Quantitative sentiment analysis utilizes natural language processing to systematically evaluate market sentiment from news, social media, and financial reports, providing traders with data-driven insights into market psychology. Machine learning trading employs algorithms to detect complex patterns in historical price and volume data, enabling automated decision-making and adaptive strategies. Explore the nuances of these approaches to enhance your trading performance.

Why it is important

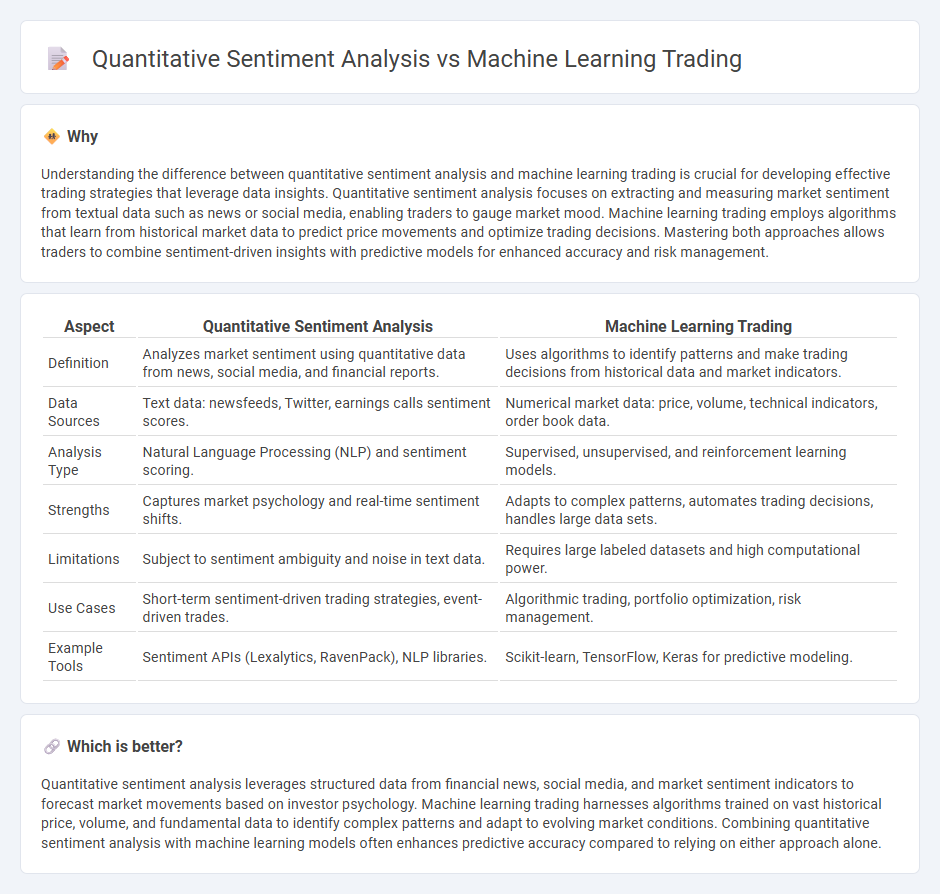

Understanding the difference between quantitative sentiment analysis and machine learning trading is crucial for developing effective trading strategies that leverage data insights. Quantitative sentiment analysis focuses on extracting and measuring market sentiment from textual data such as news or social media, enabling traders to gauge market mood. Machine learning trading employs algorithms that learn from historical market data to predict price movements and optimize trading decisions. Mastering both approaches allows traders to combine sentiment-driven insights with predictive models for enhanced accuracy and risk management.

Comparison Table

| Aspect | Quantitative Sentiment Analysis | Machine Learning Trading |

|---|---|---|

| Definition | Analyzes market sentiment using quantitative data from news, social media, and financial reports. | Uses algorithms to identify patterns and make trading decisions from historical data and market indicators. |

| Data Sources | Text data: newsfeeds, Twitter, earnings calls sentiment scores. | Numerical market data: price, volume, technical indicators, order book data. |

| Analysis Type | Natural Language Processing (NLP) and sentiment scoring. | Supervised, unsupervised, and reinforcement learning models. |

| Strengths | Captures market psychology and real-time sentiment shifts. | Adapts to complex patterns, automates trading decisions, handles large data sets. |

| Limitations | Subject to sentiment ambiguity and noise in text data. | Requires large labeled datasets and high computational power. |

| Use Cases | Short-term sentiment-driven trading strategies, event-driven trades. | Algorithmic trading, portfolio optimization, risk management. |

| Example Tools | Sentiment APIs (Lexalytics, RavenPack), NLP libraries. | Scikit-learn, TensorFlow, Keras for predictive modeling. |

Which is better?

Quantitative sentiment analysis leverages structured data from financial news, social media, and market sentiment indicators to forecast market movements based on investor psychology. Machine learning trading harnesses algorithms trained on vast historical price, volume, and fundamental data to identify complex patterns and adapt to evolving market conditions. Combining quantitative sentiment analysis with machine learning models often enhances predictive accuracy compared to relying on either approach alone.

Connection

Quantitative sentiment analysis enhances machine learning trading by transforming unstructured text data from news, social media, and financial reports into actionable numerical indicators. Machine learning algorithms utilize these sentiment-driven features to predict market movements and optimize trading strategies with improved accuracy. Integrating real-time sentiment data helps machine learning models adapt swiftly to market sentiment changes, boosting predictive performance and trading efficiency.

Key Terms

Machine learning trading:

Machine learning trading utilizes algorithms and historical market data to identify trading patterns and make automated decisions, significantly enhancing predictive accuracy and execution speed. It leverages techniques such as neural networks, reinforcement learning, and decision trees to optimize portfolio management and risk assessment. Explore more to understand how machine learning transforms algorithmic trading strategies and market analysis.

Algorithmic models

Machine learning trading employs advanced algorithms to identify patterns in large financial datasets, optimizing predictive accuracy for market movements. Quantitative sentiment analysis leverages natural language processing techniques to quantify market sentiment from text data, integrating these insights into algorithmic trading models to enhance decision-making. Explore our detailed comparison to understand which algorithmic approach best suits your investment strategy.

Feature engineering

Machine learning trading leverages advanced algorithms to analyze large datasets and identify patterns for asset price prediction, emphasizing feature engineering to extract meaningful inputs such as technical indicators, volume metrics, and market sentiment scores. Quantitative sentiment analysis, in contrast, prioritizes transforming unstructured textual data--news articles, social media feeds, earnings call transcripts--into quantifiable sentiment indexes using natural language processing techniques to influence trading strategies. Explore deeper insights into how precise feature engineering impacts the effectiveness of both approaches for optimized trading outcomes.

Source and External Links

What is Machine Learning in Trading? Examples and Types - Machine learning in trading uses supervised, unsupervised, and reinforcement learning to forecast stock prices, detect patterns, and maximize profits by automating buy/sell decisions based on market data.

stefan-jansen/machine-learning-for-trading - GitHub - This comprehensive resource offers practical guidance on applying a wide range of ML techniques for algorithmic trading, including financial feature engineering, backtesting, and deep learning for creating effective trading strategies.

CS 7646: Machine Learning for Trading - OMSCS - Georgia Tech - An advanced course that teaches real-world implementation of machine learning trading strategies using regression, Q-learning, and other algorithms, focusing on practical challenges from data gathering to market orders.

dowidth.com

dowidth.com