Order flow analysis examines real-time market transactions to identify buying and selling pressures, offering granular insights into price movements and liquidity. Trend following relies on identifying sustained price directions based on historical data and technical indicators to capture momentum over time. Explore these strategies further to understand their unique advantages and applications in trading.

Why it is important

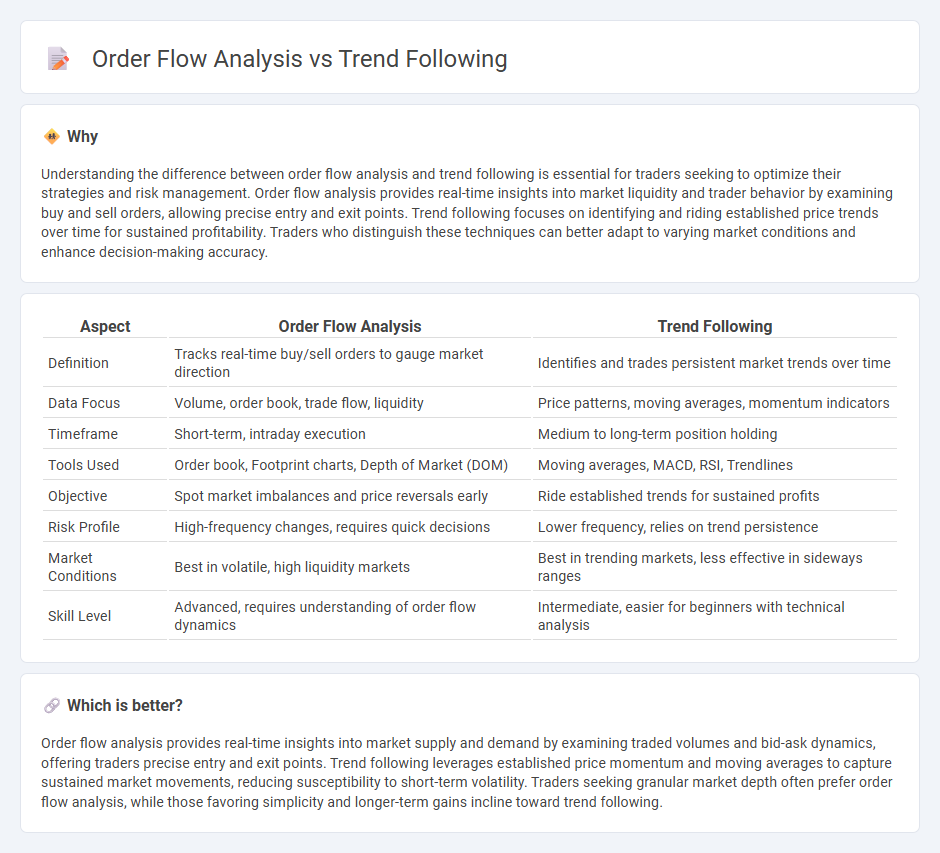

Understanding the difference between order flow analysis and trend following is essential for traders seeking to optimize their strategies and risk management. Order flow analysis provides real-time insights into market liquidity and trader behavior by examining buy and sell orders, allowing precise entry and exit points. Trend following focuses on identifying and riding established price trends over time for sustained profitability. Traders who distinguish these techniques can better adapt to varying market conditions and enhance decision-making accuracy.

Comparison Table

| Aspect | Order Flow Analysis | Trend Following |

|---|---|---|

| Definition | Tracks real-time buy/sell orders to gauge market direction | Identifies and trades persistent market trends over time |

| Data Focus | Volume, order book, trade flow, liquidity | Price patterns, moving averages, momentum indicators |

| Timeframe | Short-term, intraday execution | Medium to long-term position holding |

| Tools Used | Order book, Footprint charts, Depth of Market (DOM) | Moving averages, MACD, RSI, Trendlines |

| Objective | Spot market imbalances and price reversals early | Ride established trends for sustained profits |

| Risk Profile | High-frequency changes, requires quick decisions | Lower frequency, relies on trend persistence |

| Market Conditions | Best in volatile, high liquidity markets | Best in trending markets, less effective in sideways ranges |

| Skill Level | Advanced, requires understanding of order flow dynamics | Intermediate, easier for beginners with technical analysis |

Which is better?

Order flow analysis provides real-time insights into market supply and demand by examining traded volumes and bid-ask dynamics, offering traders precise entry and exit points. Trend following leverages established price momentum and moving averages to capture sustained market movements, reducing susceptibility to short-term volatility. Traders seeking granular market depth often prefer order flow analysis, while those favoring simplicity and longer-term gains incline toward trend following.

Connection

Order flow analysis provides real-time insights into market participant behavior by examining buy and sell orders, which helps identify the strength and direction of price movements. Trend following relies on these signals to confirm the persistence of market trends and to enter or exit positions based on momentum. Combining order flow data with trend following strategies enhances trade timing and increases the probability of capturing sustained price moves.

Key Terms

Moving Average

Trend following strategies leverage moving averages to identify and capitalize on sustained price directions by smoothing out short-term fluctuations. Order flow analysis examines real-time buying and selling pressure, offering granular insights into market dynamics that can precede trend changes captured by moving averages. Explore the nuanced interplay between moving averages and order flow to enhance your market timing and trading precision.

Volume Profile

Volume Profile reveals the distribution of trading volume at specific price levels, making it a crucial tool for order flow analysis by identifying areas of support and resistance with high market participation. Trend following strategies rely on price momentum and moving averages to capture directional moves, whereas Volume Profile provides deeper insight into market structure and liquidity zones that influence price reactions. Explore how Volume Profile enhances order flow analysis to optimize trading decisions and improve market timing.

Market Depth

Trend following relies on historical price patterns and moving averages to identify momentum and capitalize on market trends, while order flow analysis examines real-time Market Depth data, including bid-ask volumes and order book imbalances, to gauge short-term market sentiment. Market Depth provides detailed insight into liquidity and potential price movements by displaying the quantity of buy and sell orders at various price levels. Explore further to understand how integrating Market Depth analysis can enhance trading strategies for precise market timing.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where one buys an asset as its price trend rises and sells as it falls, relying on the continuation of price movements rather than predicting specific price points, using tools like moving averages and channel breakouts to identify trends.

Trend Following Trading Strategies and Systems (Backtest Results) - This resource explains trend following as a method to profit from ongoing market momentum via technical analysis, covering various specific strategies like ATR channel breakout and moving averages while emphasizing systematic rules, risk management, and psychological discipline.

Trend-Following Primer - Graham Capital Management - Trend-following is a major alternative investment strategy involving systematic models that identify price trends to go long or short accordingly, trading a wide diversified portfolio of liquid futures and currencies aiming to preserve upside and cut losses.

dowidth.com

dowidth.com