Social sentiment analysis trading leverages real-time data from social media platforms and news sources to gauge market sentiment, influencing buy and sell decisions based on collective investor emotions and trends. Event-driven trading focuses on exploiting price volatility triggered by specific events such as earnings reports, mergers, or regulatory changes to capture profit opportunities. Explore the nuances and strategies behind these trading approaches to enhance your market understanding and investment performance.

Why it is important

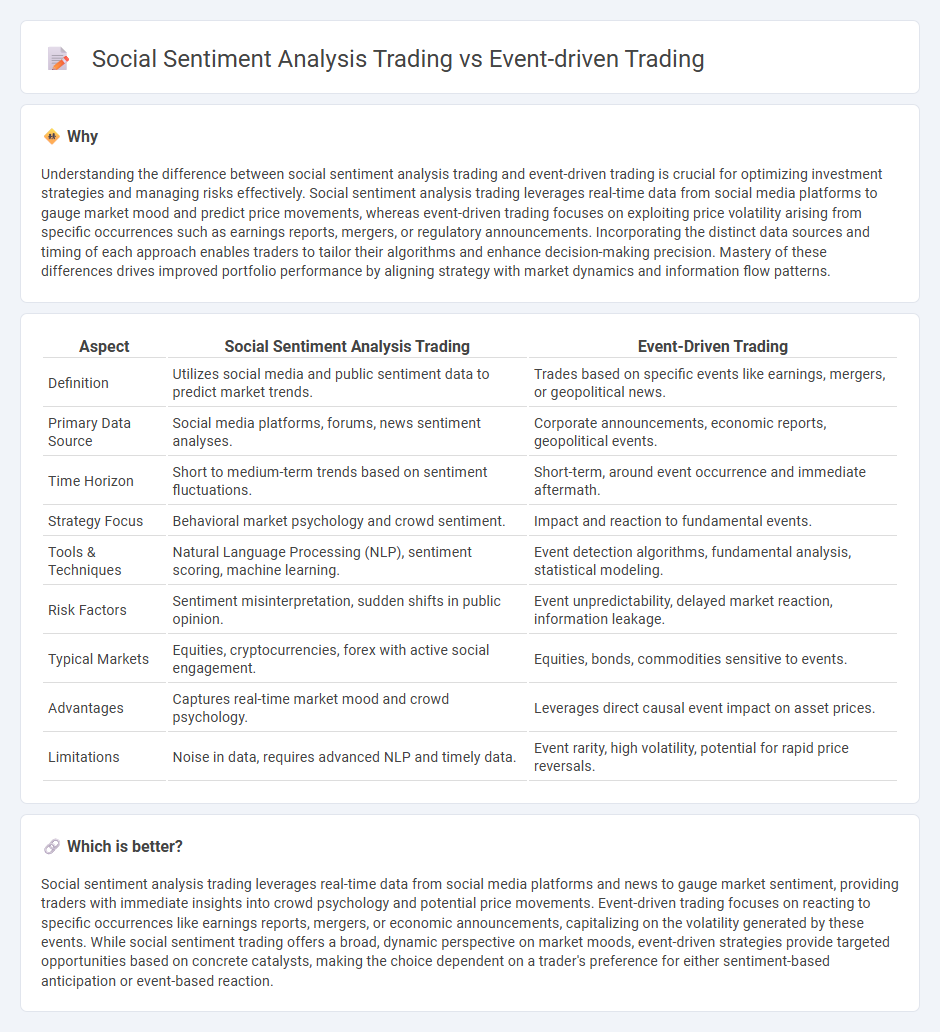

Understanding the difference between social sentiment analysis trading and event-driven trading is crucial for optimizing investment strategies and managing risks effectively. Social sentiment analysis trading leverages real-time data from social media platforms to gauge market mood and predict price movements, whereas event-driven trading focuses on exploiting price volatility arising from specific occurrences such as earnings reports, mergers, or regulatory announcements. Incorporating the distinct data sources and timing of each approach enables traders to tailor their algorithms and enhance decision-making precision. Mastery of these differences drives improved portfolio performance by aligning strategy with market dynamics and information flow patterns.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | Event-Driven Trading |

|---|---|---|

| Definition | Utilizes social media and public sentiment data to predict market trends. | Trades based on specific events like earnings, mergers, or geopolitical news. |

| Primary Data Source | Social media platforms, forums, news sentiment analyses. | Corporate announcements, economic reports, geopolitical events. |

| Time Horizon | Short to medium-term trends based on sentiment fluctuations. | Short-term, around event occurrence and immediate aftermath. |

| Strategy Focus | Behavioral market psychology and crowd sentiment. | Impact and reaction to fundamental events. |

| Tools & Techniques | Natural Language Processing (NLP), sentiment scoring, machine learning. | Event detection algorithms, fundamental analysis, statistical modeling. |

| Risk Factors | Sentiment misinterpretation, sudden shifts in public opinion. | Event unpredictability, delayed market reaction, information leakage. |

| Typical Markets | Equities, cryptocurrencies, forex with active social engagement. | Equities, bonds, commodities sensitive to events. |

| Advantages | Captures real-time market mood and crowd psychology. | Leverages direct causal event impact on asset prices. |

| Limitations | Noise in data, requires advanced NLP and timely data. | Event rarity, high volatility, potential for rapid price reversals. |

Which is better?

Social sentiment analysis trading leverages real-time data from social media platforms and news to gauge market sentiment, providing traders with immediate insights into crowd psychology and potential price movements. Event-driven trading focuses on reacting to specific occurrences like earnings reports, mergers, or economic announcements, capitalizing on the volatility generated by these events. While social sentiment trading offers a broad, dynamic perspective on market moods, event-driven strategies provide targeted opportunities based on concrete catalysts, making the choice dependent on a trader's preference for either sentiment-based anticipation or event-based reaction.

Connection

Social sentiment analysis trading leverages real-time data from social media and news platforms to gauge market mood, while event-driven trading focuses on exploiting financial opportunities triggered by specific occurrences such as earnings reports, mergers, or geopolitical events. Both strategies rely on timely information extraction and interpretation to predict price movements and investor reactions. Integrating social sentiment analysis enhances event-driven trading by providing early signals and a broader understanding of market sentiment surrounding significant events.

Key Terms

Catalyst

Event-driven trading centers on exploiting significant corporate events such as earnings reports, mergers, or regulatory changes, focusing on immediate market reactions to these catalysts. Social sentiment analysis trading leverages real-time data from social media platforms and news to gauge investor mood and predict market movements before official events unfold. Explore in-depth strategies and real-world applications of Catalyst to enhance your understanding of these contrasting trading methodologies.

News flow

Event-driven trading leverages real-time news flow to capitalize on market-moving announcements such as earnings reports, mergers, or geopolitical events, using algorithms to execute trades swiftly. Social sentiment analysis trading interprets vast amounts of data from social media platforms to gauge public sentiment and predict market trends based on collective investor behavior. Explore the nuances and effectiveness of both strategies to enhance your trading approach.

Crowd sentiment

Event-driven trading leverages real-time occurrences such as earnings reports or geopolitical developments to guide investment decisions, while social sentiment analysis trading interprets crowd sentiment from social media and news to predict market movements. Crowd sentiment, derived from vast datasets of public opinions, offers a dynamic gauge of investor emotions and market psychology that can complement event-driven strategies. Explore how integrating crowd sentiment enhances predictive accuracy and trading performance.

Source and External Links

Event Driven Trading Strategies: How They Work and Why They Matter - Event-driven trading involves identifying and analyzing specific market-moving events such as earnings announcements or mergers, then positioning trades to capitalize on the anticipated impact, while managing risks like deal risk and liquidity risk through hedging and diversification.

Event-Driven Investing | Fund Strategy + Examples - Wall Street Prep - Event-driven investing is a strategy that exploits pricing inefficiencies caused by corporate events like mergers, spin-offs, and bankruptcies, with common sub-strategies including merger arbitrage, distressed investing, and activist investing, each performing differently depending on economic conditions.

What is Event-Driven Investing: Common Strategies & Examples - Event-driven investing capitalizes on volatility and temporary mispricing from corporate events such as mergers or litigation by analyzing potential impacts and market conditions to make informed investment decisions aiming for high returns.

dowidth.com

dowidth.com