Degen trading involves high-risk, speculative trades often driven by market hype and rapid price swings, attracting traders seeking quick profits through volatile cryptocurrencies or meme stocks. Momentum trading focuses on capitalizing on existing market trends by buying assets with upward price momentum and selling those with downward momentum, relying on technical indicators to gauge entry and exit points. Explore in-depth strategies and risk management techniques to master both degen and momentum trading approaches.

Why it is important

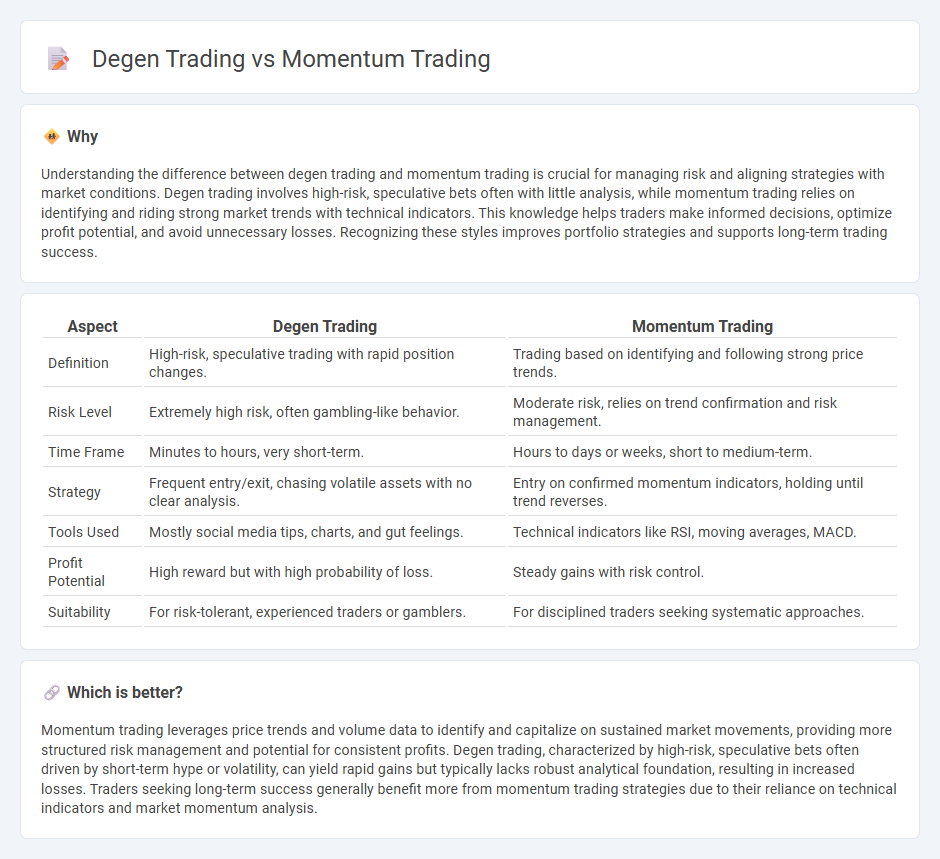

Understanding the difference between degen trading and momentum trading is crucial for managing risk and aligning strategies with market conditions. Degen trading involves high-risk, speculative bets often with little analysis, while momentum trading relies on identifying and riding strong market trends with technical indicators. This knowledge helps traders make informed decisions, optimize profit potential, and avoid unnecessary losses. Recognizing these styles improves portfolio strategies and supports long-term trading success.

Comparison Table

| Aspect | Degen Trading | Momentum Trading |

|---|---|---|

| Definition | High-risk, speculative trading with rapid position changes. | Trading based on identifying and following strong price trends. |

| Risk Level | Extremely high risk, often gambling-like behavior. | Moderate risk, relies on trend confirmation and risk management. |

| Time Frame | Minutes to hours, very short-term. | Hours to days or weeks, short to medium-term. |

| Strategy | Frequent entry/exit, chasing volatile assets with no clear analysis. | Entry on confirmed momentum indicators, holding until trend reverses. |

| Tools Used | Mostly social media tips, charts, and gut feelings. | Technical indicators like RSI, moving averages, MACD. |

| Profit Potential | High reward but with high probability of loss. | Steady gains with risk control. |

| Suitability | For risk-tolerant, experienced traders or gamblers. | For disciplined traders seeking systematic approaches. |

Which is better?

Momentum trading leverages price trends and volume data to identify and capitalize on sustained market movements, providing more structured risk management and potential for consistent profits. Degen trading, characterized by high-risk, speculative bets often driven by short-term hype or volatility, can yield rapid gains but typically lacks robust analytical foundation, resulting in increased losses. Traders seeking long-term success generally benefit more from momentum trading strategies due to their reliance on technical indicators and market momentum analysis.

Connection

Degen trading and momentum trading are connected through their reliance on rapid market movements and high-risk strategies to maximize short-term profits. Both approaches exploit volatile price trends, with degen trading often amplifying momentum signals through aggressive leverage and speculative bets on assets like cryptocurrencies. Traders engaged in these methods prioritize speed and market psychology to capitalize on swift asset price changes before reversals occur.

Key Terms

Momentum Trading:

Momentum trading capitalizes on identifying and riding price trends by analyzing volume, moving averages, and relative strength index (RSI) to enter and exit positions at optimal times. This strategy relies heavily on technical indicators and market sentiment to predict the continuation of asset momentum in stocks, cryptocurrencies, or forex markets. Discover more about how momentum trading can enhance your market performance and risk management strategies.

Trend

Momentum trading capitalizes on identifying and riding strong market trends by buying assets showing upward price movement and selling when momentum wanes. Degen trading involves high-risk, speculative bets on volatile assets or tokens without relying on clear trend signals, often fueled by hype and quick reversals. Explore how mastering trend analysis can elevate your momentum trading strategy and reduce exposure to degen-style risks.

Volume

Momentum trading leverages high trading volume to identify and capitalize on strong price trends driven by market sentiment and institutional activity. Degen trading focuses on extremely volatile, low-liquidity assets where volume spikes can signal rapid, speculative price movements often fueled by retail traders. Explore the nuances of volume dynamics in both strategies to optimize your trading approach.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends, with two main types: time-series momentum, which focuses on an asset's own historical performance, and cross-sectional momentum, which compares assets relative to each other to capitalize on price momentum.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - Momentum trading strategies include time-series momentum, which buys assets that have gained a certain percentage over a period, and cross-sectional momentum, which ranks assets by relative performance to choose top performers for trading.

Momentum Trading for Beginners (What They Don't Teach You) - This video explains momentum trading as a practical strategy that follows strong price moves using tools like RSI and MACD, emphasizing risk management and trading with trend strength rather than trying to buy low and sell high in fast-moving markets.

dowidth.com

dowidth.com