Dark pool prints reveal large, non-public block trades executed away from traditional exchanges, providing insights into institutional buying or selling activity. Level 2 data displays real-time bid and ask orders on the exchange, offering transparency into market depth and price movements. Explore how combining dark pool prints with Level 2 data can enhance your trading strategy.

Why it is important

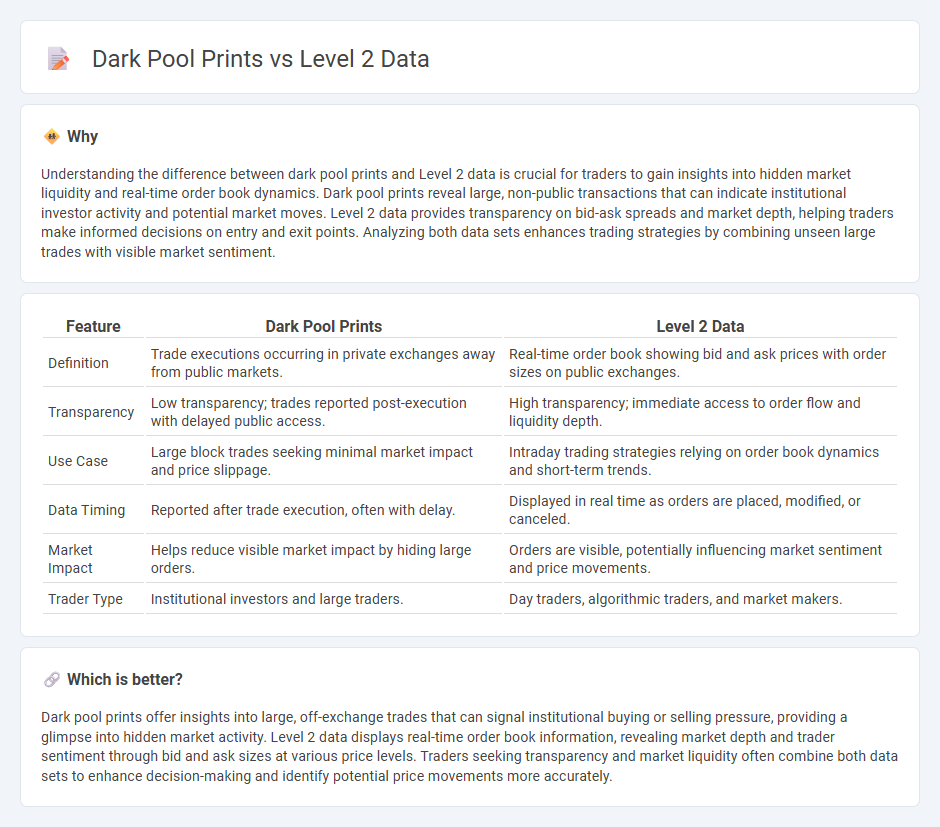

Understanding the difference between dark pool prints and Level 2 data is crucial for traders to gain insights into hidden market liquidity and real-time order book dynamics. Dark pool prints reveal large, non-public transactions that can indicate institutional investor activity and potential market moves. Level 2 data provides transparency on bid-ask spreads and market depth, helping traders make informed decisions on entry and exit points. Analyzing both data sets enhances trading strategies by combining unseen large trades with visible market sentiment.

Comparison Table

| Feature | Dark Pool Prints | Level 2 Data |

|---|---|---|

| Definition | Trade executions occurring in private exchanges away from public markets. | Real-time order book showing bid and ask prices with order sizes on public exchanges. |

| Transparency | Low transparency; trades reported post-execution with delayed public access. | High transparency; immediate access to order flow and liquidity depth. |

| Use Case | Large block trades seeking minimal market impact and price slippage. | Intraday trading strategies relying on order book dynamics and short-term trends. |

| Data Timing | Reported after trade execution, often with delay. | Displayed in real time as orders are placed, modified, or canceled. |

| Market Impact | Helps reduce visible market impact by hiding large orders. | Orders are visible, potentially influencing market sentiment and price movements. |

| Trader Type | Institutional investors and large traders. | Day traders, algorithmic traders, and market makers. |

Which is better?

Dark pool prints offer insights into large, off-exchange trades that can signal institutional buying or selling pressure, providing a glimpse into hidden market activity. Level 2 data displays real-time order book information, revealing market depth and trader sentiment through bid and ask sizes at various price levels. Traders seeking transparency and market liquidity often combine both data sets to enhance decision-making and identify potential price movements more accurately.

Connection

Dark pool prints reveal large block trades executed off-exchange, providing insight into institutional activity that is not immediately visible on public markets. Level 2 data, showing real-time bid and ask orders, helps traders gauge market depth and sentiment, which can align with or diverge from dark pool trades. The interaction between dark pool prints and Level 2 data enables a deeper understanding of supply and demand dynamics, informing more strategic trading decisions.

Key Terms

Order Book Depth

Level 2 data reveals real-time order book depth by displaying bid and ask prices along with their respective volumes, offering traders insight into market liquidity and potential price movements. Dark pool prints represent off-exchange transactions that occur in private trading venues, providing limited visibility into market supply and demand but often signaling large institutional trades. Explore the differences in order book transparency and market impact between Level 2 data and dark pool prints to enhance your trading strategy.

Trade Transparency

Level 2 data offers detailed insight into the order book, revealing bid and ask prices along with volumes for various price levels, which enhances market transparency by showing real-time supply and demand dynamics. Dark pool prints refer to trade reports from private exchanges where large trades occur without pre-trade transparency, often leading to delayed or limited visibility of price impact. Explore more on how trade transparency varies between these data sources and its impact on trading strategies.

Off-Exchange Transactions

Level 2 data provides detailed insights into the order book, showing real-time bids and asks across multiple price levels, which helps traders gauge market depth and liquidity. Dark pool prints reveal off-exchange transactions, offering a view of large block trades executed anonymously to minimize market impact and signal institutional activity. Explore the nuances of off-exchange transactions to better understand hidden liquidity and improve trading strategies.

Source and External Links

How to Interpret Level 2 Data - A Complete Guide - Level 2 data shows the full range of open limit orders for a stock beyond just the best bid and ask prices, revealing market depth and order book details useful for analyzing supply, demand, and potential support/resistance levels in trading.

What's Level II Market Data? - Robinhood - Level II market data provides detailed insight into multiple bid and ask prices from Nasdaq, showing the quantities at each price level to help traders assess market interest and short-term price direction.

Level 1 & Level 2 Market Data - Topstep Help Center - Level 2 data, also called Depth of Market data, displays 5-10 of the best bid and ask prices beyond Level 1 data, allowing traders to view pending buy and sell orders and is often used in DOM or matrix trading.

dowidth.com

dowidth.com