Liquidity mining involves providing funds to decentralized finance (DeFi) platforms to earn rewards, enhancing market liquidity and generating passive income through trading fees and token incentives. Spot trading, on the other hand, refers to the immediate purchase or sale of assets like cryptocurrencies or stocks at current market prices, focusing on direct ownership and price speculation. Explore more to understand which trading strategy aligns best with your investment goals.

Why it is important

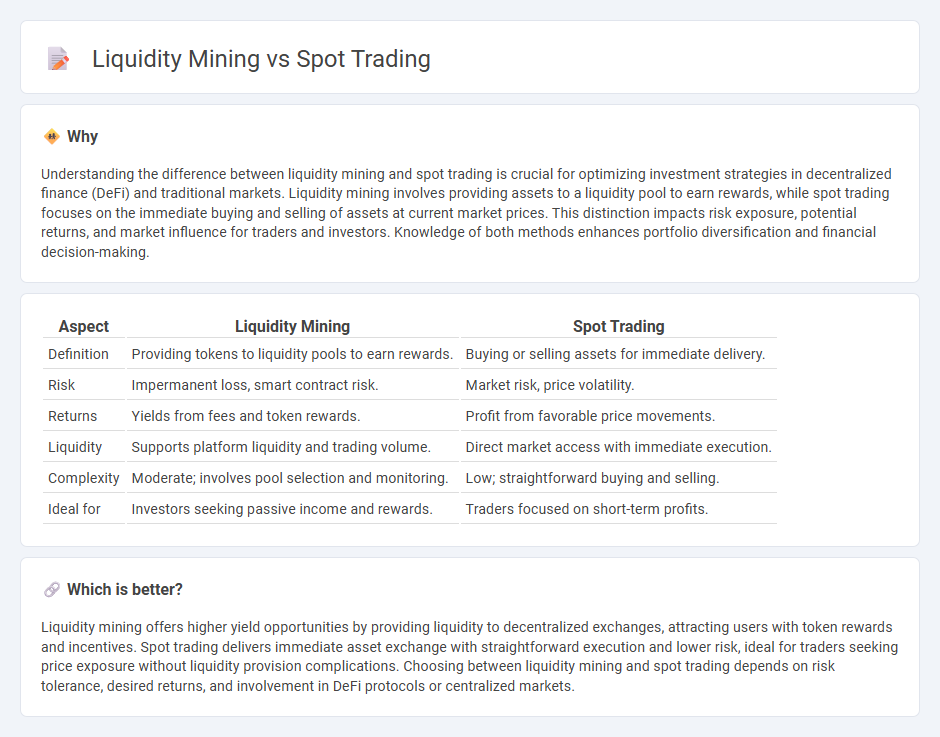

Understanding the difference between liquidity mining and spot trading is crucial for optimizing investment strategies in decentralized finance (DeFi) and traditional markets. Liquidity mining involves providing assets to a liquidity pool to earn rewards, while spot trading focuses on the immediate buying and selling of assets at current market prices. This distinction impacts risk exposure, potential returns, and market influence for traders and investors. Knowledge of both methods enhances portfolio diversification and financial decision-making.

Comparison Table

| Aspect | Liquidity Mining | Spot Trading |

|---|---|---|

| Definition | Providing tokens to liquidity pools to earn rewards. | Buying or selling assets for immediate delivery. |

| Risk | Impermanent loss, smart contract risk. | Market risk, price volatility. |

| Returns | Yields from fees and token rewards. | Profit from favorable price movements. |

| Liquidity | Supports platform liquidity and trading volume. | Direct market access with immediate execution. |

| Complexity | Moderate; involves pool selection and monitoring. | Low; straightforward buying and selling. |

| Ideal for | Investors seeking passive income and rewards. | Traders focused on short-term profits. |

Which is better?

Liquidity mining offers higher yield opportunities by providing liquidity to decentralized exchanges, attracting users with token rewards and incentives. Spot trading delivers immediate asset exchange with straightforward execution and lower risk, ideal for traders seeking price exposure without liquidity provision complications. Choosing between liquidity mining and spot trading depends on risk tolerance, desired returns, and involvement in DeFi protocols or centralized markets.

Connection

Liquidity mining enhances spot trading by providing ample market liquidity, which reduces price slippage and volatility during transactions. Traders benefit from deeper order books and tighter spreads, resulting in more efficient and cost-effective spot trading experiences. The incentives offered in liquidity mining programs attract more participants, further boosting the overall liquidity available for spot markets.

Key Terms

Order Book

Spot trading involves buying or selling assets immediately at the current market price using an order book that records buy and sell orders to match trades efficiently. Liquidity mining incentivizes users to provide liquidity to decentralized exchanges by depositing assets into liquidity pools, often bypassing the traditional order book system. Explore how these mechanisms impact market efficiency and trader opportunities in depth.

Yield Farming

Spot trading involves buying and selling cryptocurrencies at current market prices, enabling immediate ownership transfer and straightforward profit realization. Liquidity mining in Yield Farming entails providing assets to decentralized pools in return for rewards, leveraging DeFi protocols to generate passive income through yield optimization strategies. Explore diverse Yield Farming opportunities to maximize returns and deepen your understanding of automated liquidity provision.

Market Price

Spot trading involves buying and selling assets at current market prices, reflecting real-time supply and demand. In contrast, liquidity mining rewards users for providing liquidity, often impacting market prices by increasing bid-ask spreads and reducing volatility. Explore the dynamics of spot trading and liquidity mining to understand their effects on market price efficiency.

Source and External Links

Differences of Spot Trading vs. Day Trading - Nasdaq - Spot trading involves the immediate exchange of assets such as currencies, commodities, or securities at the current market price, with transactions typically settled within two business days.

What is spot trading in crypto and how does it work? - Coinbase - Spot trading in crypto is the process of buying and selling digital currencies at their current market prices, allowing traders to own the assets they acquire immediately.

What is Spot Trading and How Do You Trade Spot Markets? - IG - Spot trading is buying and selling assets at the spot price with the intention of immediate delivery, popular among day traders and available via various markets including commodities, forex, and shares.

dowidth.com

dowidth.com