High frequency trading bots execute numerous trades within milliseconds by leveraging advanced algorithms and real-time market data to capitalize on small price fluctuations. Position trading involves holding assets for extended periods, from weeks to months, focusing on long-term market trends and fundamental analysis. Explore the key differences and strategies to optimize your trading approach.

Why it is important

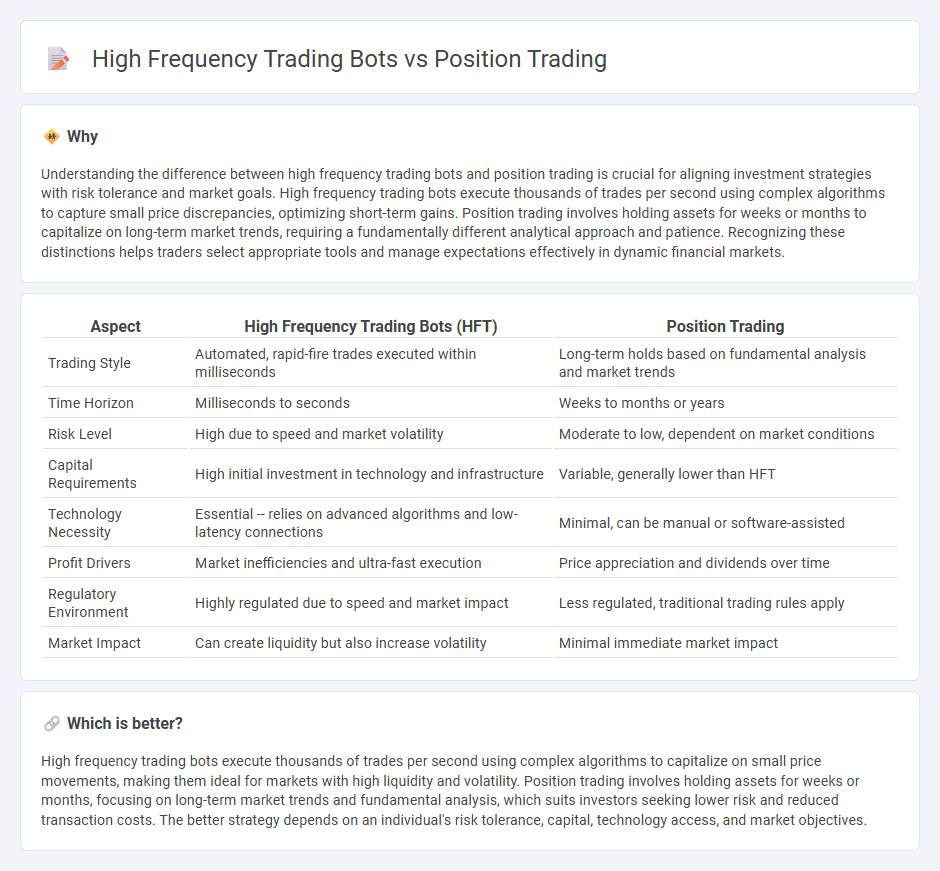

Understanding the difference between high frequency trading bots and position trading is crucial for aligning investment strategies with risk tolerance and market goals. High frequency trading bots execute thousands of trades per second using complex algorithms to capture small price discrepancies, optimizing short-term gains. Position trading involves holding assets for weeks or months to capitalize on long-term market trends, requiring a fundamentally different analytical approach and patience. Recognizing these distinctions helps traders select appropriate tools and manage expectations effectively in dynamic financial markets.

Comparison Table

| Aspect | High Frequency Trading Bots (HFT) | Position Trading |

|---|---|---|

| Trading Style | Automated, rapid-fire trades executed within milliseconds | Long-term holds based on fundamental analysis and market trends |

| Time Horizon | Milliseconds to seconds | Weeks to months or years |

| Risk Level | High due to speed and market volatility | Moderate to low, dependent on market conditions |

| Capital Requirements | High initial investment in technology and infrastructure | Variable, generally lower than HFT |

| Technology Necessity | Essential -- relies on advanced algorithms and low-latency connections | Minimal, can be manual or software-assisted |

| Profit Drivers | Market inefficiencies and ultra-fast execution | Price appreciation and dividends over time |

| Regulatory Environment | Highly regulated due to speed and market impact | Less regulated, traditional trading rules apply |

| Market Impact | Can create liquidity but also increase volatility | Minimal immediate market impact |

Which is better?

High frequency trading bots execute thousands of trades per second using complex algorithms to capitalize on small price movements, making them ideal for markets with high liquidity and volatility. Position trading involves holding assets for weeks or months, focusing on long-term market trends and fundamental analysis, which suits investors seeking lower risk and reduced transaction costs. The better strategy depends on an individual's risk tolerance, capital, technology access, and market objectives.

Connection

High frequency trading bots execute large volumes of trades within milliseconds, leveraging algorithms to exploit short-term market inefficiencies, while position trading focuses on holding assets over extended periods based on fundamental analysis. Both strategies rely on advanced data analysis and market signals, with HFT bots providing liquidity and price discovery that position traders use to inform long-term investment decisions. Integration of HFT data can enhance position trading by identifying optimal entry and exit points through real-time market sentiment and trend shifts.

Key Terms

Holding Period

Position trading emphasizes holding assets for weeks to months, capitalizing on long-term market trends and fundamental analysis. High-frequency trading bots execute thousands of transactions in milliseconds, profiting from minimal price discrepancies and liquidity imbalances. Explore the nuanced strategies behind these distinct holding periods to optimize your trading approach.

Trade Frequency

Position trading involves holding assets for weeks or months, allowing traders to capitalize on long-term market trends with fewer transactions. High-frequency trading (HFT) bots execute thousands of trades per second, leveraging algorithms to profit from minute price discrepancies in ultra-short timeframes. Explore the advantages and challenges of both trading strategies to determine the best fit for your investment goals.

Strategy Automation

Position trading relies on long-term market analysis and strategic investment decisions, often holding assets for weeks or months to capitalize on major price movements. High-frequency trading bots execute thousands of trades within seconds, using algorithms to exploit minute price discrepancies and leverage speed for profit. Discover more about how automation shapes these distinct trading strategies and their market impact.

Source and External Links

Position Trading 101: A Beginner's Guide With Examples - Position trading is a medium- to long-term trading strategy where traders hold positions for weeks to months, aiming to ride market trends by going long or short, unlike buy-and-hold investors who do not typically hedge or time exits.

A guide to position trading: definition, examples and strategies - Position trading seeks to capture major trends over time, utilizing strategies like trend trading, breakout trading, and pullback trading, and focusing on entry early in trends and exiting after profit targets are met.

Position Trading Strategy: How To Use It | Capital.com - Position trading involves holding trades over months or years to profit from long-term trends, with benefits such as reduced trading frequency and transaction costs compared to day trading, and can be applied across various markets including stocks, forex, and commodities.

dowidth.com

dowidth.com