Degen trading involves rapid, high-risk trades aiming for quick profits from volatile market movements, often relying on short-term price fluctuations and speculative assets. Position trading focuses on long-term investment strategies, holding assets for weeks or months to capitalize on fundamental trends and market cycles. Explore the key differences and benefits of each approach to enhance your trading strategy.

Why it is important

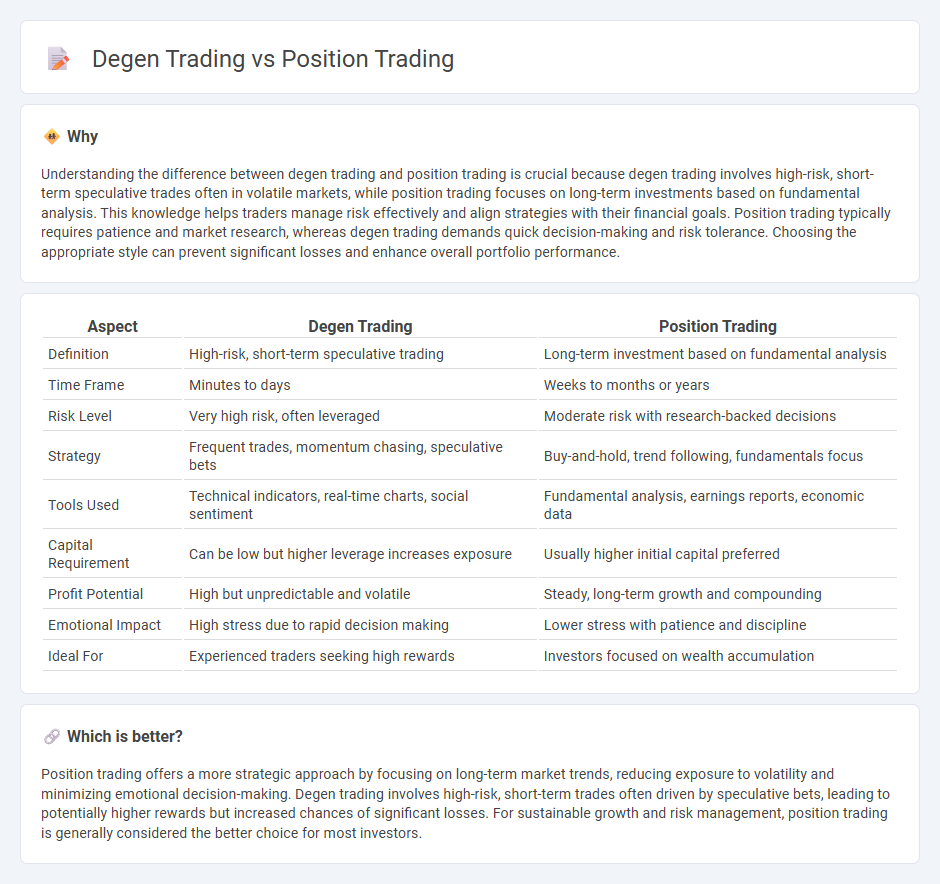

Understanding the difference between degen trading and position trading is crucial because degen trading involves high-risk, short-term speculative trades often in volatile markets, while position trading focuses on long-term investments based on fundamental analysis. This knowledge helps traders manage risk effectively and align strategies with their financial goals. Position trading typically requires patience and market research, whereas degen trading demands quick decision-making and risk tolerance. Choosing the appropriate style can prevent significant losses and enhance overall portfolio performance.

Comparison Table

| Aspect | Degen Trading | Position Trading |

|---|---|---|

| Definition | High-risk, short-term speculative trading | Long-term investment based on fundamental analysis |

| Time Frame | Minutes to days | Weeks to months or years |

| Risk Level | Very high risk, often leveraged | Moderate risk with research-backed decisions |

| Strategy | Frequent trades, momentum chasing, speculative bets | Buy-and-hold, trend following, fundamentals focus |

| Tools Used | Technical indicators, real-time charts, social sentiment | Fundamental analysis, earnings reports, economic data |

| Capital Requirement | Can be low but higher leverage increases exposure | Usually higher initial capital preferred |

| Profit Potential | High but unpredictable and volatile | Steady, long-term growth and compounding |

| Emotional Impact | High stress due to rapid decision making | Lower stress with patience and discipline |

| Ideal For | Experienced traders seeking high rewards | Investors focused on wealth accumulation |

Which is better?

Position trading offers a more strategic approach by focusing on long-term market trends, reducing exposure to volatility and minimizing emotional decision-making. Degen trading involves high-risk, short-term trades often driven by speculative bets, leading to potentially higher rewards but increased chances of significant losses. For sustainable growth and risk management, position trading is generally considered the better choice for most investors.

Connection

Degen trading involves high-risk, speculative trades often driven by short-term market signals, while position trading focuses on long-term investment based on fundamental analysis. Both strategies rely on market trends and trader psychology to optimize timing and decision-making. Understanding the risk tolerance and market conditions helps traders balance aggressive degen tactics with the disciplined patience of position trading.

Key Terms

**Position Trading:**

Position trading involves holding assets for weeks to months, capitalizing on long-term trends and fundamental analysis to achieve significant gains. This strategy requires patience, risk management, and thorough market research to avoid impulsive decisions common in short-term trading styles like degen trading. Explore more about how position trading can enhance your investment portfolio with sustainable growth.

Holding Period

Position trading involves holding assets for weeks to months, capitalizing on long-term market trends and fundamental analysis. Degen trading typically features high-frequency trades within minutes or hours, driven by speculation and short-term technical signals. Explore more to understand how holding periods impact trading strategies and risk management.

Fundamental Analysis

Position trading emphasizes long-term investment decisions based on comprehensive fundamental analysis of economic indicators, company performance, and market trends. Degen trading relies on short-term speculation and reactive moves, often disregarding fundamental data in favor of high-risk, high-reward opportunities. Explore the detailed differences between these strategies to enhance your trading approach and risk management.

Source and External Links

A guide to position trading: definition, examples and strategies - Position trading is a style where traders hold positions for weeks to months to benefit from a major market trend, using strategies like trend trading, breakout trading, and pullback trading to capture long-term movements.

Position Trading 101: A Beginner's Guide With Examples - Position trading is a medium- to long-term active trading approach involving holding trades from weeks to months to ride market trends both upward and downward, differentiating from buy-and-hold by actively timing entries and exits.

Positional Trading: Meaning, Strategies, Pros and Cons - Positional trading means buying and holding stocks for extended periods, often weeks or months, using strategies like trend-following, breakout, and pullback trading, and typically involves fundamental analysis to select strong companies.

dowidth.com

dowidth.com