Delta neutral strategy involves creating a portfolio with balanced delta exposure, minimizing risk from price movements by using options and underlying assets. Scalping focuses on quick, small profits through rapid trades exploiting market inefficiencies and liquidity. Explore in-depth comparisons and benefits of delta neutral trading versus scalping strategies to optimize your trading approach.

Why it is important

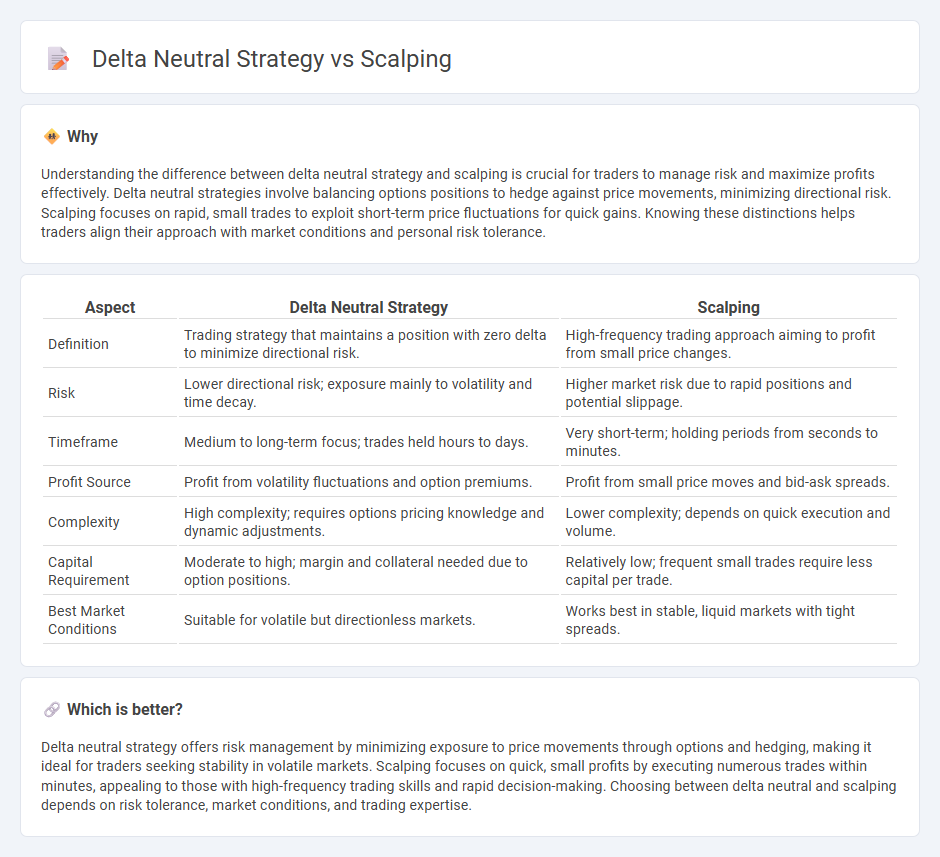

Understanding the difference between delta neutral strategy and scalping is crucial for traders to manage risk and maximize profits effectively. Delta neutral strategies involve balancing options positions to hedge against price movements, minimizing directional risk. Scalping focuses on rapid, small trades to exploit short-term price fluctuations for quick gains. Knowing these distinctions helps traders align their approach with market conditions and personal risk tolerance.

Comparison Table

| Aspect | Delta Neutral Strategy | Scalping |

|---|---|---|

| Definition | Trading strategy that maintains a position with zero delta to minimize directional risk. | High-frequency trading approach aiming to profit from small price changes. |

| Risk | Lower directional risk; exposure mainly to volatility and time decay. | Higher market risk due to rapid positions and potential slippage. |

| Timeframe | Medium to long-term focus; trades held hours to days. | Very short-term; holding periods from seconds to minutes. |

| Profit Source | Profit from volatility fluctuations and option premiums. | Profit from small price moves and bid-ask spreads. |

| Complexity | High complexity; requires options pricing knowledge and dynamic adjustments. | Lower complexity; depends on quick execution and volume. |

| Capital Requirement | Moderate to high; margin and collateral needed due to option positions. | Relatively low; frequent small trades require less capital per trade. |

| Best Market Conditions | Suitable for volatile but directionless markets. | Works best in stable, liquid markets with tight spreads. |

Which is better?

Delta neutral strategy offers risk management by minimizing exposure to price movements through options and hedging, making it ideal for traders seeking stability in volatile markets. Scalping focuses on quick, small profits by executing numerous trades within minutes, appealing to those with high-frequency trading skills and rapid decision-making. Choosing between delta neutral and scalping depends on risk tolerance, market conditions, and trading expertise.

Connection

Delta neutral strategy and scalping both focus on minimizing market risk while capitalizing on short-term price movements; delta neutral positions balance options and underlying assets to achieve near-zero sensitivity to price changes. Scalping exploits small, frequent price fluctuations, making delta neutral setups ideal for quickly adjusting positions to maintain neutrality amid rapid market shifts. Together, these techniques enable traders to lock in incremental profits while hedging against directional exposure in volatile markets.

Key Terms

Timeframe

Scalping strategies typically operate on very short timeframes, ranging from seconds to minutes, aiming to capture small price movements with high frequency. In contrast, delta neutral strategies focus on maintaining a balanced portfolio over longer timeframes to hedge directional risk, often adjusting positions dynamically to remain market neutral. Explore detailed comparisons to understand which timeframe suits your trading style best.

Position Hedging

Scalping exploits small price movements for quick profits, relying on rapid trade execution and high market volatility, while delta neutral strategies focus on position hedging to minimize directional risk by balancing options and underlying assets. Delta neutral hedging involves continuously adjusting the portfolio's delta to stay close to zero, reducing exposure to price fluctuations; scalping does not prioritize risk neutrality but rather swift market entry and exit. Explore more about effective position hedging techniques and their impact on risk management strategies.

Order Flow

Scalping involves rapidly executing trades to capitalize on small price movements, relying heavily on real-time order flow data to gauge market sentiment and liquidity. Delta neutral strategies use options and underlying assets to hedge directional risk, with order flow analysis providing insights into potential imbalances affecting hedging efficiency. Explore the detailed mechanics and practical applications of order flow in both strategies to enhance your trading precision.

Source and External Links

Scalping (Day Trading Technique) - Scalping is a day trading strategy where investors buy and sell a stock multiple times within the same day to make small profits from each trade, often focusing on highly volatile stocks and executing numerous trades quickly.

Scalping (trading) - Scalping in trading can refer to a legitimate method of arbitrage exploiting small price differences or, alternatively, a fraudulent market manipulation tactic; legitimate scalpers aim to profit from tiny price changes by quickly opening and closing positions, often within seconds or minutes.

What is a scalping strategy in the stock market and how ... - Popular scalping strategies use technical indicators like the Stochastic Oscillator, Moving Averages, Parabolic SAR, RSI, and MACD to identify short-term price movements, allowing traders to capitalize on quick trades either as their primary strategy or as a supplement to broader portfolio management.

dowidth.com

dowidth.com