Pair trading involves simultaneously buying and selling two correlated assets to exploit price discrepancies, emphasizing mean reversion between the pair. Statistical arbitrage utilizes quantitative models and large datasets to identify mispricings across numerous securities, enabling algorithm-driven market-neutral strategies. Explore the differences and applications of pair trading and statistical arbitrage in modern trading practices.

Why it is important

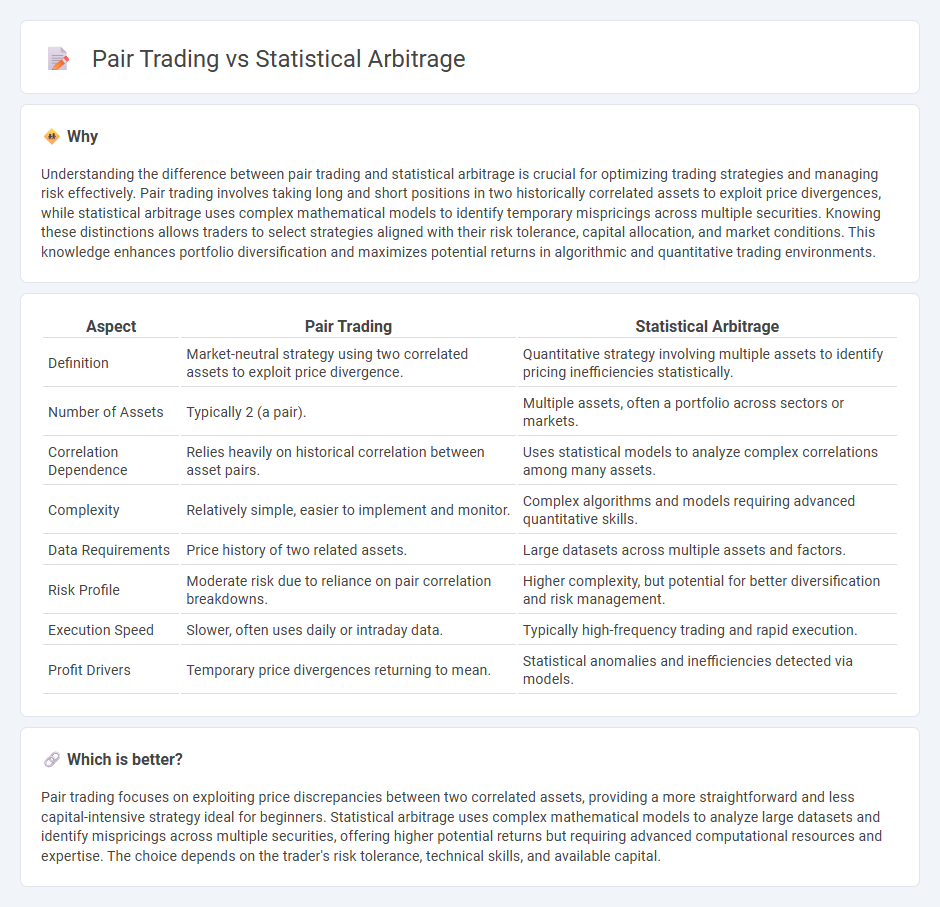

Understanding the difference between pair trading and statistical arbitrage is crucial for optimizing trading strategies and managing risk effectively. Pair trading involves taking long and short positions in two historically correlated assets to exploit price divergences, while statistical arbitrage uses complex mathematical models to identify temporary mispricings across multiple securities. Knowing these distinctions allows traders to select strategies aligned with their risk tolerance, capital allocation, and market conditions. This knowledge enhances portfolio diversification and maximizes potential returns in algorithmic and quantitative trading environments.

Comparison Table

| Aspect | Pair Trading | Statistical Arbitrage |

|---|---|---|

| Definition | Market-neutral strategy using two correlated assets to exploit price divergence. | Quantitative strategy involving multiple assets to identify pricing inefficiencies statistically. |

| Number of Assets | Typically 2 (a pair). | Multiple assets, often a portfolio across sectors or markets. |

| Correlation Dependence | Relies heavily on historical correlation between asset pairs. | Uses statistical models to analyze complex correlations among many assets. |

| Complexity | Relatively simple, easier to implement and monitor. | Complex algorithms and models requiring advanced quantitative skills. |

| Data Requirements | Price history of two related assets. | Large datasets across multiple assets and factors. |

| Risk Profile | Moderate risk due to reliance on pair correlation breakdowns. | Higher complexity, but potential for better diversification and risk management. |

| Execution Speed | Slower, often uses daily or intraday data. | Typically high-frequency trading and rapid execution. |

| Profit Drivers | Temporary price divergences returning to mean. | Statistical anomalies and inefficiencies detected via models. |

Which is better?

Pair trading focuses on exploiting price discrepancies between two correlated assets, providing a more straightforward and less capital-intensive strategy ideal for beginners. Statistical arbitrage uses complex mathematical models to analyze large datasets and identify mispricings across multiple securities, offering higher potential returns but requiring advanced computational resources and expertise. The choice depends on the trader's risk tolerance, technical skills, and available capital.

Connection

Pair trading and statistical arbitrage share a common foundation in identifying and exploiting pricing inefficiencies between related financial instruments. Both strategies rely on statistical models to analyze historical price relationships and deviations, enabling traders to execute long and short positions simultaneously to profit from mean reversion. Effective pair trading is often considered a subset of statistical arbitrage, emphasizing correlated asset pairs to minimize market risk while capitalizing on relative value discrepancies.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages advanced quantitative models and large datasets to identify pricing inefficiencies across a broad universe of securities, optimizing portfolio returns through high-frequency trading strategies. It employs mean-reversion principles and machine learning algorithms to capitalize on transient market anomalies, often involving hundreds or thousands of assets simultaneously. Explore more about how statistical arbitrage enhances risk-adjusted performance compared to traditional pair trading methods.

Mean Reversion

Statistical arbitrage leverages quantitative models to identify and exploit mispricings across a broad set of assets, while pair trading specifically focuses on the mean reversion of price ratios between two correlated securities. Mean reversion in pair trading assumes that deviations from historical price relationships will correct over time, enabling traders to profit when prices return to their long-term equilibrium. Explore more about how mean reversion strategies can enhance both statistical arbitrage and pair trading techniques.

Market Neutral

Statistical arbitrage leverages quantitative models analyzing historical price data to identify mispriced securities across a broad universe, optimizing portfolio risk and return while maintaining market neutrality. Pair trading, a subset of statistical arbitrage, specifically targets two correlated stocks, exploiting temporary divergences in their price relationship to achieve profits neutral to overall market movements. Explore the nuances and strategies behind statistical arbitrage and pair trading to enhance market-neutral investment approaches.

Source and External Links

The Power of Statistical Arbitrage in Finance - PyQuant News - Statistical arbitrage, or "stat arb," uses quantitative models to identify and exploit temporary price differences between related financial instruments based on the principle of mean reversion, involving data analysis, model development, and trade execution.

Statistical arbitrage - Wikipedia - Statistical arbitrage is a class of short-term financial trading strategies using mean reversion models applied to large portfolios held for brief periods, typically implemented in an automated, beta-neutral, multi-factor approach emphasizing data mining and computational techniques.

Statistical Arbitrage in High Frequency Trading Based on Limit Order Books (PDF) - Statistical arbitrage spreads risk across thousands to millions of trades with very short holding times to capture small, temporary mispricings in asset prices.

dowidth.com

dowidth.com