Dark pool aggregation combines multiple non-exchange trading venues to enhance liquidity and reduce market impact, optimizing trade execution for institutional investors. Internalization involves brokers matching client orders internally without routing them to public exchanges, potentially lowering transaction costs but raising concerns about price transparency. Explore how these trading mechanisms influence market efficiency and order execution quality.

Why it is important

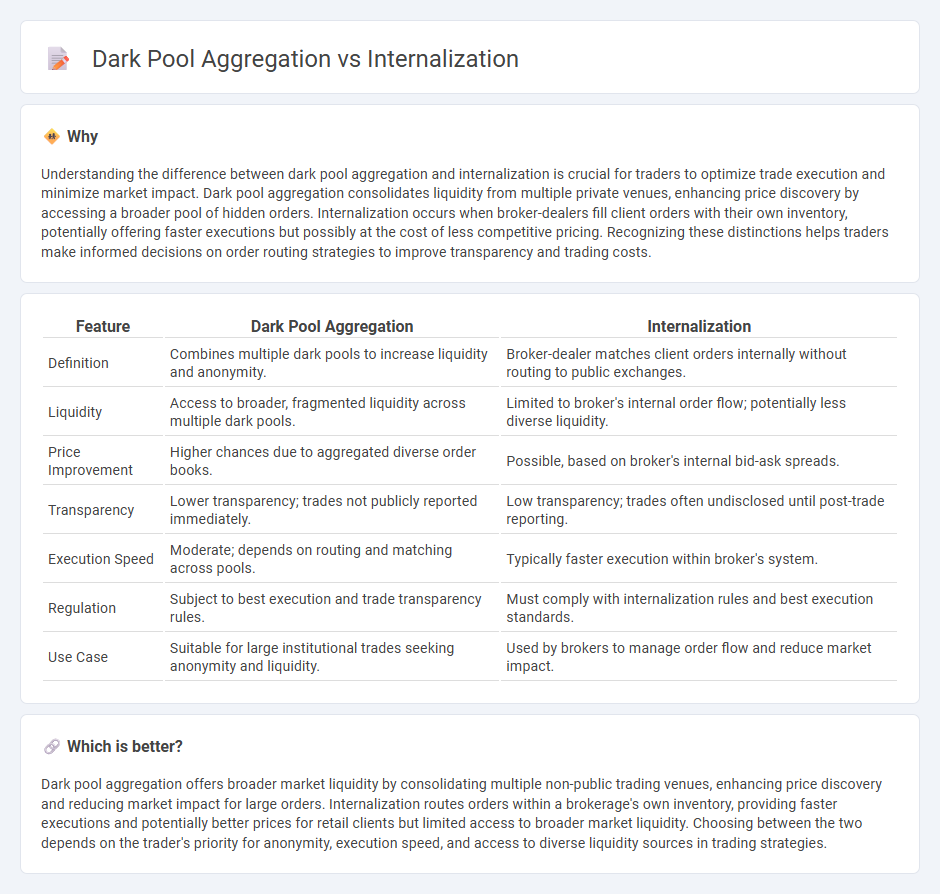

Understanding the difference between dark pool aggregation and internalization is crucial for traders to optimize trade execution and minimize market impact. Dark pool aggregation consolidates liquidity from multiple private venues, enhancing price discovery by accessing a broader pool of hidden orders. Internalization occurs when broker-dealers fill client orders with their own inventory, potentially offering faster executions but possibly at the cost of less competitive pricing. Recognizing these distinctions helps traders make informed decisions on order routing strategies to improve transparency and trading costs.

Comparison Table

| Feature | Dark Pool Aggregation | Internalization |

|---|---|---|

| Definition | Combines multiple dark pools to increase liquidity and anonymity. | Broker-dealer matches client orders internally without routing to public exchanges. |

| Liquidity | Access to broader, fragmented liquidity across multiple dark pools. | Limited to broker's internal order flow; potentially less diverse liquidity. |

| Price Improvement | Higher chances due to aggregated diverse order books. | Possible, based on broker's internal bid-ask spreads. |

| Transparency | Lower transparency; trades not publicly reported immediately. | Low transparency; trades often undisclosed until post-trade reporting. |

| Execution Speed | Moderate; depends on routing and matching across pools. | Typically faster execution within broker's system. |

| Regulation | Subject to best execution and trade transparency rules. | Must comply with internalization rules and best execution standards. |

| Use Case | Suitable for large institutional trades seeking anonymity and liquidity. | Used by brokers to manage order flow and reduce market impact. |

Which is better?

Dark pool aggregation offers broader market liquidity by consolidating multiple non-public trading venues, enhancing price discovery and reducing market impact for large orders. Internalization routes orders within a brokerage's own inventory, providing faster executions and potentially better prices for retail clients but limited access to broader market liquidity. Choosing between the two depends on the trader's priority for anonymity, execution speed, and access to diverse liquidity sources in trading strategies.

Connection

Dark pool aggregation involves consolidating multiple dark liquidity pools to enhance price discovery and reduce market impact, while internalization refers to brokers executing client orders within their own inventory instead of public exchanges. Both practices are interconnected as they aim to improve trade execution quality by minimizing market footprint and reducing transaction costs. Aggregated dark pools provide brokers with a broader internalized liquidity source, optimizing order matching and enhancing overall trading efficiency.

Key Terms

Order Flow

Internalization involves brokers filling client orders using their own inventory, resulting in reduced market transparency but often faster execution with potentially better pricing. Dark pool aggregation consolidates liquidity across multiple private venues, allowing large orders to execute with minimal market impact and lower information leakage. Explore further to understand how these mechanisms influence order flow dynamics and overall trading strategies.

Liquidity

Internalization involves broker-dealers executing client orders within their own networks, offering immediate liquidity but potentially less price transparency. Dark pool aggregation consolidates orders across multiple private trading venues to access larger liquidity pools while maintaining anonymity and minimizing market impact. Explore how these mechanisms affect market efficiency and trade execution quality in greater detail.

Execution Transparency

Internalization occurs when broker-dealers execute client orders within their own inventory, potentially limiting price discovery and reducing market transparency. Dark pool aggregation consolidates multiple non-public trading venues, enhancing execution quality by accessing a broader liquidity pool while maintaining confidentiality. Explore how these mechanisms impact execution transparency and trading efficiency in today's markets.

Source and External Links

Internalization (sociology) - Internalization is the process by which an individual accepts and integrates norms, values, attitudes, and behaviors established by others into their own identity, often through socialization and unconscious assimilation, shaping moral and social development.

Internalization: A Cognitive Process - Internalization in psychology refers to how individuals subconsciously adopt and integrate external attitudes, norms, and values into their own cognitive and behavioral framework, transforming them into intrinsic motivations that influence identity and self-regulation.

INTERNALIZATION definition | Cambridge English Dictionary - Internalization means accepting or absorbing an idea, belief, or value so thoroughly that it becomes a fundamental part of one's character or behavior, commonly influencing moral and social development.

dowidth.com

dowidth.com