Options flow provides insight into large, unusual options trades indicating potential market moves, while tape reading focuses on real-time analysis of price action and volume from the time and sales data to gauge market sentiment. Both methods offer traders unique data points for decision-making, with options flow highlighting institutional interest and tape reading emphasizing immediate market dynamics. Discover how integrating both techniques can enhance trading strategies and market timing.

Why it is important

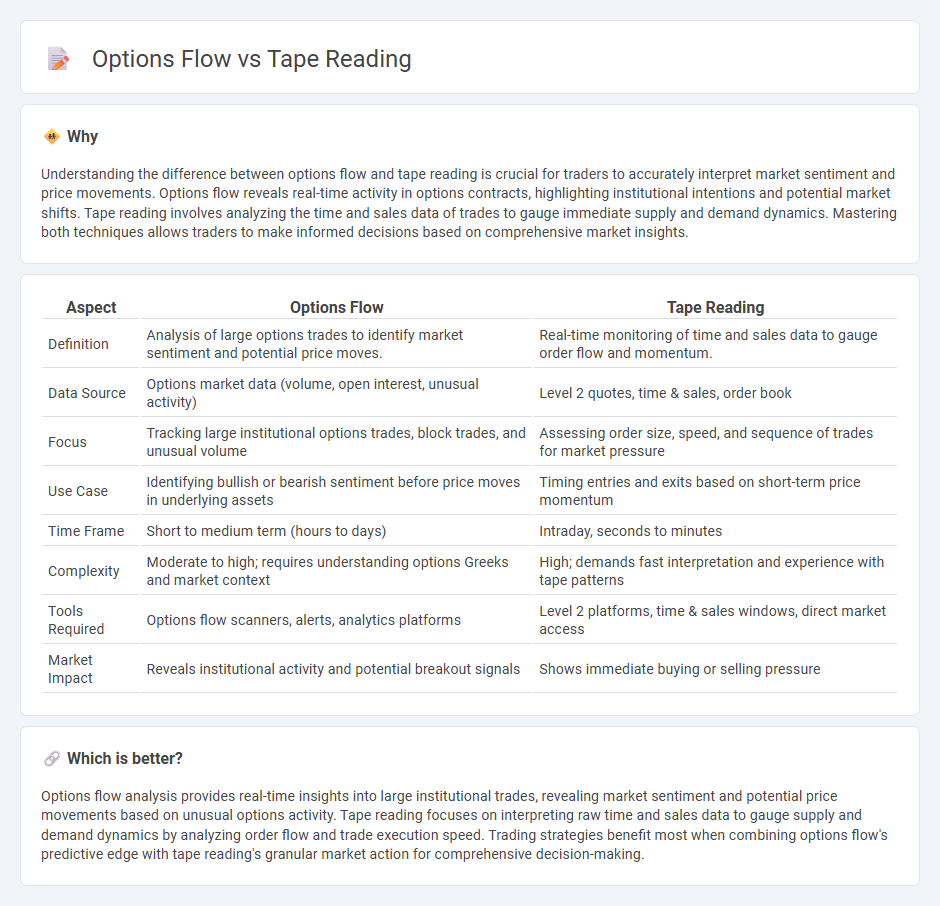

Understanding the difference between options flow and tape reading is crucial for traders to accurately interpret market sentiment and price movements. Options flow reveals real-time activity in options contracts, highlighting institutional intentions and potential market shifts. Tape reading involves analyzing the time and sales data of trades to gauge immediate supply and demand dynamics. Mastering both techniques allows traders to make informed decisions based on comprehensive market insights.

Comparison Table

| Aspect | Options Flow | Tape Reading |

|---|---|---|

| Definition | Analysis of large options trades to identify market sentiment and potential price moves. | Real-time monitoring of time and sales data to gauge order flow and momentum. |

| Data Source | Options market data (volume, open interest, unusual activity) | Level 2 quotes, time & sales, order book |

| Focus | Tracking large institutional options trades, block trades, and unusual volume | Assessing order size, speed, and sequence of trades for market pressure |

| Use Case | Identifying bullish or bearish sentiment before price moves in underlying assets | Timing entries and exits based on short-term price momentum |

| Time Frame | Short to medium term (hours to days) | Intraday, seconds to minutes |

| Complexity | Moderate to high; requires understanding options Greeks and market context | High; demands fast interpretation and experience with tape patterns |

| Tools Required | Options flow scanners, alerts, analytics platforms | Level 2 platforms, time & sales windows, direct market access |

| Market Impact | Reveals institutional activity and potential breakout signals | Shows immediate buying or selling pressure |

Which is better?

Options flow analysis provides real-time insights into large institutional trades, revealing market sentiment and potential price movements based on unusual options activity. Tape reading focuses on interpreting raw time and sales data to gauge supply and demand dynamics by analyzing order flow and trade execution speed. Trading strategies benefit most when combining options flow's predictive edge with tape reading's granular market action for comprehensive decision-making.

Connection

Options flow reveals large trader activity by tracking unusual option volume and open interest changes, offering insights into market sentiment and potential price moves. Tape reading complements this by analyzing real-time order book data and trade prints to gauge supply and demand dynamics. Together, these techniques enhance traders' ability to predict short-term price movements and identify institutional trading patterns.

Key Terms

**Tape Reading:**

Tape reading involves analyzing real-time trade data to understand market sentiment and price movements by observing the time and volume of transactions. Traders use Level II quotes and the time and sales window to identify large orders, momentum shifts, and potential support or resistance areas. Explore deeper insights into tape reading techniques and how they can enhance your trading strategy.

Time and Sales

Tape reading involves analyzing real-time Time and Sales data to track individual trades, offering insights into market sentiment and liquidity through trade size, price, and speed. Options flow extends this by focusing on large options transactions and the direction of bullish or bearish positions, revealing institutional activity and potential stock movement. Explore more to understand how combining Time and Sales with options flow enhances trading strategies and decision-making.

Level 2 Quotes

Level 2 Quotes provide real-time insights into market depth by displaying the order book with bid and ask prices and sizes, essential for tape reading to gauge supply and demand dynamics. Options flow analysis complements this by revealing large option trades and unusual activity, highlighting potential market moves before they impact Level 2 data. Discover how integrating Level 2 Quotes with options flow enhances trading precision and market prediction strategies.

Source and External Links

What Is Tape Reading and How Does It Work - Earn2Trade Blog - Tape reading is a technique for analyzing price and volume data by observing real-time trades, helping traders identify support and resistance levels, but it offers only a partial picture and should be complemented with other analysis tools.

What is Tape Reading Today? - Bookmap - Originally from reading ticker tapes, tape reading now involves interpreting real-time time and sales data, focusing on order flow and market depth, but requires integrating multiple market data for a full understanding.

Top 4 Tape Reading Mistakes (& How Scalping Can Save You!) - Tape reading involves watching time and sales and Level 2 data to read market decisions live, but traders must avoid common mistakes and understand it is not a magic bullet; it remains a core skill of many successful traders.

dowidth.com

dowidth.com