Grid trading involves placing buy and sell orders at predetermined intervals around a set price, capturing profits in ranging markets through systematic order execution. Trend following relies on identifying and riding sustained price movements, aiming to maximize gains by aligning trades with market momentum. Explore detailed strategies and performance insights to determine which method aligns best with your trading goals.

Why it is important

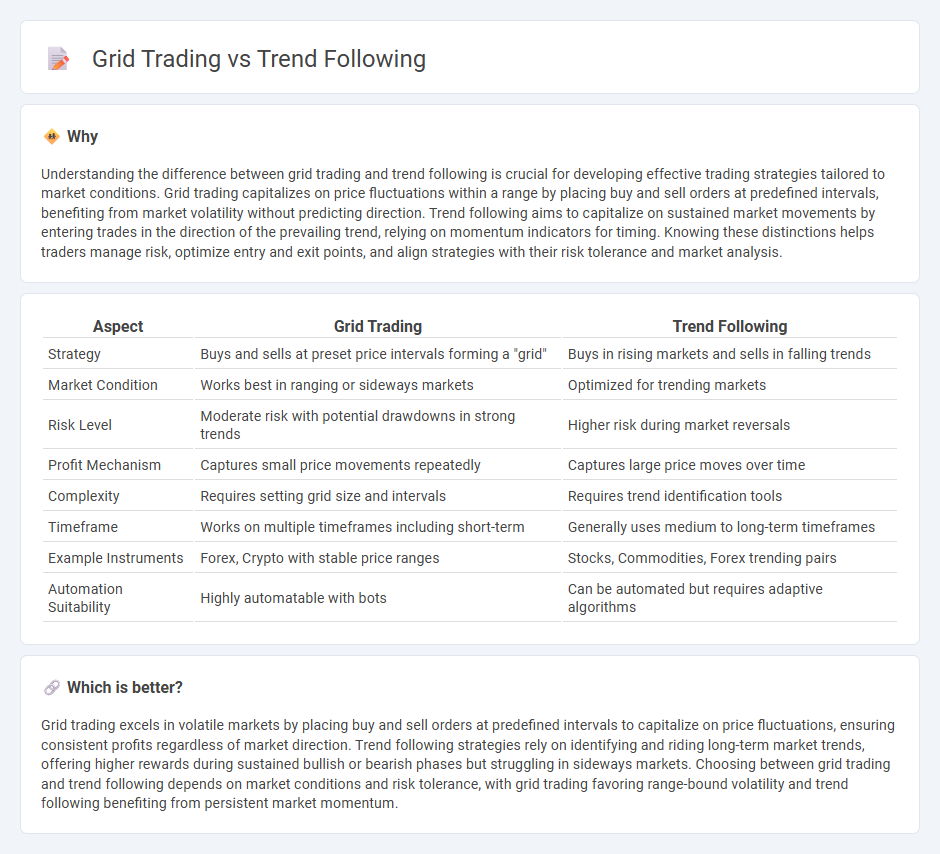

Understanding the difference between grid trading and trend following is crucial for developing effective trading strategies tailored to market conditions. Grid trading capitalizes on price fluctuations within a range by placing buy and sell orders at predefined intervals, benefiting from market volatility without predicting direction. Trend following aims to capitalize on sustained market movements by entering trades in the direction of the prevailing trend, relying on momentum indicators for timing. Knowing these distinctions helps traders manage risk, optimize entry and exit points, and align strategies with their risk tolerance and market analysis.

Comparison Table

| Aspect | Grid Trading | Trend Following |

|---|---|---|

| Strategy | Buys and sells at preset price intervals forming a "grid" | Buys in rising markets and sells in falling trends |

| Market Condition | Works best in ranging or sideways markets | Optimized for trending markets |

| Risk Level | Moderate risk with potential drawdowns in strong trends | Higher risk during market reversals |

| Profit Mechanism | Captures small price movements repeatedly | Captures large price moves over time |

| Complexity | Requires setting grid size and intervals | Requires trend identification tools |

| Timeframe | Works on multiple timeframes including short-term | Generally uses medium to long-term timeframes |

| Example Instruments | Forex, Crypto with stable price ranges | Stocks, Commodities, Forex trending pairs |

| Automation Suitability | Highly automatable with bots | Can be automated but requires adaptive algorithms |

Which is better?

Grid trading excels in volatile markets by placing buy and sell orders at predefined intervals to capitalize on price fluctuations, ensuring consistent profits regardless of market direction. Trend following strategies rely on identifying and riding long-term market trends, offering higher rewards during sustained bullish or bearish phases but struggling in sideways markets. Choosing between grid trading and trend following depends on market conditions and risk tolerance, with grid trading favoring range-bound volatility and trend following benefiting from persistent market momentum.

Connection

Grid trading and trend following both leverage market price movements to generate profits by strategically placing buy and sell orders; grid trading exploits price fluctuations within a range, while trend following capitalizes on sustained directional trends. Combining these methods allows traders to capture gains during trending phases and consolidate profits within sideways markets, enhancing overall strategy robustness. Effective integration of grid spacing and trend indicators optimizes entry and exit points, reducing risk and improving return consistency.

Key Terms

Momentum

Trend following strategies capitalize on momentum by entering trades aligned with sustained price directions, often using indicators like moving averages or the MACD to confirm trends. Grid trading, in contrast, builds a matrix of buy and sell orders at preset intervals without relying on momentum, aiming to profit from market volatility regardless of trend direction. Explore more about how momentum influences these trading methods to optimize your strategy.

Mean Reversion

Trend following strategies capitalize on sustained market momentum by entering positions aligned with the prevailing price direction, whereas grid trading involves placing buy and sell orders at predefined intervals to profit from price fluctuations within a range. Mean reversion techniques assume prices oscillate around an average value, making grid trading particularly effective in sideways markets where prices revert to the mean, while trend following can suffer from false breakouts. Explore detailed insights on optimizing mean reversion strategies for both trading methods to enhance your market performance.

Price Channel

Price Channel is a key indicator for trend following strategies, helping traders identify breakout points and confirm market direction by tracking highs and lows over a set period. Grid trading, however, utilizes price channels to set predetermined entry and exit levels within a range-bound market, capitalizing on price fluctuations without relying on trend direction. Explore detailed insights on how Price Channel optimizes both trend following and grid trading techniques for enhanced market performance.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where one buys an asset when its price trend is upward and sells when the trend is downward, expecting that price movements will continue in the direction of the trend, using various methods like moving averages or channel breakouts to identify these trends.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies focus on profiting from existing market momentum by entering trades aligned with current trends and exiting upon reversal signals, employing tools like ATR channels, Bollinger Bands, and moving averages; they are systematic, diversified, and require disciplined risk management due to possible drawdowns.

Trend-Following Primer - Graham Capital Management - Trend following is a major alternative investment strategy with over $300 billion in assets, characterized by systematic, algorithm-driven trading that longs in upward trends and shorts in downward trends, trading across many liquid futures and currency markets to diversify and manage risk effectively.

dowidth.com

dowidth.com