Gamma squeeze occurs when large option buying forces market makers to hedge by purchasing the underlying asset, driving prices sharply higher. Stop loss hunting involves triggering traders' stop loss orders to create volatility and capitalize on forced market exits. Explore detailed strategies and market implications to better understand these trading phenomena.

Why it is important

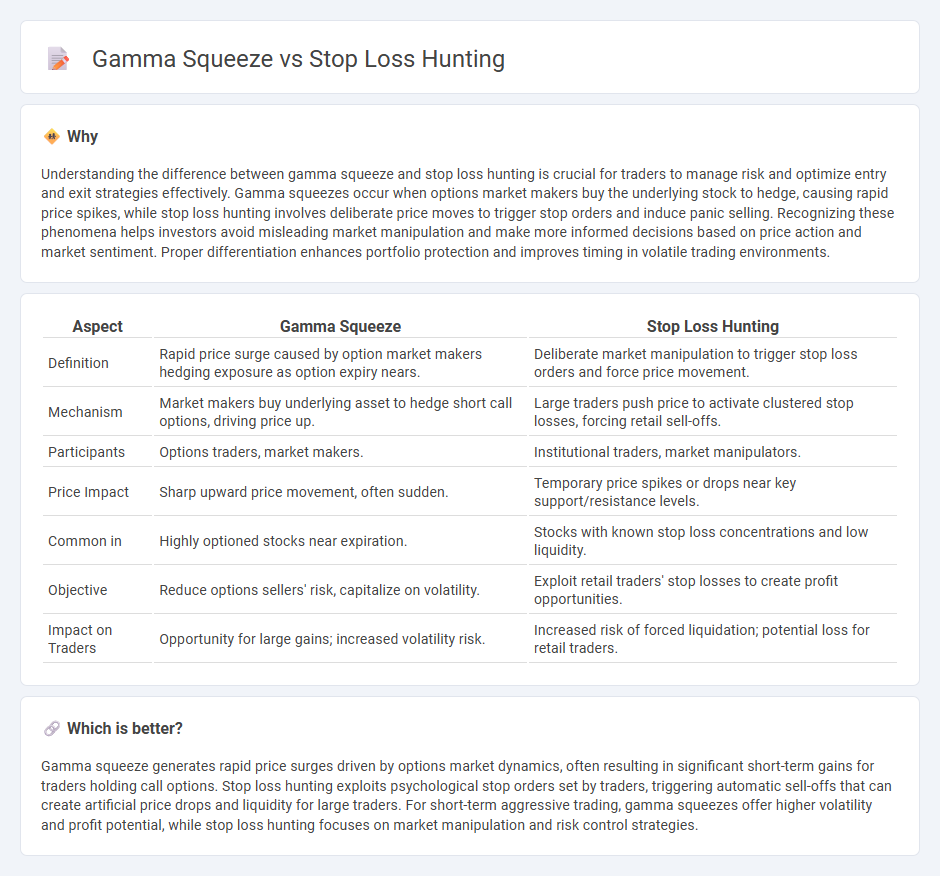

Understanding the difference between gamma squeeze and stop loss hunting is crucial for traders to manage risk and optimize entry and exit strategies effectively. Gamma squeezes occur when options market makers buy the underlying stock to hedge, causing rapid price spikes, while stop loss hunting involves deliberate price moves to trigger stop orders and induce panic selling. Recognizing these phenomena helps investors avoid misleading market manipulation and make more informed decisions based on price action and market sentiment. Proper differentiation enhances portfolio protection and improves timing in volatile trading environments.

Comparison Table

| Aspect | Gamma Squeeze | Stop Loss Hunting |

|---|---|---|

| Definition | Rapid price surge caused by option market makers hedging exposure as option expiry nears. | Deliberate market manipulation to trigger stop loss orders and force price movement. |

| Mechanism | Market makers buy underlying asset to hedge short call options, driving price up. | Large traders push price to activate clustered stop losses, forcing retail sell-offs. |

| Participants | Options traders, market makers. | Institutional traders, market manipulators. |

| Price Impact | Sharp upward price movement, often sudden. | Temporary price spikes or drops near key support/resistance levels. |

| Common in | Highly optioned stocks near expiration. | Stocks with known stop loss concentrations and low liquidity. |

| Objective | Reduce options sellers' risk, capitalize on volatility. | Exploit retail traders' stop losses to create profit opportunities. |

| Impact on Traders | Opportunity for large gains; increased volatility risk. | Increased risk of forced liquidation; potential loss for retail traders. |

Which is better?

Gamma squeeze generates rapid price surges driven by options market dynamics, often resulting in significant short-term gains for traders holding call options. Stop loss hunting exploits psychological stop orders set by traders, triggering automatic sell-offs that can create artificial price drops and liquidity for large traders. For short-term aggressive trading, gamma squeezes offer higher volatility and profit potential, while stop loss hunting focuses on market manipulation and risk control strategies.

Connection

Gamma squeeze and stop loss hunting are interconnected through market dynamics where rapid price movements trigger stop loss orders, amplifying volatility. Gamma squeezes occur when options market makers hedge positions by buying underlying assets as prices rise, creating upward momentum that can trigger clustered stop loss levels. This cascade effect intensifies price swings, linking gamma squeezes to stop loss hunting strategies often exploited by traders to force liquidations.

Key Terms

Liquidity

Stop loss hunting exploits clustered stop loss orders to trigger rapid price declines by targeting liquidity gaps, intensifying market volatility. Gamma squeezes occur as options market makers hedge their positions, forcing continuous buying of the underlying asset, which drives liquidity deeper and prices higher. Explore the intricate dynamics of liquidity in these market phenomena to enhance trading strategies.

Options Delta

Stop loss hunting exploits key price levels to trigger automatic sell orders, often targeting retail investors' stops to accelerate downward price movement. Gamma squeeze occurs when market makers hedge large option positions, buying underlying shares to adjust delta exposure as option deltas change rapidly near expiration, causing sharp price spikes. Explore detailed mechanics of options delta impact on market volatility for better trading strategies.

Market Maker

Market makers play a crucial role in stop loss hunting by strategically triggering clustered stop losses to induce sharp price movements, thus capturing liquidity. In gamma squeezes, they actively hedge their options positions by dynamically buying or selling underlying assets, leading to exaggerated price volatility due to increased demand. Explore how market makers' tactics influence these phenomena and their impact on trading strategies.

Source and External Links

Stop Hunting Guide (2025): How the Strategy Works - Stop loss hunting is a controversial strategy where large players like banks or hedge funds push prices to trigger many stop-loss orders, forcing smaller traders out of their positions for profit by identifying clustered stop-loss points and pushing prices strategically to activate them.

How to Avoid Stop-Loss Hunting in Forex - Blueberry Markets - Traders can avoid stop loss hunting by using mental stops, setting stops at key technical levels instead of obvious round numbers, and adjusting position sizes to reduce vulnerability to stop-loss triggering by manipulative price moves.

Stop Loss Hunting - How to Use It and How to Protect Yourself From It - Stop loss hunting aims to profit from deliberately triggering others' stops, and traders can protect themselves by placing stop losses where they invalidate their trade setups and by learning trading approaches like mean reversion to capitalize on stop hunts.

dowidth.com

dowidth.com