Paper trading platforms provide simulated environments for practicing trades without financial risk, ideal for beginners and strategy testing. Proprietary trading platforms offer advanced tools and direct market access for professional traders, maximizing execution speed and customization. Explore the features and benefits of both to determine the best fit for your trading goals.

Why it is important

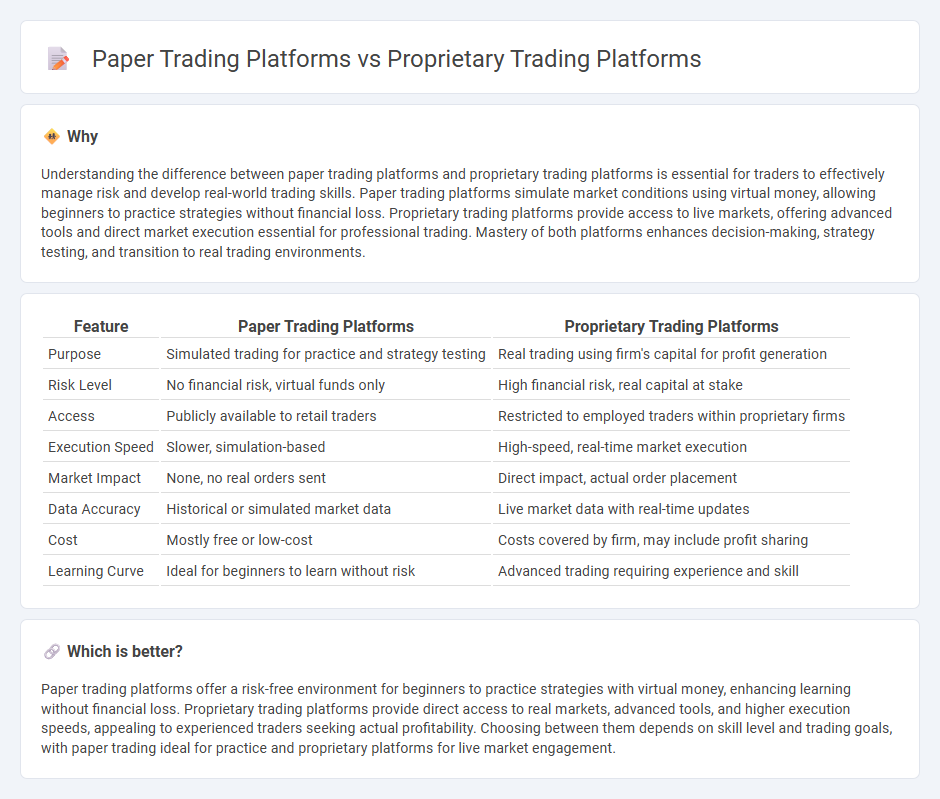

Understanding the difference between paper trading platforms and proprietary trading platforms is essential for traders to effectively manage risk and develop real-world trading skills. Paper trading platforms simulate market conditions using virtual money, allowing beginners to practice strategies without financial loss. Proprietary trading platforms provide access to live markets, offering advanced tools and direct market execution essential for professional trading. Mastery of both platforms enhances decision-making, strategy testing, and transition to real trading environments.

Comparison Table

| Feature | Paper Trading Platforms | Proprietary Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Real trading using firm's capital for profit generation |

| Risk Level | No financial risk, virtual funds only | High financial risk, real capital at stake |

| Access | Publicly available to retail traders | Restricted to employed traders within proprietary firms |

| Execution Speed | Slower, simulation-based | High-speed, real-time market execution |

| Market Impact | None, no real orders sent | Direct impact, actual order placement |

| Data Accuracy | Historical or simulated market data | Live market data with real-time updates |

| Cost | Mostly free or low-cost | Costs covered by firm, may include profit sharing |

| Learning Curve | Ideal for beginners to learn without risk | Advanced trading requiring experience and skill |

Which is better?

Paper trading platforms offer a risk-free environment for beginners to practice strategies with virtual money, enhancing learning without financial loss. Proprietary trading platforms provide direct access to real markets, advanced tools, and higher execution speeds, appealing to experienced traders seeking actual profitability. Choosing between them depends on skill level and trading goals, with paper trading ideal for practice and proprietary platforms for live market engagement.

Connection

Paper trading platforms simulate real-market conditions by allowing traders to practice strategies without financial risk, using virtual funds and real-time data. Proprietary trading platforms leverage these simulations to test algorithmic models and refine decision-making before deploying actual capital. The integration of both platforms enhances trader proficiency and reduces risk exposure in live trading environments.

Key Terms

Real Capital

Proprietary trading platforms offer direct market access with actual capital and advanced algorithmic tools, enabling traders to execute real-time trades and strategies with tangible financial outcomes. Paper trading platforms simulate market conditions without financial risk, allowing users to practice and refine strategies on Real Capital without incurring losses or commitments. Explore the key differences and benefits of Real Capital's proprietary and paper trading platforms to optimize your trading approach.

Simulation Environment

Proprietary trading platforms offer real-time market access with live data feeds, enabling traders to execute actual trades and manage real capital. Paper trading platforms simulate the trading environment without financial risk, providing historical data and virtual portfolios to test strategies in a risk-free setting. Explore the key differences in simulation environments to choose the ideal platform for your trading goals.

Execution Speed

Proprietary trading platforms often deliver superior execution speed compared to paper trading platforms because they operate directly with live market data and real-time order placement, minimizing delays and slippage. Paper trading platforms simulate market conditions but lack the real-time processing power and infrastructure required for instant execution, which is critical in high-frequency trading or volatile markets. Explore more to understand how execution speed impacts trading performance across different platform types.

Source and External Links

Proprietary Trading: Top 10 Platforms - UpTrader CRM - Lists leading proprietary trading platforms such as CQG Integrated Client, TradeStation, Jane Street, and Sierra Chart, highlighting advanced charting, automated trading, and global market access tailored for professional prop traders.

Top Prop Trading Firms: 10 Best Companies For Traders 2024 - Describes top prop firms like Jane Street, DRW Trading, and Tower Research Capital, renowned for combining proprietary trading platforms with sophisticated quantitative strategies and technology infrastructure supporting multi-asset trading globally.

Best prop firms for US traders in 2025 - CBS News - Reviews proprietary trading firms and their platforms such as TradeLocker (integrated with TradingView) and DXTrade, discussing leverage options, asset classes, and features suited for both manual and automated trading approaches.

dowidth.com

dowidth.com