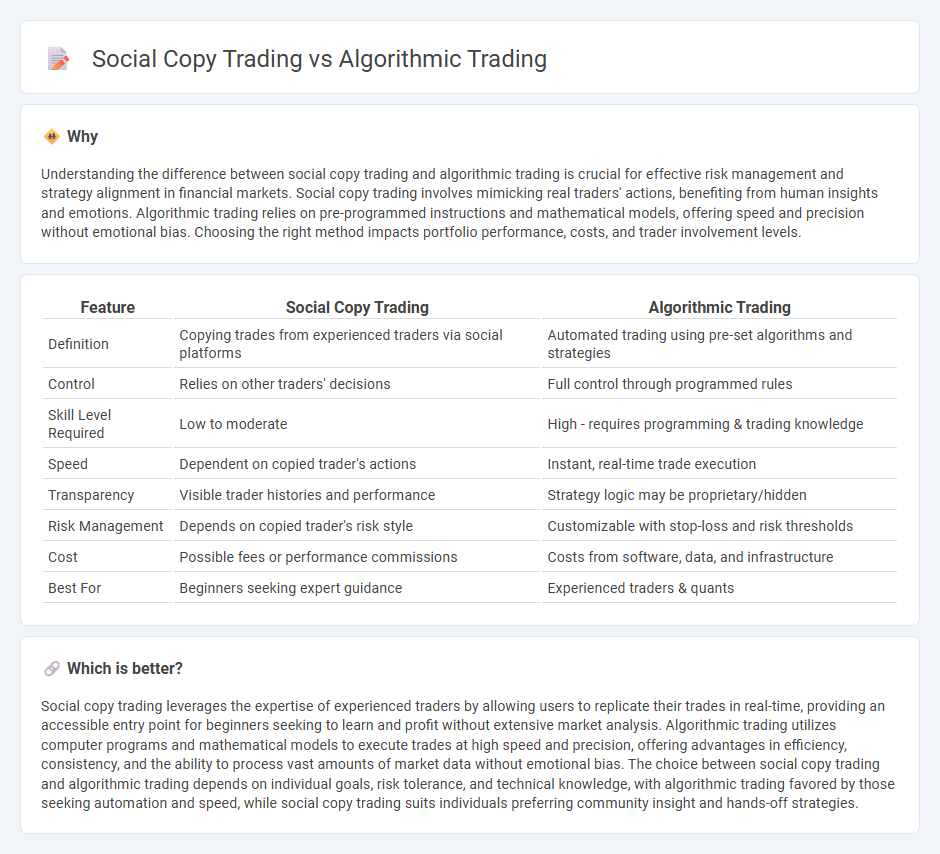

Understanding the difference between social copy trading and algorithmic trading is crucial for effective risk management and strategy alignment in financial markets. Social copy trading involves mimicking real traders' actions, benefiting from human insights and emotions. Algorithmic trading relies on pre-programmed instructions and mathematical models, offering speed and precision without emotional bias. Choosing the right method impacts portfolio performance, costs, and trader involvement levels.

Comparison Table

| Feature | Social Copy Trading | Algorithmic Trading |

|---|---|---|

| Definition | Copying trades from experienced traders via social platforms | Automated trading using pre-set algorithms and strategies |

| Control | Relies on other traders' decisions | Full control through programmed rules |

| Skill Level Required | Low to moderate | High - requires programming & trading knowledge |

| Speed | Dependent on copied trader's actions | Instant, real-time trade execution |

| Transparency | Visible trader histories and performance | Strategy logic may be proprietary/hidden |

| Risk Management | Depends on copied trader's risk style | Customizable with stop-loss and risk thresholds |

| Cost | Possible fees or performance commissions | Costs from software, data, and infrastructure |

| Best For | Beginners seeking expert guidance | Experienced traders & quants |

Which is better?

Social copy trading leverages the expertise of experienced traders by allowing users to replicate their trades in real-time, providing an accessible entry point for beginners seeking to learn and profit without extensive market analysis. Algorithmic trading utilizes computer programs and mathematical models to execute trades at high speed and precision, offering advantages in efficiency, consistency, and the ability to process vast amounts of market data without emotional bias. The choice between social copy trading and algorithmic trading depends on individual goals, risk tolerance, and technical knowledge, with algorithmic trading favored by those seeking automation and speed, while social copy trading suits individuals preferring community insight and hands-off strategies.

Connection

Social copy trading leverages collective trader insights by allowing investors to replicate the strategies of experienced traders, while algorithmic trading employs automated systems to execute trades based on predefined criteria. Both methods utilize data-driven approaches, with social copy trading benefiting from real-time decision-making by human experts and algorithmic trading relying on sophisticated algorithms for efficiency and speed. Integrating these strategies enhances portfolio diversification, reduces emotional bias, and maximizes profit opportunities through combined human expertise and automated precision.

Key Terms

Automated Strategies

Algorithmic trading leverages pre-programmed instructions and complex mathematical models to execute trades at high speed and volume, optimizing market opportunities based on historical data and real-time analysis. Social copy trading enables investors to replicate the trades of expert traders by following their strategies, fostering a community-driven approach that simplifies engagement in financial markets without requiring extensive technical knowledge. Explore the distinct advantages and mechanisms of these automated strategies to enhance your trading experience and outcomes.

Signal Providers

Algorithmic trading relies on sophisticated computer algorithms to execute trades based on predefined criteria, minimizing human bias and enhancing execution speed. Social copy trading involves replicating the trades of expert signal providers, allowing traders to benefit from their experience and market insights. Explore the key differences and advantages of signal providers in both to optimize your trading strategy.

Execution Speed

Algorithmic trading leverages advanced computer algorithms to execute trades at lightning-fast speeds, often within milliseconds, enabling traders to capitalize on fleeting market opportunities. Social copy trading involves replicating the strategies of experienced traders, which may introduce delays due to reliance on manual actions and platform processing times. Explore deeper insights into execution speed differences and their impact on trading performance.

Source and External Links

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves using pre-programmed computer rules to automatically execute trades when certain market conditions are met; it is often used to implement strategies like moving average trading to buy or sell stocks based on price movements relative to averages.

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading employs computer code to open and close trades automatically according to defined rules, often using price action or technical indicators, and can include strategies like scalping or high-frequency trading.

Algorithmic trading - Wikipedia - Algorithmic trading systems consist of three components--exchange data feed, server/database, and application for strategy execution and order submission--using protocols like FIX to connect to markets and modern low-latency infrastructure to optimize trading decisions.

dowidth.com

dowidth.com