Pair trading leverages the statistical relationship between two correlated assets to identify profitable divergences, aiming to capitalize on the convergence of their price spread. Mean reversion strategies focus on exploiting price deviations from an asset's historical average, betting that prices will revert back to the mean over time. Explore detailed comparisons and strategy implementations to enhance your trading expertise.

Why it is important

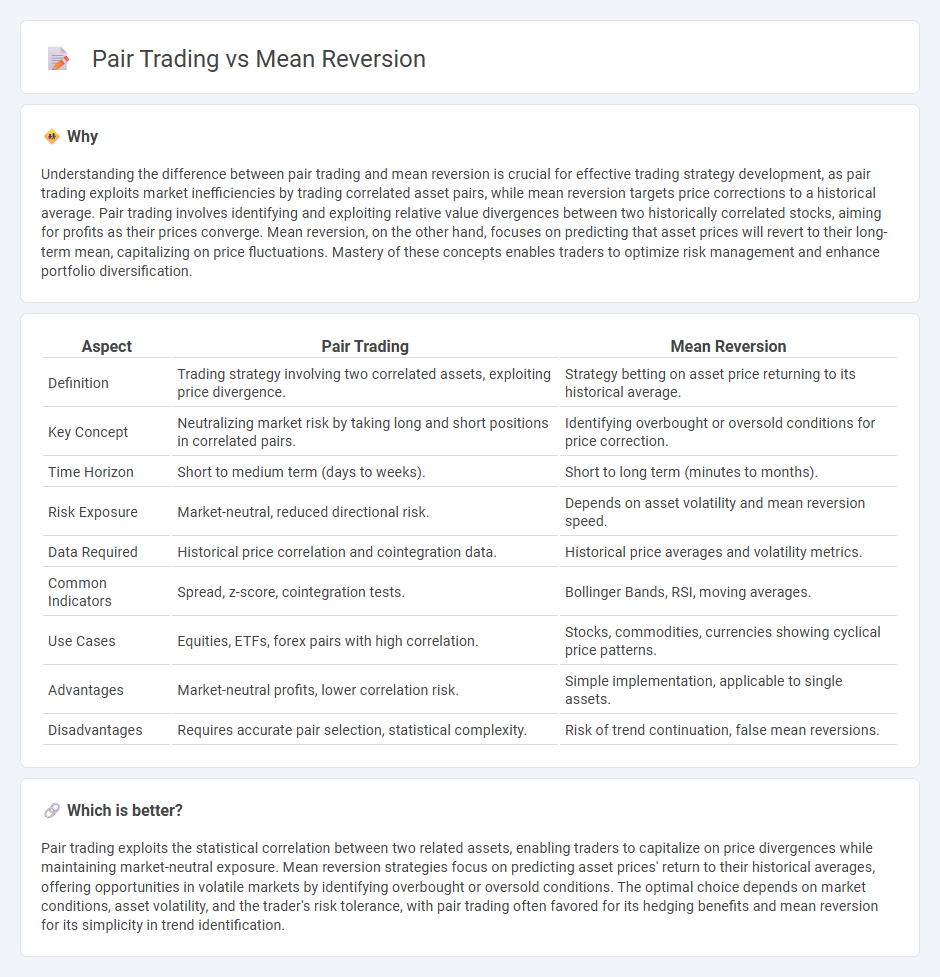

Understanding the difference between pair trading and mean reversion is crucial for effective trading strategy development, as pair trading exploits market inefficiencies by trading correlated asset pairs, while mean reversion targets price corrections to a historical average. Pair trading involves identifying and exploiting relative value divergences between two historically correlated stocks, aiming for profits as their prices converge. Mean reversion, on the other hand, focuses on predicting that asset prices will revert to their long-term mean, capitalizing on price fluctuations. Mastery of these concepts enables traders to optimize risk management and enhance portfolio diversification.

Comparison Table

| Aspect | Pair Trading | Mean Reversion |

|---|---|---|

| Definition | Trading strategy involving two correlated assets, exploiting price divergence. | Strategy betting on asset price returning to its historical average. |

| Key Concept | Neutralizing market risk by taking long and short positions in correlated pairs. | Identifying overbought or oversold conditions for price correction. |

| Time Horizon | Short to medium term (days to weeks). | Short to long term (minutes to months). |

| Risk Exposure | Market-neutral, reduced directional risk. | Depends on asset volatility and mean reversion speed. |

| Data Required | Historical price correlation and cointegration data. | Historical price averages and volatility metrics. |

| Common Indicators | Spread, z-score, cointegration tests. | Bollinger Bands, RSI, moving averages. |

| Use Cases | Equities, ETFs, forex pairs with high correlation. | Stocks, commodities, currencies showing cyclical price patterns. |

| Advantages | Market-neutral profits, lower correlation risk. | Simple implementation, applicable to single assets. |

| Disadvantages | Requires accurate pair selection, statistical complexity. | Risk of trend continuation, false mean reversions. |

Which is better?

Pair trading exploits the statistical correlation between two related assets, enabling traders to capitalize on price divergences while maintaining market-neutral exposure. Mean reversion strategies focus on predicting asset prices' return to their historical averages, offering opportunities in volatile markets by identifying overbought or oversold conditions. The optimal choice depends on market conditions, asset volatility, and the trader's risk tolerance, with pair trading often favored for its hedging benefits and mean reversion for its simplicity in trend identification.

Connection

Pair trading relies on mean reversion by identifying two correlated assets whose price ratio deviates from its historical average, signaling potential trade opportunities. When the spread between the pair widens beyond the mean, traders anticipate a reversion to the average, executing simultaneous long and short positions to capitalize on the expected convergence. This strategy reduces market risk by focusing on relative value rather than directional market moves.

Key Terms

**Mean Reversion:**

Mean reversion trading strategy capitalizes on the tendency of asset prices to revert to their historical average or mean level after deviating significantly. This approach uses statistical measures such as moving averages, Bollinger Bands, or z-scores to identify overbought or oversold conditions, enabling traders to predict potential price corrections. Explore how mean reversion techniques can enhance your market timing and risk management by learning more about its methodologies and applications.

Statistical Arbitrage

Mean reversion and pair trading are fundamental strategies within statistical arbitrage, leveraging price trends to capitalize on market inefficiencies. Mean reversion assumes prices will revert to their historical mean, while pair trading identifies correlated asset pairs to exploit temporary divergences. Explore detailed analyses and performance metrics to master statistical arbitrage techniques.

Z-Score

Mean reversion strategies rely on the assumption that asset prices will revert to their historical average, often measured using Z-Score to identify deviations from the mean. Pair trading involves selecting two historically correlated securities and using the Z-Score of the price spread to detect divergence and predict convergence. Explore the critical role of Z-Score in distinguishing effective mean reversion from pair trading models.

Source and External Links

Mean Reversion Strategies: Introduction, Trading, Strategies and More - Mean reversion is a financial theory where asset prices and returns tend to revert to their historical mean, and trading strategies involve identifying the mean price, spotting deviations, generating buy/sell signals, and executing trades accordingly.

Mean reversion (finance) - Wikipedia - Mean reversion refers to the assumption that asset prices will converge to an average price over time, forming the basis of timing strategies that rely on price deviations to identify buying and selling points.

Mean Reversion - Overview, Trading, Impact of Catalysts - This theory states asset prices and returns move toward a long-term mean, and traders use deviations from this mean to decide when to buy undervalued or sell overvalued securities, often factoring in catalysts to predict price movements.

dowidth.com

dowidth.com