Execution algorithms optimize trade timing and size by analyzing market conditions to reduce transaction costs and minimize market impact. Smart order routing systems dynamically direct orders across multiple trading venues to achieve the best execution price and increase order fill rates. Explore how these technologies enhance trading efficiency and decision-making.

Why it is important

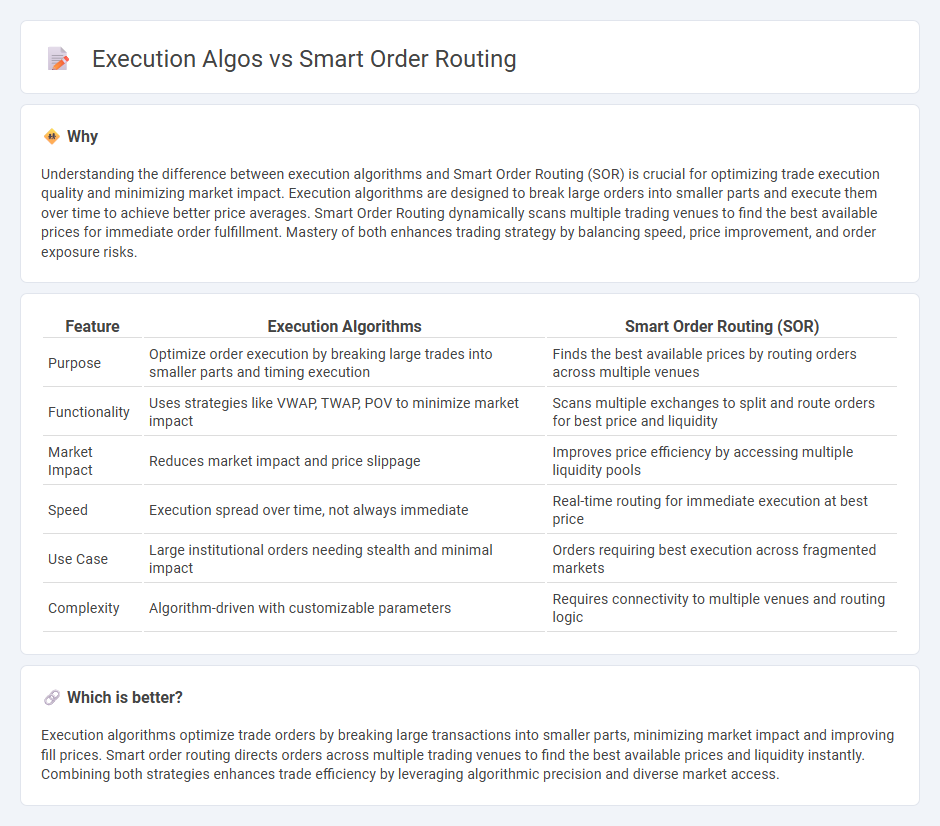

Understanding the difference between execution algorithms and Smart Order Routing (SOR) is crucial for optimizing trade execution quality and minimizing market impact. Execution algorithms are designed to break large orders into smaller parts and execute them over time to achieve better price averages. Smart Order Routing dynamically scans multiple trading venues to find the best available prices for immediate order fulfillment. Mastery of both enhances trading strategy by balancing speed, price improvement, and order exposure risks.

Comparison Table

| Feature | Execution Algorithms | Smart Order Routing (SOR) |

|---|---|---|

| Purpose | Optimize order execution by breaking large trades into smaller parts and timing execution | Finds the best available prices by routing orders across multiple venues |

| Functionality | Uses strategies like VWAP, TWAP, POV to minimize market impact | Scans multiple exchanges to split and route orders for best price and liquidity |

| Market Impact | Reduces market impact and price slippage | Improves price efficiency by accessing multiple liquidity pools |

| Speed | Execution spread over time, not always immediate | Real-time routing for immediate execution at best price |

| Use Case | Large institutional orders needing stealth and minimal impact | Orders requiring best execution across fragmented markets |

| Complexity | Algorithm-driven with customizable parameters | Requires connectivity to multiple venues and routing logic |

Which is better?

Execution algorithms optimize trade orders by breaking large transactions into smaller parts, minimizing market impact and improving fill prices. Smart order routing directs orders across multiple trading venues to find the best available prices and liquidity instantly. Combining both strategies enhances trade efficiency by leveraging algorithmic precision and diverse market access.

Connection

Execution algorithms analyze market conditions and trade objectives to optimize order placement, while Smart Order Routing (SOR) dynamically scans multiple trading venues to identify the best prices and liquidity. These technologies work together to reduce market impact and improve trade efficiency by automatically directing orders through optimal routes based on real-time data. Combining execution algos with SOR enables traders to achieve faster execution, lower costs, and enhanced price discovery in fragmented markets.

Key Terms

Liquidity Access

Smart order routing optimizes trade execution by dynamically scanning multiple venues to access the best available liquidity and prices, reducing market impact and improving fill rates. Execution algorithms strategically break down large orders into smaller pieces using time or volume-based tactics to minimize market disruption and exploit liquidity pools over time. Explore the nuances of liquidity access and execution strategies to enhance trading performance and cost efficiency.

Order Splitting

Smart order routing leverages multiple venues to find the best price and liquidity for a trade, dynamically splitting orders across exchanges to minimize market impact and latency. Execution algorithms employ order splitting techniques to break large orders into smaller, strategically timed trades, optimizing for price improvement and minimizing market disruption. Explore the nuances of order splitting in smart order routing and execution algorithms to enhance trading performance.

Venue Selection

Smart order routing optimizes trade execution by dynamically directing orders to multiple venues based on real-time market data, liquidity, and price improvements. Execution algorithms prioritize trade strategies like VWAP or TWAP while selecting venues to minimize market impact and slippage. Discover the nuances of venue selection and how it impacts trading efficiency in advanced market environments.

Source and External Links

Smart Order Routing: Prioritize Fulfillment Locations and Deliver Products Faster to Your Customers - Smart order routing automatically routes orders to the best fulfillment location, such as a warehouse, retail store, or third-party logistics provider, based on rules like proximity, inventory availability, and minimizing split fulfillment to speed up order delivery and improve efficiency.

Smart Order Routing (SOR): definition and function explained simply - In trading, smart order routing uses advanced algorithms to execute orders optimally across various platforms by selecting venues with the best prices, highest liquidity, and lowest fees, thereby reducing slippage and increasing trading efficiency.

What is Smart Order Routing? (The Complete Guide) - Smart order routing algorithms scan multiple order routes and liquidity sources, including dark pools, to prioritize either speed or price of fills while automating order execution to improve efficiency compared to manual routing.

dowidth.com

dowidth.com