Flash loans allow traders to borrow assets instantly without collateral, taking advantage of arbitrage opportunities or executing complex trading strategies within a single transaction. Decentralized exchanges (DEXs) facilitate peer-to-peer trading directly on the blockchain, offering increased security, transparency, and control compared to centralized platforms. Explore the differences and innovative potential of flash loans versus decentralized exchanges to enhance your trading approach.

Why it is important

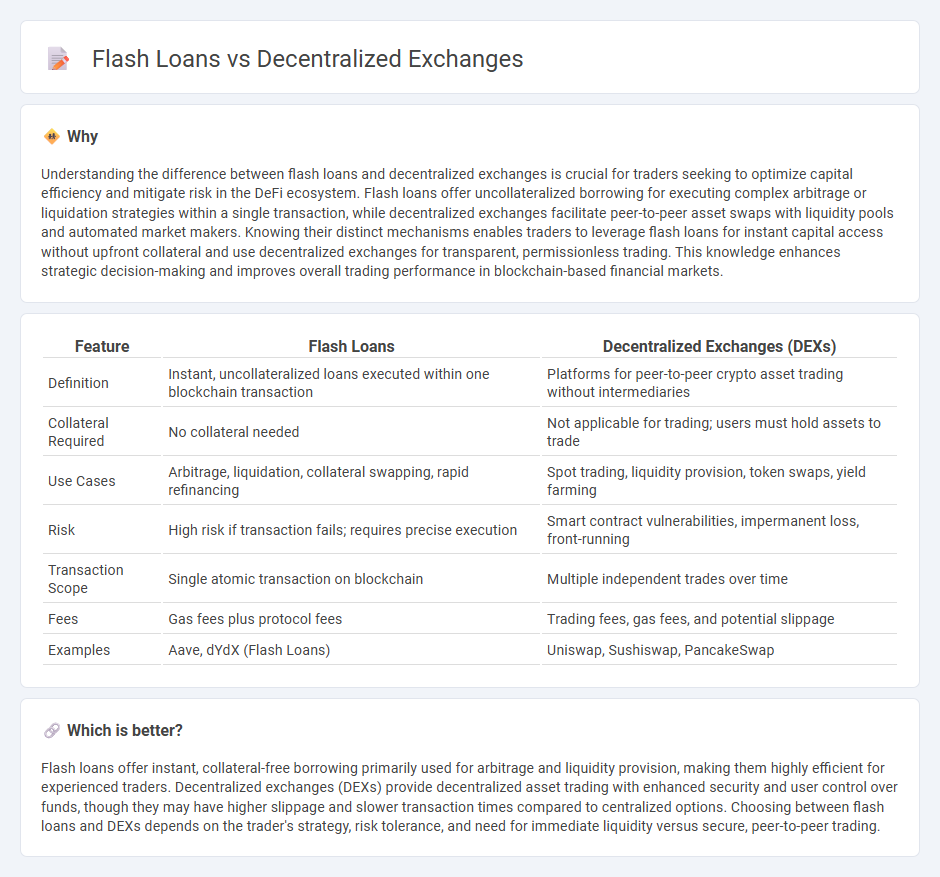

Understanding the difference between flash loans and decentralized exchanges is crucial for traders seeking to optimize capital efficiency and mitigate risk in the DeFi ecosystem. Flash loans offer uncollateralized borrowing for executing complex arbitrage or liquidation strategies within a single transaction, while decentralized exchanges facilitate peer-to-peer asset swaps with liquidity pools and automated market makers. Knowing their distinct mechanisms enables traders to leverage flash loans for instant capital access without upfront collateral and use decentralized exchanges for transparent, permissionless trading. This knowledge enhances strategic decision-making and improves overall trading performance in blockchain-based financial markets.

Comparison Table

| Feature | Flash Loans | Decentralized Exchanges (DEXs) |

|---|---|---|

| Definition | Instant, uncollateralized loans executed within one blockchain transaction | Platforms for peer-to-peer crypto asset trading without intermediaries |

| Collateral Required | No collateral needed | Not applicable for trading; users must hold assets to trade |

| Use Cases | Arbitrage, liquidation, collateral swapping, rapid refinancing | Spot trading, liquidity provision, token swaps, yield farming |

| Risk | High risk if transaction fails; requires precise execution | Smart contract vulnerabilities, impermanent loss, front-running |

| Transaction Scope | Single atomic transaction on blockchain | Multiple independent trades over time |

| Fees | Gas fees plus protocol fees | Trading fees, gas fees, and potential slippage |

| Examples | Aave, dYdX (Flash Loans) | Uniswap, Sushiswap, PancakeSwap |

Which is better?

Flash loans offer instant, collateral-free borrowing primarily used for arbitrage and liquidity provision, making them highly efficient for experienced traders. Decentralized exchanges (DEXs) provide decentralized asset trading with enhanced security and user control over funds, though they may have higher slippage and slower transaction times compared to centralized options. Choosing between flash loans and DEXs depends on the trader's strategy, risk tolerance, and need for immediate liquidity versus secure, peer-to-peer trading.

Connection

Flash loans enable instant, uncollateralized borrowing of cryptocurrency, which traders utilize on decentralized exchanges (DEXs) to execute complex arbitrage and liquidation strategies within a single transaction. These loans facilitate rapid capital access without upfront collateral, allowing seamless asset swaps and liquidity provision on DEX platforms. By leveraging flash loans, traders exploit price discrepancies across decentralized markets, enhancing efficiency and market depth.

Key Terms

Liquidity Pools

Decentralized exchanges (DEXs) rely on liquidity pools to enable seamless token swaps without intermediaries, where users provide assets to earn fees and facilitate trades. Flash loans leverage liquidity pools instantly borrowing large amounts of capital for arbitrage, collateral swapping, or refinancing within a single transaction, requiring no upfront collateral but high technical know-how. Explore more about how liquidity pools power both DEXs and innovative DeFi tools like flash loans.

Smart Contracts

Decentralized exchanges (DEXs) utilize smart contracts to enable peer-to-peer trading without intermediaries, ensuring trustless and transparent asset swaps. Flash loans, powered by smart contracts, allow users to borrow large amounts of cryptocurrency instantly and without collateral, provided the loan is repaid within the same transaction block. Explore the intricate role of smart contracts in revolutionizing decentralized finance by learning more about DEXs and flash loans.

Arbitrage

Decentralized exchanges (DEXs) offer permissionless trading environments with liquidity pools that enable rapid asset swaps, essential for arbitrage opportunities. Flash loans provide instant, uncollateralized capital to execute complex arbitrage strategies across multiple platforms within a single transaction, minimizing capital risk. Explore how combining DEXs and flash loans can maximize arbitrage profits in the decentralized finance ecosystem.

Source and External Links

Best DEX Decentralized exchanges - DeFi Prime - Decentralized exchanges (DEXs) operate without a central authority and include platforms like GMX, Hyperliquid, 1inch.exchange, Aevo, AirSwap, Balancer, and Bancor, offering various features such as spot and perpetual trading, derivatives, and liquidity pools.

What is a DEX? - Coinbase - A DEX is a peer-to-peer crypto marketplace allowing direct trades between users using smart contracts and liquidity pools, operating without centralized order books and settling transactions on the blockchain.

What Is a DEX? Decentralized Exchange Platforms - Gemini - DEXs are non-custodial platforms that connect buyers and sellers directly via smart contracts, enabling automated trustless trading while users retain control of their private keys with no central authority involved.

dowidth.com

dowidth.com