Proprietary trading firms offer traders capital to trade with, but the pressure to perform consistently and meet stringent risk management rules can be intense compared to traditional brokerages where individuals trade their own funds. Unlike brokerages that provide straightforward access to markets, prop firms often require passing evaluation phases and adhering to profit targets, which can limit trading freedom. Explore more about the unique challenges and opportunities presented by prop firms versus traditional brokerage environments.

Why it is important

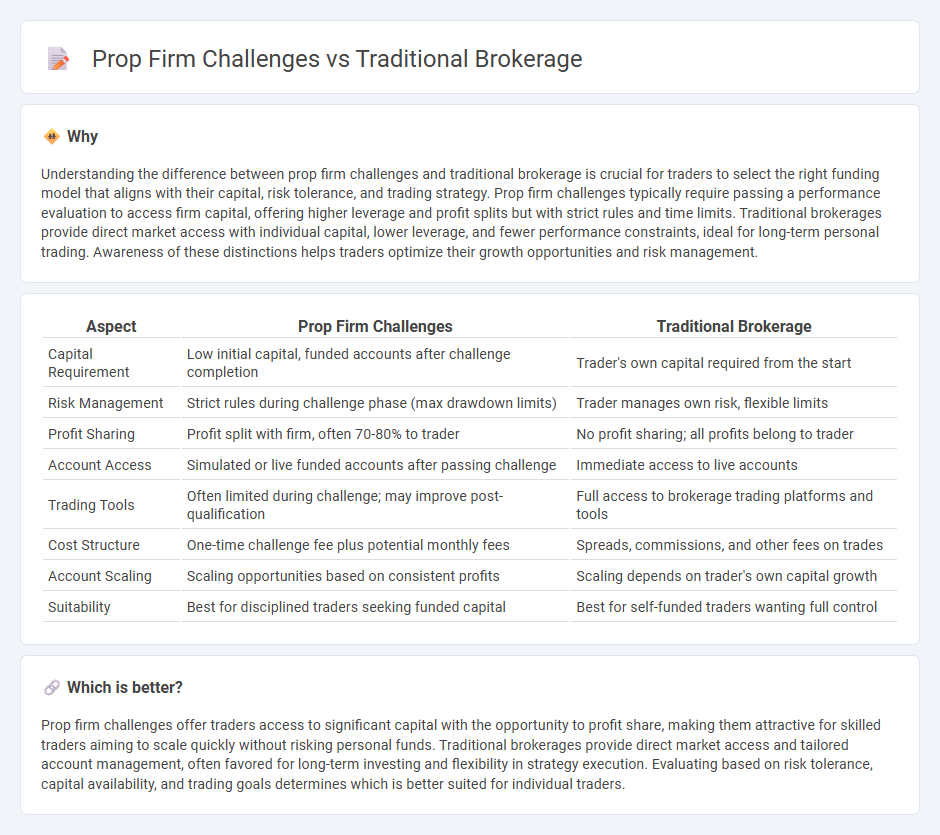

Understanding the difference between prop firm challenges and traditional brokerage is crucial for traders to select the right funding model that aligns with their capital, risk tolerance, and trading strategy. Prop firm challenges typically require passing a performance evaluation to access firm capital, offering higher leverage and profit splits but with strict rules and time limits. Traditional brokerages provide direct market access with individual capital, lower leverage, and fewer performance constraints, ideal for long-term personal trading. Awareness of these distinctions helps traders optimize their growth opportunities and risk management.

Comparison Table

| Aspect | Prop Firm Challenges | Traditional Brokerage |

|---|---|---|

| Capital Requirement | Low initial capital, funded accounts after challenge completion | Trader's own capital required from the start |

| Risk Management | Strict rules during challenge phase (max drawdown limits) | Trader manages own risk, flexible limits |

| Profit Sharing | Profit split with firm, often 70-80% to trader | No profit sharing; all profits belong to trader |

| Account Access | Simulated or live funded accounts after passing challenge | Immediate access to live accounts |

| Trading Tools | Often limited during challenge; may improve post-qualification | Full access to brokerage trading platforms and tools |

| Cost Structure | One-time challenge fee plus potential monthly fees | Spreads, commissions, and other fees on trades |

| Account Scaling | Scaling opportunities based on consistent profits | Scaling depends on trader's own capital growth |

| Suitability | Best for disciplined traders seeking funded capital | Best for self-funded traders wanting full control |

Which is better?

Prop firm challenges offer traders access to significant capital with the opportunity to profit share, making them attractive for skilled traders aiming to scale quickly without risking personal funds. Traditional brokerages provide direct market access and tailored account management, often favored for long-term investing and flexibility in strategy execution. Evaluating based on risk tolerance, capital availability, and trading goals determines which is better suited for individual traders.

Connection

Prop firm challenges serve as performance gateways, requiring traders to meet specific profit targets and risk management criteria before accessing firm capital, closely aligning with the trading conditions and compliance standards enforced by traditional brokerages. Both models emphasize disciplined trading strategies, evaluated risk parameters, and consistent profitability to sustain operational viability and trader credibility. The integration of these elements ensures seamless transition for traders from prop firm evaluations to live brokerage accounts, fostering professional growth and effective capital deployment.

Key Terms

Capital Requirements

Traditional brokerages often require significant capital to cover regulatory compliance and client account mandates, posing high entry barriers for traders. Proprietary trading firms typically capitalize on internal funds, reducing personal capital strain but enforcing strict performance criteria and risk controls. Discover how each model balances capital demands and risk management for trader success.

Risk Management

Traditional brokerage firms often implement strict risk management protocols to safeguard client assets while maintaining regulatory compliance, leading to conservative trading limits and margin requirements. Proprietary trading firms take on higher risk by using their own capital, employing dynamic risk models and real-time analytics to capitalize on market opportunities while managing potential losses. Discover how these different approaches to risk management impact trading strategies and profitability in detail.

Payout Structure

Traditional brokerage payout structures typically involve commissions based on client trades, often resulting in lower immediate earnings but offering steady income through client retention. Proprietary trading firms, in contrast, provide traders with a share of the profits generated from their trades, incentivizing performance but increasing risk exposure. Explore the nuances of payout models to determine which aligns best with your trading goals and risk tolerance.

Source and External Links

Traditional Brokerage vs. Self-Directed IRA - A traditional brokerage involves depositing funds with a financial institution that offers a range of investment options like stocks, bonds, mutual funds, and ETFs, emphasizing simplicity and ease of management.

Traditional Brokerage Services - American Capital Partners - Traditional brokerage services provide expert financial guidance, access to equity and fixed income trading, retirement planning, portfolio management, and market research tailored to individual investment goals.

What is a Brokerage account and how does it work? - Vanguard - A brokerage account is a nonretirement investing account allowing investors to buy and hold diverse securities such as stocks, bonds, ETFs, and mutual funds with flexible access to funds and no early withdrawal penalties.

dowidth.com

dowidth.com