Liquidity sweep exploits large market orders to rapidly absorb available liquidity at multiple price levels, facilitating swift trade execution and price movement. Quote stuffing overwhelms trading platforms with excessive order messages, creating market confusion and latency to manipulate price perception. Discover the distinct impacts and detection techniques behind liquidity sweep and quote stuffing in trading.

Why it is important

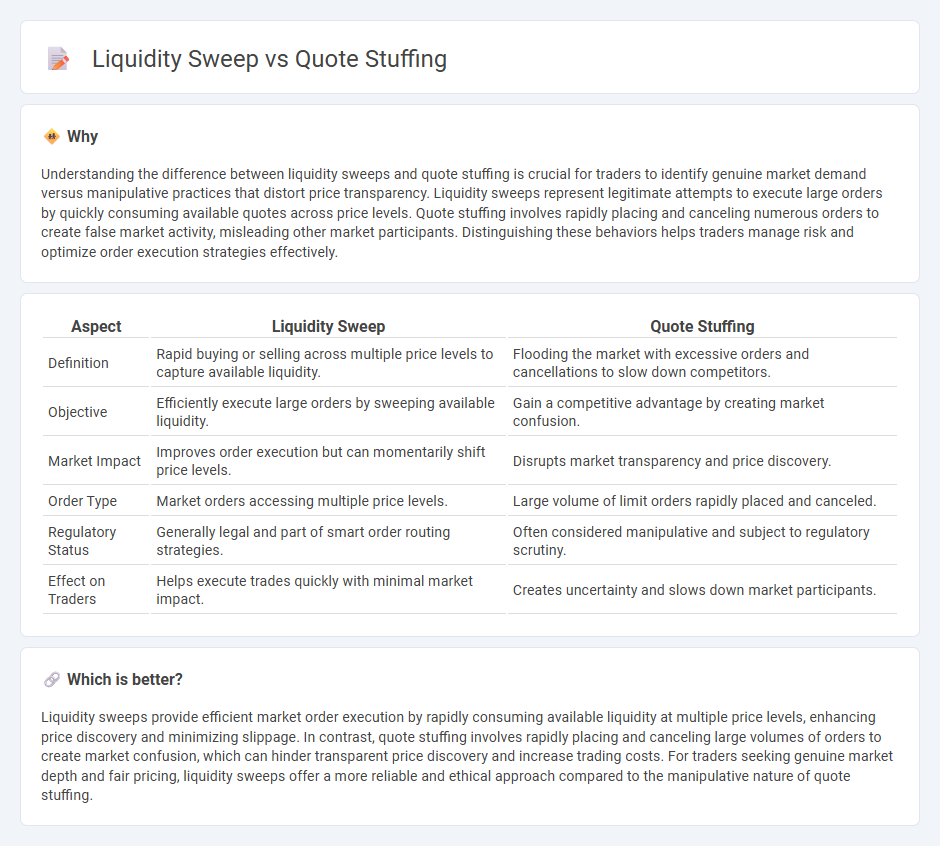

Understanding the difference between liquidity sweeps and quote stuffing is crucial for traders to identify genuine market demand versus manipulative practices that distort price transparency. Liquidity sweeps represent legitimate attempts to execute large orders by quickly consuming available quotes across price levels. Quote stuffing involves rapidly placing and canceling numerous orders to create false market activity, misleading other market participants. Distinguishing these behaviors helps traders manage risk and optimize order execution strategies effectively.

Comparison Table

| Aspect | Liquidity Sweep | Quote Stuffing |

|---|---|---|

| Definition | Rapid buying or selling across multiple price levels to capture available liquidity. | Flooding the market with excessive orders and cancellations to slow down competitors. |

| Objective | Efficiently execute large orders by sweeping available liquidity. | Gain a competitive advantage by creating market confusion. |

| Market Impact | Improves order execution but can momentarily shift price levels. | Disrupts market transparency and price discovery. |

| Order Type | Market orders accessing multiple price levels. | Large volume of limit orders rapidly placed and canceled. |

| Regulatory Status | Generally legal and part of smart order routing strategies. | Often considered manipulative and subject to regulatory scrutiny. |

| Effect on Traders | Helps execute trades quickly with minimal market impact. | Creates uncertainty and slows down market participants. |

Which is better?

Liquidity sweeps provide efficient market order execution by rapidly consuming available liquidity at multiple price levels, enhancing price discovery and minimizing slippage. In contrast, quote stuffing involves rapidly placing and canceling large volumes of orders to create market confusion, which can hinder transparent price discovery and increase trading costs. For traders seeking genuine market depth and fair pricing, liquidity sweeps offer a more reliable and ethical approach compared to the manipulative nature of quote stuffing.

Connection

Liquidity sweep and quote stuffing are connected through their impact on market liquidity and order book dynamics. Liquidity sweep involves rapidly executing orders to capture liquidity before it vanishes, while quote stuffing floods the market with excessive orders to confuse or slow down other traders. Both tactics can create temporary market inefficiencies that disrupt fair price discovery and trading strategies.

Key Terms

High-Frequency Trading (HFT)

Quote stuffing floods order books with rapid, high-volume order cancellations designed to confuse competitors and gain market advantage in High-Frequency Trading (HFT). Liquidity sweep involves aggressively executing large orders across multiple price levels to capture available liquidity quickly in fragmented markets. Explore more about HFT strategies and their impact on modern trading dynamics.

Order Book

Quote stuffing overwhelms the order book with rapid, excessive order submissions and cancellations, creating artificial market depth and confusing price signals. Liquidity sweeps systematically consume available orders across multiple price levels to capitalize on short-term price movements and volume imbalances. Explore how these tactics impact order book dynamics and market efficiency to enhance trading strategies.

Market Impact

Quote stuffing involves placing a rapid series of buy or sell orders to create market noise and confuse other traders, increasing short-term market impact by artificially inflating order book volume. Liquidity sweep executes large orders by consuming available liquidity across multiple price levels, minimizing market impact by reducing order visibility and price slippage. Explore strategies to optimize trading performance by understanding the nuanced effects of quote stuffing and liquidity sweeps on market dynamics.

Source and External Links

Quote Stuffing - Overview, How It Works, Example - Quote stuffing is the practice of entering and immediately canceling a massive number of orders to buy or sell stocks to manipulate the market price and profit from false demand.

How Larger Players Use Quote Stuffing to Gain an Edge in Trading - Quote stuffing involves flooding the market with an excessive number of orders or quotes within a short timeframe, quickly canceling them to create market confusion, disrupt trading, and mislead other participants, often using advanced algorithms.

Quote Stuffing - What Is It, Vs Spoofing Vs Layering - WallStreetMojo - Quote stuffing is a market manipulation technique where traders place and suddenly withdraw multiple buy and sell orders to create a false market hype and gain a price advantage, commonly used by high-frequency traders employing algorithms.

dowidth.com

dowidth.com