Atomic swaps enable direct cryptocurrency exchanges between different blockchains without intermediaries, enhancing security and reducing transaction costs. Peer-to-peer trading involves direct asset transactions between users, often facilitated by decentralized platforms but may require trust or escrow services. Explore the distinct advantages of atomic swaps and peer-to-peer trading to optimize your trading strategy.

Why it is important

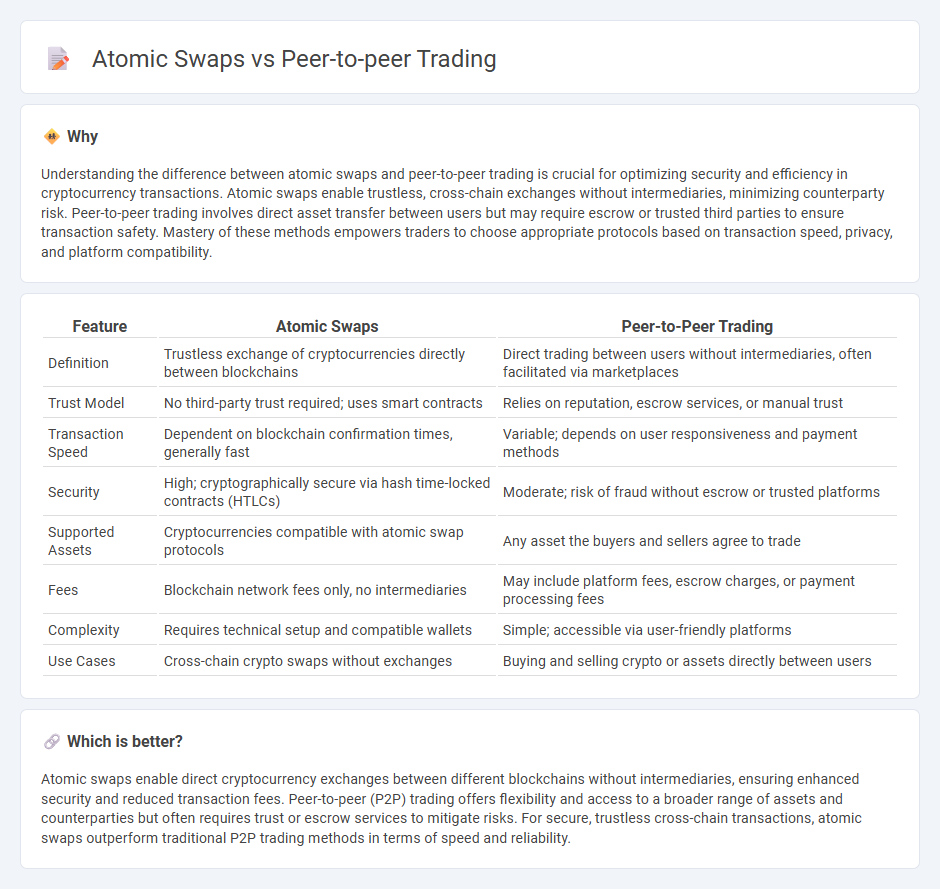

Understanding the difference between atomic swaps and peer-to-peer trading is crucial for optimizing security and efficiency in cryptocurrency transactions. Atomic swaps enable trustless, cross-chain exchanges without intermediaries, minimizing counterparty risk. Peer-to-peer trading involves direct asset transfer between users but may require escrow or trusted third parties to ensure transaction safety. Mastery of these methods empowers traders to choose appropriate protocols based on transaction speed, privacy, and platform compatibility.

Comparison Table

| Feature | Atomic Swaps | Peer-to-Peer Trading |

|---|---|---|

| Definition | Trustless exchange of cryptocurrencies directly between blockchains | Direct trading between users without intermediaries, often facilitated via marketplaces |

| Trust Model | No third-party trust required; uses smart contracts | Relies on reputation, escrow services, or manual trust |

| Transaction Speed | Dependent on blockchain confirmation times, generally fast | Variable; depends on user responsiveness and payment methods |

| Security | High; cryptographically secure via hash time-locked contracts (HTLCs) | Moderate; risk of fraud without escrow or trusted platforms |

| Supported Assets | Cryptocurrencies compatible with atomic swap protocols | Any asset the buyers and sellers agree to trade |

| Fees | Blockchain network fees only, no intermediaries | May include platform fees, escrow charges, or payment processing fees |

| Complexity | Requires technical setup and compatible wallets | Simple; accessible via user-friendly platforms |

| Use Cases | Cross-chain crypto swaps without exchanges | Buying and selling crypto or assets directly between users |

Which is better?

Atomic swaps enable direct cryptocurrency exchanges between different blockchains without intermediaries, ensuring enhanced security and reduced transaction fees. Peer-to-peer (P2P) trading offers flexibility and access to a broader range of assets and counterparties but often requires trust or escrow services to mitigate risks. For secure, trustless cross-chain transactions, atomic swaps outperform traditional P2P trading methods in terms of speed and reliability.

Connection

Atomic swaps enable peer-to-peer trading by allowing users to exchange cryptocurrencies directly between different blockchains without intermediaries, enhancing security and trustlessness. This technology leverages smart contracts to ensure that both parties complete the trade simultaneously, minimizing counterparty risk. By facilitating decentralized, cross-chain transactions, atomic swaps drive the growth of truly peer-to-peer trading ecosystems.

Key Terms

Trustless

Peer-to-peer trading involves direct transactions between users without intermediaries, but it often requires trust or escrow services to ensure security. Atomic swaps enable trustless exchanges by using cryptographic protocols that guarantee simultaneous asset transfers without relying on third parties. Explore the detailed mechanisms behind trustless atomic swaps to understand their impact on decentralized trading.

Intermediary

Peer-to-peer trading involves direct transactions between users but often requires an intermediary such as a centralized exchange or escrow service to ensure trust and security. Atomic swaps eliminate the need for intermediaries by enabling cross-chain transactions through smart contracts that execute trades simultaneously, reducing counterparty risk. Discover the advantages and challenges of both methods to optimize your decentralized trading strategy.

Smart Contract

Peer-to-peer trading leverages smart contracts to automate and enforce agreements directly between users without intermediaries, enhancing trust and security through programmable conditions. Atomic swaps utilize smart contracts to enable instant, trustless cross-chain exchanges of cryptocurrencies, ensuring that either both parties fulfill the trade simultaneously or the transaction reverses. Discover how smart contract innovations redefine decentralized trading mechanisms.

Source and External Links

Peer-to-peer (P2P) vs. centralized crypto exchanges - Cointelegraph - Peer-to-peer exchanges are online platforms where users trade cryptocurrencies directly with each other, without intermediaries, using blockchain for transparency and escrow for security.

What Is Peer-To-Peer Trading and How Do People Use It? - P2P trading allows users to buy and sell cryptocurrencies directly among themselves, facilitated by exchanges that offer escrow, user ratings, and dispute resolution for safer transactions.

What is P2P Crypto Exchange and How Does Peer-to-Peer Works? - P2P crypto exchanges connect buyers and sellers directly, supporting a wide range of payment methods and operating especially well in regions with strict financial regulations.

dowidth.com

dowidth.com