Liquidity mining involves providing cryptocurrency assets to decentralized finance (DeFi) protocols in exchange for rewards, enhancing market liquidity and enabling efficient trading. Staking requires locking up tokens to support blockchain network operations, earning rewards based on the staked amount and duration. Explore the detailed differences and benefits of liquidity mining versus staking to optimize your trading strategy.

Why it is important

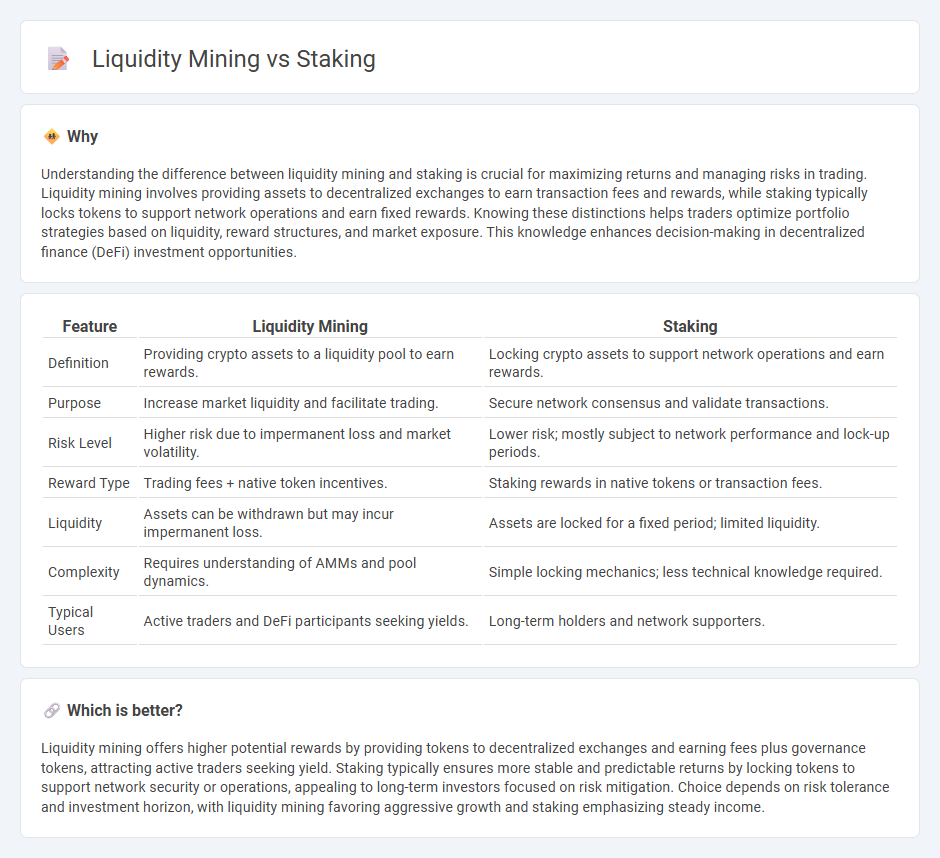

Understanding the difference between liquidity mining and staking is crucial for maximizing returns and managing risks in trading. Liquidity mining involves providing assets to decentralized exchanges to earn transaction fees and rewards, while staking typically locks tokens to support network operations and earn fixed rewards. Knowing these distinctions helps traders optimize portfolio strategies based on liquidity, reward structures, and market exposure. This knowledge enhances decision-making in decentralized finance (DeFi) investment opportunities.

Comparison Table

| Feature | Liquidity Mining | Staking |

|---|---|---|

| Definition | Providing crypto assets to a liquidity pool to earn rewards. | Locking crypto assets to support network operations and earn rewards. |

| Purpose | Increase market liquidity and facilitate trading. | Secure network consensus and validate transactions. |

| Risk Level | Higher risk due to impermanent loss and market volatility. | Lower risk; mostly subject to network performance and lock-up periods. |

| Reward Type | Trading fees + native token incentives. | Staking rewards in native tokens or transaction fees. |

| Liquidity | Assets can be withdrawn but may incur impermanent loss. | Assets are locked for a fixed period; limited liquidity. |

| Complexity | Requires understanding of AMMs and pool dynamics. | Simple locking mechanics; less technical knowledge required. |

| Typical Users | Active traders and DeFi participants seeking yields. | Long-term holders and network supporters. |

Which is better?

Liquidity mining offers higher potential rewards by providing tokens to decentralized exchanges and earning fees plus governance tokens, attracting active traders seeking yield. Staking typically ensures more stable and predictable returns by locking tokens to support network security or operations, appealing to long-term investors focused on risk mitigation. Choice depends on risk tolerance and investment horizon, with liquidity mining favoring aggressive growth and staking emphasizing steady income.

Connection

Liquidity mining incentivizes traders to provide assets to decentralized exchanges by offering rewards, enhancing market liquidity and facilitating smoother trade executions. Staking involves locking tokens in a protocol to support network security or operations, often yielding staking rewards that complement liquidity mining incentives. Both mechanisms synergize in decentralized finance (DeFi) ecosystems by promoting asset availability and user participation, crucial for efficient trading environments.

Key Terms

Rewards

Staking offers predictable rewards by locking tokens in a blockchain network to support operations and secure the system, typically yielding fixed or variable interest rates. Liquidity mining provides incentives through transaction fees and governance tokens by supplying assets to decentralized finance (DeFi) pools, often resulting in higher but more volatile returns. Explore the detailed comparison of staking and liquidity mining rewards to optimize your crypto investment strategy.

Lock-up Period

Staking typically involves locking up cryptocurrencies for a fixed period to earn rewards, ensuring network security and consensus participation. Liquidity mining requires providing tokens to decentralized exchanges or protocols, with more flexible or shorter lock-up periods but higher exposure to impermanent loss. Explore detailed comparisons on lock-up durations and reward mechanisms to optimize your DeFi strategy.

Risk (Impermanent Loss)

Staking involves locking tokens to support blockchain operations, offering predictable rewards with minimal risk of impermanent loss, whereas liquidity mining requires providing assets to decentralized pools, exposing investors to impermanent loss due to price fluctuations between paired tokens. Impermanent loss occurs when the value of deposited assets changes relative to holding them, potentially reducing overall returns in liquidity mining. Explore deeper insights into risk management strategies for both staking and liquidity mining.

Source and External Links

What is crypto staking and how does it work? - Crypto staking is the process where users lock up their cryptocurrencies to validate blockchain transactions via a proof-of-stake consensus, earning rewards for helping maintain the network's security and integrity.

Staking on Solana - Staking involves delegating your tokens to a validator to increase its voting power in the network's consensus, while you retain full control of your tokens and earn rewards proportionally to the stake delegated.

What is staking? - Staking allows cryptocurrency holders to earn rewards by putting their crypto to work supporting blockchain networks without lending their assets, helping ensure the network runs smoothly and securely.

dowidth.com

dowidth.com