Paper trading platforms enable users to practice trading strategies using simulated funds, offering a risk-free environment to test market conditions and refine skills. High-frequency trading platforms utilize advanced algorithms and ultra-low latency infrastructure to execute thousands of trades per second, capitalizing on minimal price discrepancies for profit. Explore the key differences and advantages of each platform to optimize your trading approach.

Why it is important

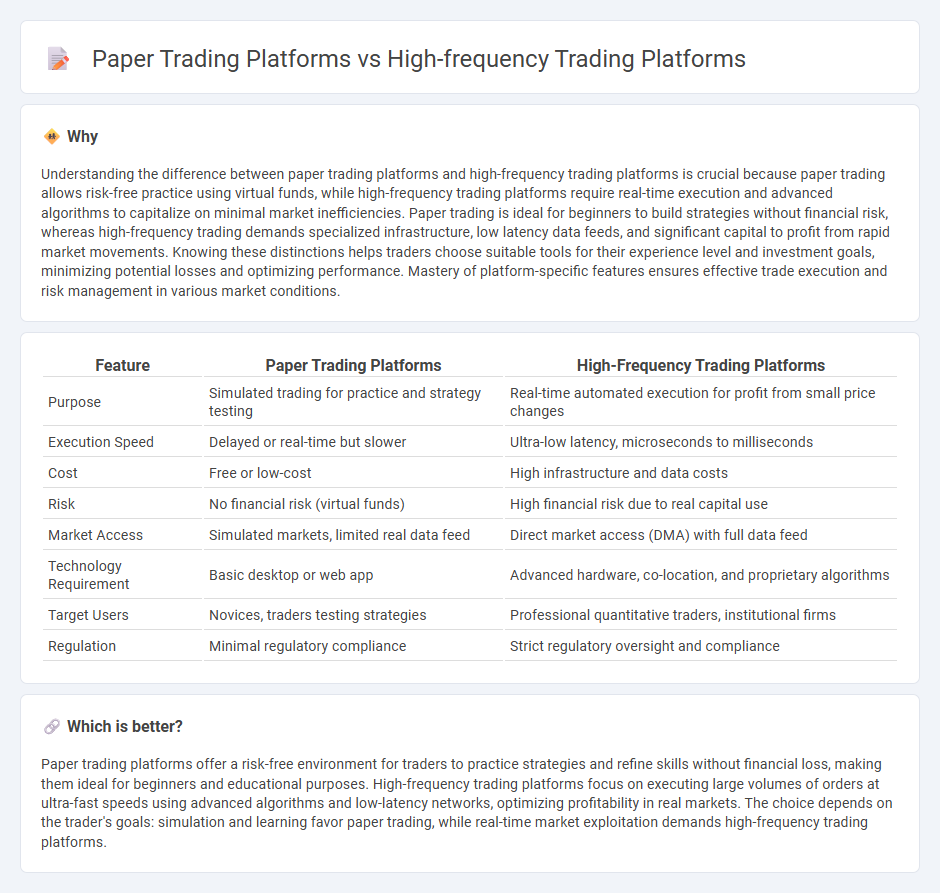

Understanding the difference between paper trading platforms and high-frequency trading platforms is crucial because paper trading allows risk-free practice using virtual funds, while high-frequency trading platforms require real-time execution and advanced algorithms to capitalize on minimal market inefficiencies. Paper trading is ideal for beginners to build strategies without financial risk, whereas high-frequency trading demands specialized infrastructure, low latency data feeds, and significant capital to profit from rapid market movements. Knowing these distinctions helps traders choose suitable tools for their experience level and investment goals, minimizing potential losses and optimizing performance. Mastery of platform-specific features ensures effective trade execution and risk management in various market conditions.

Comparison Table

| Feature | Paper Trading Platforms | High-Frequency Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Real-time automated execution for profit from small price changes |

| Execution Speed | Delayed or real-time but slower | Ultra-low latency, microseconds to milliseconds |

| Cost | Free or low-cost | High infrastructure and data costs |

| Risk | No financial risk (virtual funds) | High financial risk due to real capital use |

| Market Access | Simulated markets, limited real data feed | Direct market access (DMA) with full data feed |

| Technology Requirement | Basic desktop or web app | Advanced hardware, co-location, and proprietary algorithms |

| Target Users | Novices, traders testing strategies | Professional quantitative traders, institutional firms |

| Regulation | Minimal regulatory compliance | Strict regulatory oversight and compliance |

Which is better?

Paper trading platforms offer a risk-free environment for traders to practice strategies and refine skills without financial loss, making them ideal for beginners and educational purposes. High-frequency trading platforms focus on executing large volumes of orders at ultra-fast speeds using advanced algorithms and low-latency networks, optimizing profitability in real markets. The choice depends on the trader's goals: simulation and learning favor paper trading, while real-time market exploitation demands high-frequency trading platforms.

Connection

Paper trading platforms simulate real-market conditions allowing traders to test high-frequency trading (HFT) algorithms without financial risk, enabling refinement of strategies before live implementation. High-frequency trading platforms depend on rapid execution and low-latency data feeds, making realistic simulation on paper trading platforms essential for optimizing order book dynamics and minimizing slippage. The integration of historical and real-time data in paper trading environments provides a critical feedback loop for HFT algorithms to enhance predictive accuracy and execution efficiency.

Key Terms

Latency

High-frequency trading platforms prioritize ultra-low latency with execution times measured in microseconds to capitalize on fleeting market opportunities, leveraging direct market access and co-location services. Paper trading platforms, by contrast, simulate trades without real-time execution constraints, emphasizing strategy development over speed, with latency not impacting virtual performance. Explore our detailed analysis to understand how latency differentials shape trading outcomes and platform choices.

Execution Speed

High-frequency trading platforms execute trades in milliseconds or microseconds using advanced algorithms and low-latency infrastructure, significantly outperforming paper trading platforms that simulate trades without real-time market execution. Execution speed on high-frequency trading platforms directly impacts profitability by capturing transient market opportunities, whereas paper trading platforms are primarily for strategy testing without real financial risk. Explore further to understand how execution speed differences influence trading strategies and outcomes.

Simulation

High-frequency trading platforms leverage real-time market data and algorithmic strategies to execute rapid trades, while paper trading platforms focus on simulating market conditions for strategy testing without financial risk. Simulation in paper trading allows traders to evaluate the effectiveness and robustness of their high-frequency algorithms in a controlled, risk-free environment. Explore the capabilities and benefits of both types of platforms to enhance your trading approach.

Source and External Links

List Of 10 HFT Brokers That Allow High-Frequency Trading - Vantage Markets is highlighted as a strong HFT platform providing ultra-fast execution, low latency through Equinix NY4 data center, support for MT4/MT5, competitive pricing, and API access essential for high-frequency trading strategies.

High Frequency Trading - Best HFT Brokers - DayTrading.com - High-frequency trading platforms use advanced technology such as FPGAs, GPUs, and complex algorithms often written in languages like Python and C++; they require ultra-low latency execution and often leverage colocation or cloud VPS to optimize speed across stocks, forex, and even cryptocurrency markets.

List of the Best High Frequency Trading Software 2025 - Bullish Bears - High-frequency trading software prioritizes minimizing physical distance from exchange servers through colocation to gain microsecond advantages, enabling lightning-fast trade execution and massive transaction turnover, all critical to HFT platform effectiveness.

dowidth.com

dowidth.com