High frequency trading bots execute thousands of trades per second using advanced algorithms to capitalize on minimal price fluctuations, offering rapid market entry and exit. Trend following bots analyze market patterns and indicators over longer periods, aiming to identify and capitalize on sustained price movements. Explore the strengths and limitations of each trading bot type to optimize your investment strategy.

Why it is important

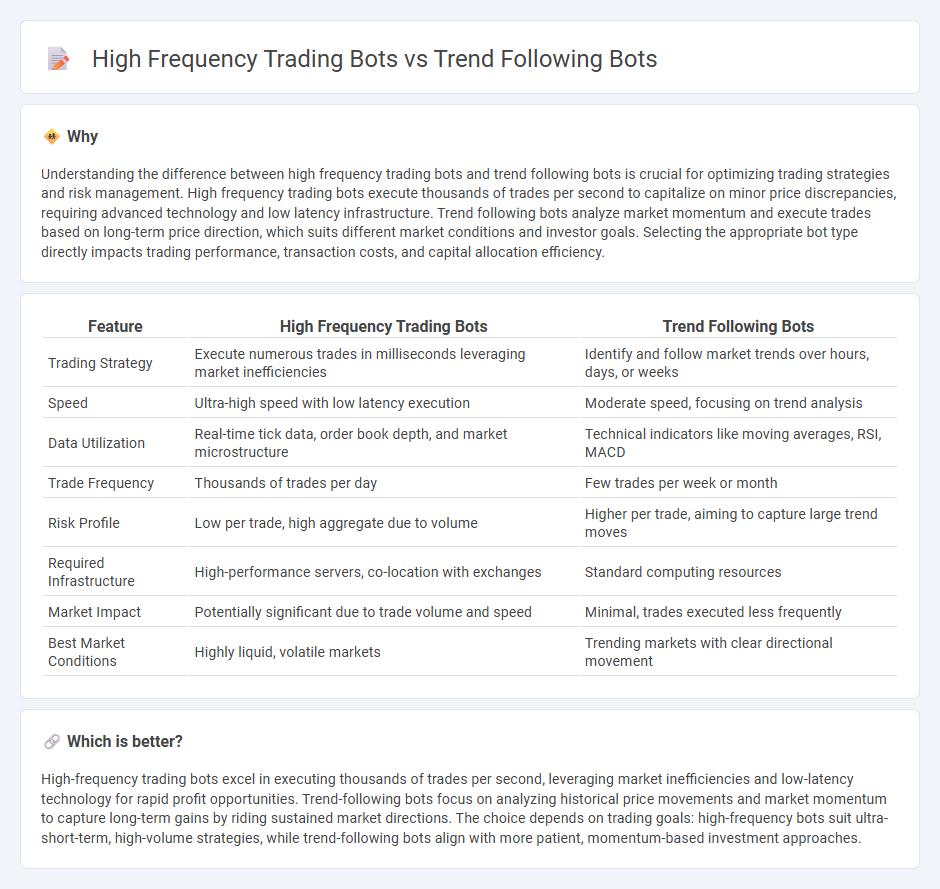

Understanding the difference between high frequency trading bots and trend following bots is crucial for optimizing trading strategies and risk management. High frequency trading bots execute thousands of trades per second to capitalize on minor price discrepancies, requiring advanced technology and low latency infrastructure. Trend following bots analyze market momentum and execute trades based on long-term price direction, which suits different market conditions and investor goals. Selecting the appropriate bot type directly impacts trading performance, transaction costs, and capital allocation efficiency.

Comparison Table

| Feature | High Frequency Trading Bots | Trend Following Bots |

|---|---|---|

| Trading Strategy | Execute numerous trades in milliseconds leveraging market inefficiencies | Identify and follow market trends over hours, days, or weeks |

| Speed | Ultra-high speed with low latency execution | Moderate speed, focusing on trend analysis |

| Data Utilization | Real-time tick data, order book depth, and market microstructure | Technical indicators like moving averages, RSI, MACD |

| Trade Frequency | Thousands of trades per day | Few trades per week or month |

| Risk Profile | Low per trade, high aggregate due to volume | Higher per trade, aiming to capture large trend moves |

| Required Infrastructure | High-performance servers, co-location with exchanges | Standard computing resources |

| Market Impact | Potentially significant due to trade volume and speed | Minimal, trades executed less frequently |

| Best Market Conditions | Highly liquid, volatile markets | Trending markets with clear directional movement |

Which is better?

High-frequency trading bots excel in executing thousands of trades per second, leveraging market inefficiencies and low-latency technology for rapid profit opportunities. Trend-following bots focus on analyzing historical price movements and market momentum to capture long-term gains by riding sustained market directions. The choice depends on trading goals: high-frequency bots suit ultra-short-term, high-volume strategies, while trend-following bots align with more patient, momentum-based investment approaches.

Connection

High frequency trading bots and trend following bots both leverage algorithmic strategies to maximize trading profits through automation but focus on different market dynamics and timeframes. High frequency trading bots execute thousands of trades per second to exploit minute price discrepancies, while trend following bots identify and capitalize on sustained price movements across longer periods. Their connection lies in their reliance on quantitative data analysis and real-time market information to optimize trade execution and risk management.

Key Terms

Timeframe

Trend following bots operate on longer timeframes, typically holding positions from days to weeks, leveraging moving averages and momentum indicators to capture sustained market trends. High frequency trading (HFT) bots execute thousands of trades per second, capitalizing on micro-price discrepancies within milliseconds to seconds, relying on ultra-low latency infrastructure and co-location near exchanges. Explore deeper insights into how timeframe strategies impact algorithmic trading performance and risk management.

Trade Frequency

Trend following bots execute trades less frequently, often holding positions for days or weeks to capitalize on sustained market movements, which reduces transaction costs and slippage. High frequency trading (HFT) bots engage in rapid, high-volume trades within milliseconds or seconds, exploiting minute price discrepancies and market inefficiencies for small, consistent profits. Explore how trade frequency impacts strategy performance and risk management to optimize your trading approach.

Execution Speed

Trend following bots execute trades based on longer-term market movements, allowing for more relaxed execution speeds compared to high frequency trading (HFT) bots, which rely on ultra-fast execution measured in microseconds to capitalize on minute price discrepancies. HFT bots deploy advanced algorithms and co-location strategies to minimize latency and maximize trade execution speed, essential for capturing fleeting arbitrage opportunities in volatile markets. Discover how these differing execution speeds impact profitability and risk management in automated trading systems.

Source and External Links

Discover Trend-Following Bots: Boost Your Trading Efficiency - Trend-following bots are automated trading systems that use algorithmic strategies to detect market trends, execute trades based on those trends, and offer customizable settings for risk management, pattern recognition, and real-time monitoring to improve trading efficiency and consistency.

Trend Following Trading Bot | Ride Market Trends with 3Commas - These bots monitor technical signals to initiate trades at trend starts, using tools like trailing take-profits and dynamic stop-losses to stay in profitable trends, with features that support beginner to intermediate traders through automation and integration with TradingView strategies.

5+ Best AI Trading Bots in 2025 - Core Devs Ltd - Trend-following bots are specialized AI systems focusing on market trend identification and execution, alongside other bot types like high-frequency, mean reversion, and sentiment analysis bots, offering diversified approaches to automated trading.

dowidth.com

dowidth.com