Tape reading focuses on analyzing real-time transaction data to gauge market sentiment by observing price, volume, and time variations, while order flow examines the depth of buy and sell orders to predict short-term price movements. Traders use tape reading for immediate execution insights, whereas order flow provides a broader understanding of supply and demand dynamics within the order book. Explore deeper differences and practical applications of tape reading versus order flow to enhance your trading strategy.

Why it is important

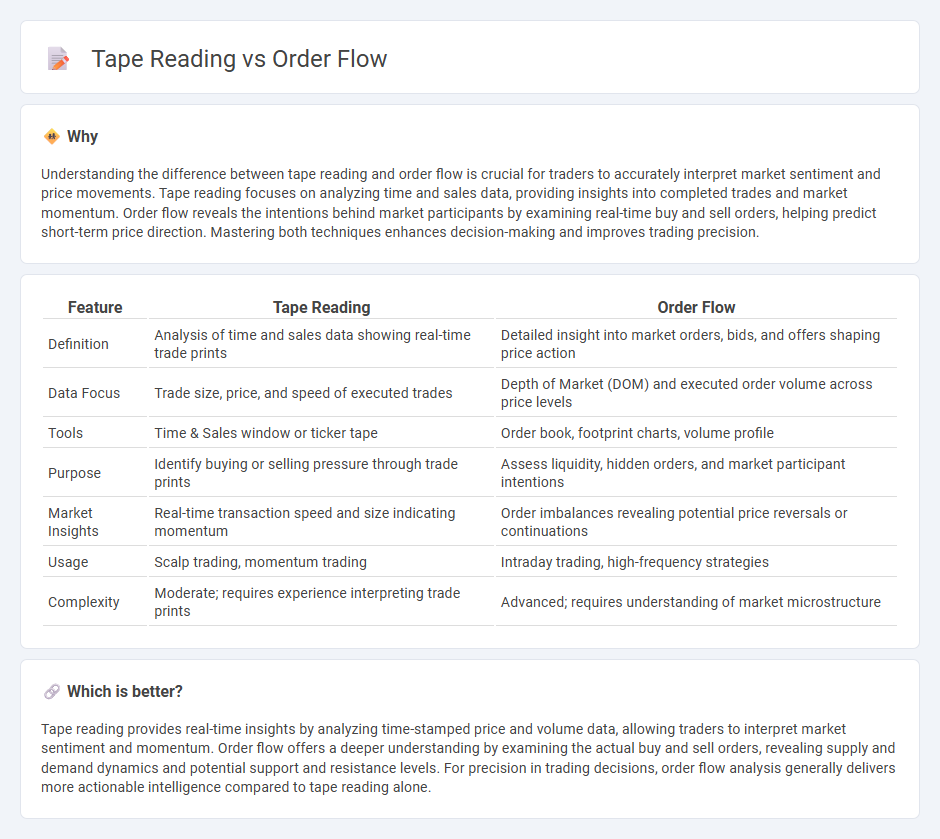

Understanding the difference between tape reading and order flow is crucial for traders to accurately interpret market sentiment and price movements. Tape reading focuses on analyzing time and sales data, providing insights into completed trades and market momentum. Order flow reveals the intentions behind market participants by examining real-time buy and sell orders, helping predict short-term price direction. Mastering both techniques enhances decision-making and improves trading precision.

Comparison Table

| Feature | Tape Reading | Order Flow |

|---|---|---|

| Definition | Analysis of time and sales data showing real-time trade prints | Detailed insight into market orders, bids, and offers shaping price action |

| Data Focus | Trade size, price, and speed of executed trades | Depth of Market (DOM) and executed order volume across price levels |

| Tools | Time & Sales window or ticker tape | Order book, footprint charts, volume profile |

| Purpose | Identify buying or selling pressure through trade prints | Assess liquidity, hidden orders, and market participant intentions |

| Market Insights | Real-time transaction speed and size indicating momentum | Order imbalances revealing potential price reversals or continuations |

| Usage | Scalp trading, momentum trading | Intraday trading, high-frequency strategies |

| Complexity | Moderate; requires experience interpreting trade prints | Advanced; requires understanding of market microstructure |

Which is better?

Tape reading provides real-time insights by analyzing time-stamped price and volume data, allowing traders to interpret market sentiment and momentum. Order flow offers a deeper understanding by examining the actual buy and sell orders, revealing supply and demand dynamics and potential support and resistance levels. For precision in trading decisions, order flow analysis generally delivers more actionable intelligence compared to tape reading alone.

Connection

Tape reading involves analyzing real-time price and volume data to interpret market sentiment, while order flow provides insight into the actual buy and sell orders driving price movements. Together, they enable traders to gauge supply and demand dynamics and predict short-term price fluctuations more accurately. Mastering tape reading and order flow analysis enhances decision-making in high-frequency and day trading strategies.

Key Terms

Liquidity

Order flow and tape reading both analyze market liquidity by examining the actual transactions and order book dynamics to identify supply and demand imbalances. Order flow focuses on real-time analysis of market orders, limit orders, and cancellations to gauge immediate liquidity shifts, whereas tape reading interprets time and sales data to detect large trades and price movement patterns. Explore deeper insights into how liquidity drives trading strategies and market behavior.

Bid-Ask Spread

Order flow trading analyzes the real-time transactions and the volume behind market moves, providing insight into market sentiment by observing bid and ask orders. Tape reading emphasizes monitoring the actual execution of trades, focusing on the bid-ask spread to gauge immediate buying and selling pressure. Explore how mastering bid-ask dynamics through order flow and tape reading can enhance your trading accuracy.

Market Orders

Market orders play a pivotal role in both order flow analysis and tape reading by indicating immediate buying or selling pressure through executed trades. Order flow focuses on aggregating these market orders to reveal volume imbalances and potential price movements, while tape reading interprets time and sales data for real-time insights into order execution speed and size. Explore in-depth strategies to leverage market orders for enhanced trading decisions.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools - Order flow analysis involves observing and interpreting real-time buy and sell orders, including their size and aggressiveness, to predict price movements through techniques like reading the order book and volume analysis.

Lesson 1 - The Basics of Order Flow & Volume Analysis - Order flow analysis is based on understanding market and limit orders, tracking how aggressive market orders (buyers or sellers) consume bids or offers affecting price direction in real time.

Order Flow Trading & Volumetric Bars - Order flow trading uses tools like volumetric bars, market depth, VWAP, and cumulative delta to visualize buying and selling pressure, identify support and resistance, and confirm market trends as they develop.

dowidth.com

dowidth.com