Front running involves a trader executing orders based on advance knowledge of pending large transactions to profit from subsequent price movements, while wash trading entails repeatedly buying and selling the same asset to create misleading market activity without actual risk exposure. Both practices manipulate market integrity and are prohibited by regulatory authorities such as the SEC and CFTC to protect investors. Explore further to understand how these tactics impact market fairness and investor confidence.

Why it is important

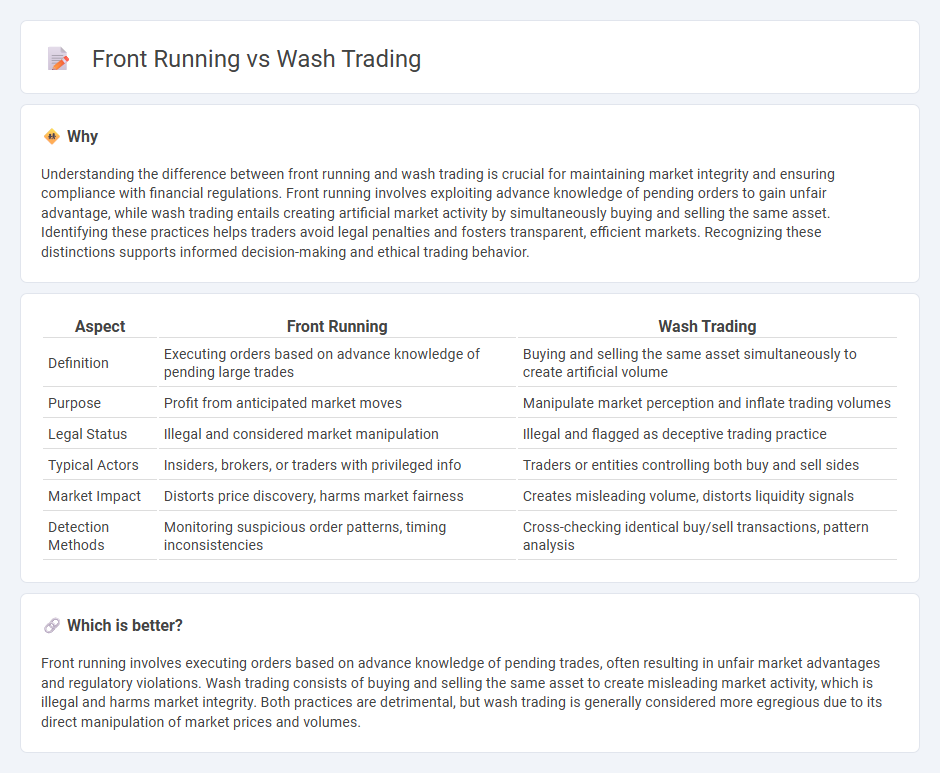

Understanding the difference between front running and wash trading is crucial for maintaining market integrity and ensuring compliance with financial regulations. Front running involves exploiting advance knowledge of pending orders to gain unfair advantage, while wash trading entails creating artificial market activity by simultaneously buying and selling the same asset. Identifying these practices helps traders avoid legal penalties and fosters transparent, efficient markets. Recognizing these distinctions supports informed decision-making and ethical trading behavior.

Comparison Table

| Aspect | Front Running | Wash Trading |

|---|---|---|

| Definition | Executing orders based on advance knowledge of pending large trades | Buying and selling the same asset simultaneously to create artificial volume |

| Purpose | Profit from anticipated market moves | Manipulate market perception and inflate trading volumes |

| Legal Status | Illegal and considered market manipulation | Illegal and flagged as deceptive trading practice |

| Typical Actors | Insiders, brokers, or traders with privileged info | Traders or entities controlling both buy and sell sides |

| Market Impact | Distorts price discovery, harms market fairness | Creates misleading volume, distorts liquidity signals |

| Detection Methods | Monitoring suspicious order patterns, timing inconsistencies | Cross-checking identical buy/sell transactions, pattern analysis |

Which is better?

Front running involves executing orders based on advance knowledge of pending trades, often resulting in unfair market advantages and regulatory violations. Wash trading consists of buying and selling the same asset to create misleading market activity, which is illegal and harms market integrity. Both practices are detrimental, but wash trading is generally considered more egregious due to its direct manipulation of market prices and volumes.

Connection

Front running and wash trading are connected through their manipulative impact on market fairness and liquidity. Front running involves a trader exploiting non-public information about pending orders to execute trades for personal gain, while wash trading creates artificial market activity by repeatedly buying and selling the same asset to mislead other participants. Both practices distort true market signals, undermining price discovery and regulatory compliance in trading environments.

Key Terms

Fake volume (wash trading)

Wash trading involves creating fake volume by simultaneously buying and selling the same asset to mislead market participants about its liquidity. This deceptive practice inflates trading volumes without genuine market interest, contrasting with front running, where traders exploit non-public information for profit. Explore more to understand the impact of wash trading on market integrity and investor trust.

Insider knowledge (front running)

Front running involves exploiting insider knowledge, where traders use non-public information about upcoming orders to execute trades ahead of others, profiting from anticipated market movements. In contrast, wash trading artificially inflates market activity without genuine insider insight, aiming to mislead other participants about asset demand or price. Discover how regulatory frameworks target front running abuses to protect market integrity and investor trust.

Market manipulation

Wash trading involves creating artificial trading activity by simultaneously buying and selling the same financial instruments to mislead market participants about demand and liquidity. Front running is the practice where a trader executes orders based on advance knowledge of pending large transactions to profit unfairly, undermining market integrity. Explore the detailed differences and impact of these market manipulation tactics to protect your investments.

Source and External Links

What is Wash Trading? - Wash trading is a market manipulation tactic where a trader buys and sells the same security simultaneously or nearly simultaneously to create false trading activity, inflate volume, and manipulate prices without actual change in ownership.

What is Wash Trading? - It involves collusion between buyer and seller to mislead the market by artificially inflating security value through repetitive trades that return ownership to original parties, banned federally since 1936.

Wash Trading - Overview, How It Works, and Example - Also called round trip trading, it's an illegal practice where investors buy and sell the same instruments themselves to manipulate the market by increasing volume and perceived demand.

dowidth.com

dowidth.com