Synthetic positions replicate the payoff of options by combining underlying assets and options, offering traders tailored risk-return profiles without directly holding the options themselves. Strangle strategies involve purchasing out-of-the-money call and put options simultaneously to profit from significant price movements in either direction while limiting risk. Explore the differences in risk management and potential rewards between synthetic positions and strangles to enhance your trading strategy.

Why it is important

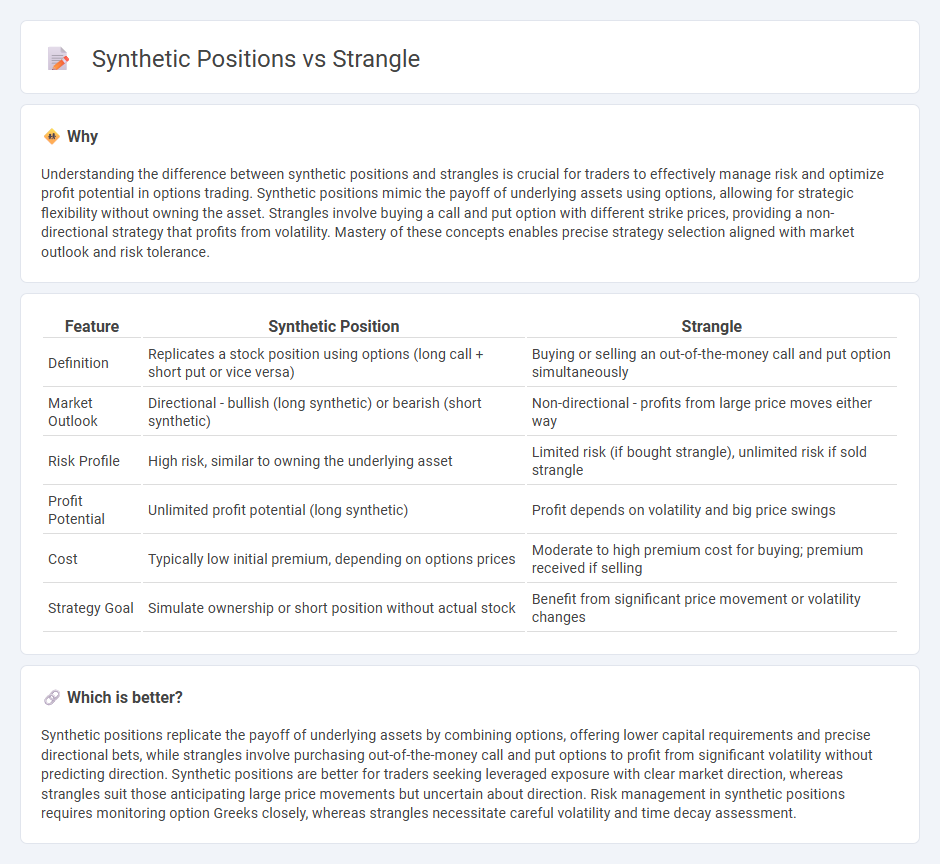

Understanding the difference between synthetic positions and strangles is crucial for traders to effectively manage risk and optimize profit potential in options trading. Synthetic positions mimic the payoff of underlying assets using options, allowing for strategic flexibility without owning the asset. Strangles involve buying a call and put option with different strike prices, providing a non-directional strategy that profits from volatility. Mastery of these concepts enables precise strategy selection aligned with market outlook and risk tolerance.

Comparison Table

| Feature | Synthetic Position | Strangle |

|---|---|---|

| Definition | Replicates a stock position using options (long call + short put or vice versa) | Buying or selling an out-of-the-money call and put option simultaneously |

| Market Outlook | Directional - bullish (long synthetic) or bearish (short synthetic) | Non-directional - profits from large price moves either way |

| Risk Profile | High risk, similar to owning the underlying asset | Limited risk (if bought strangle), unlimited risk if sold strangle |

| Profit Potential | Unlimited profit potential (long synthetic) | Profit depends on volatility and big price swings |

| Cost | Typically low initial premium, depending on options prices | Moderate to high premium cost for buying; premium received if selling |

| Strategy Goal | Simulate ownership or short position without actual stock | Benefit from significant price movement or volatility changes |

Which is better?

Synthetic positions replicate the payoff of underlying assets by combining options, offering lower capital requirements and precise directional bets, while strangles involve purchasing out-of-the-money call and put options to profit from significant volatility without predicting direction. Synthetic positions are better for traders seeking leveraged exposure with clear market direction, whereas strangles suit those anticipating large price movements but uncertain about direction. Risk management in synthetic positions requires monitoring option Greeks closely, whereas strangles necessitate careful volatility and time decay assessment.

Connection

Synthetic positions replicate the payoff of traditional options or futures contracts by combining long and short options, often involving calls and puts with the same strike price and expiration date. A strangle involves purchasing or selling out-of-the-money call and put options with different strike prices but the same expiration, creating a non-directional strategy that benefits from significant price movements. Both synthetic positions and strangles utilize option combinations to manage risk or speculate on volatility, leveraging options as flexible tools for customized exposure in trading.

Key Terms

Options (Calls & Puts)

A strangle in options trading involves buying or selling out-of-the-money calls and puts with different strike prices but the same expiration date, aiming to profit from significant price movements in either direction. Synthetic positions combine options to replicate the payoff of another asset or position, such as using a call and put at the same strike price to mimic holding the underlying stock. Explore detailed strategies and risk profiles of strangles and synthetic positions to optimize your options trading.

Strike Price

Strangle and synthetic positions differ primarily in strike price selection to manage risk and reward profiles in options trading. A strangle involves buying out-of-the-money call and put options with different strike prices, capturing large price movements with limited initial investment. Explore detailed strike price strategies to enhance your options trading success.

Payoff Structure

Strangle and synthetic positions differ primarily in payoff structure and risk profiles; a strangle involves buying or selling out-of-the-money call and put options with different strike prices, resulting in a non-linear payoff that benefits from significant price movement in either direction. Synthetic positions, created by combining options and/or underlying assets to mimic the payoff of another position, offer a more linear and controlled payoff structure, often replicating a long or short stock position with defined risk and reward. Explore deeper analysis of their strategic applications and risk management techniques to optimize your trading approach.

Source and External Links

Strangle (options) - Wikipedia - In finance, a strangle is an options strategy involving buying or selling a call and a put option with different strike prices but the same expiry and underlying asset, allowing profit from price movement regardless of direction.

Strangle Definition & Meaning | Britannica Dictionary - To strangle means to kill by squeezing the throat or to stop something from growing or developing, such as strangling competition or plants.

Strangling - Wikipedia - Strangling is the act of compressing the neck to restrict oxygen flow, which can cause unconsciousness or death and includes types such as hanging, ligature, or manual strangulation.

dowidth.com

dowidth.com