Zero knowledge proof trading enhances privacy by allowing transactions to be verified without revealing sensitive details, ensuring secure asset exchange on blockchain platforms. Dark pool trading involves private exchanges where large orders are executed anonymously, minimizing market impact and information leakage. Explore the distinct mechanisms and benefits of zero knowledge proof and dark pool trading to understand their roles in modern financial markets.

Why it is important

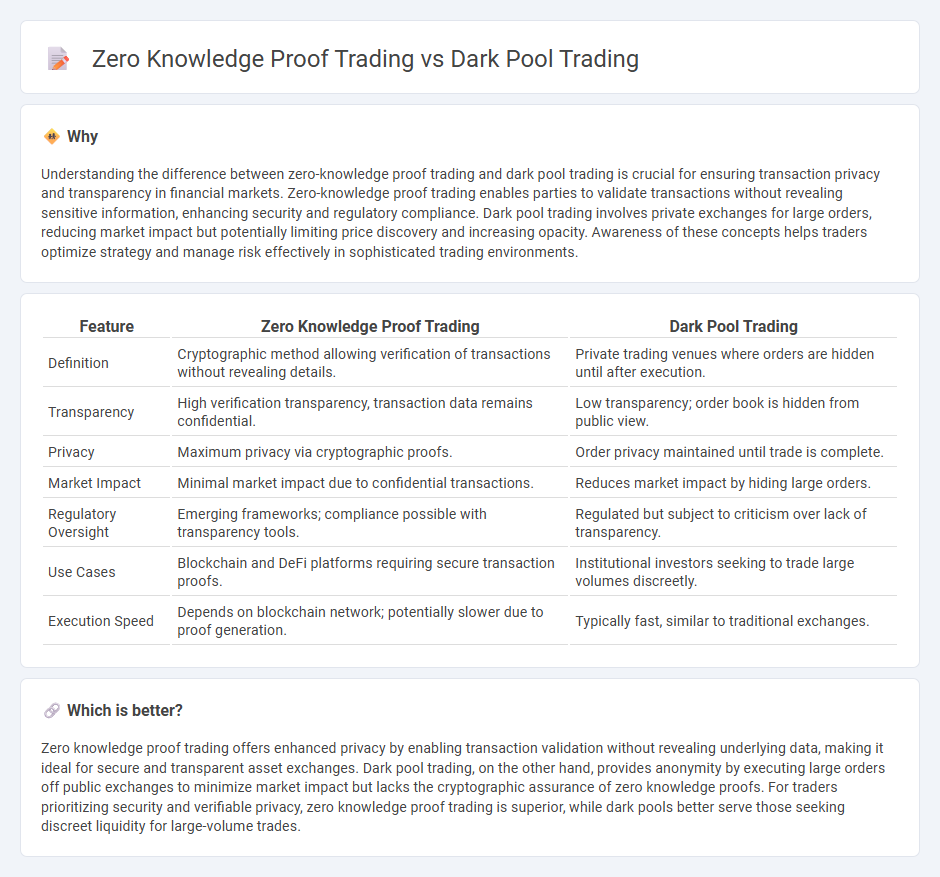

Understanding the difference between zero-knowledge proof trading and dark pool trading is crucial for ensuring transaction privacy and transparency in financial markets. Zero-knowledge proof trading enables parties to validate transactions without revealing sensitive information, enhancing security and regulatory compliance. Dark pool trading involves private exchanges for large orders, reducing market impact but potentially limiting price discovery and increasing opacity. Awareness of these concepts helps traders optimize strategy and manage risk effectively in sophisticated trading environments.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Dark Pool Trading |

|---|---|---|

| Definition | Cryptographic method allowing verification of transactions without revealing details. | Private trading venues where orders are hidden until after execution. |

| Transparency | High verification transparency, transaction data remains confidential. | Low transparency; order book is hidden from public view. |

| Privacy | Maximum privacy via cryptographic proofs. | Order privacy maintained until trade is complete. |

| Market Impact | Minimal market impact due to confidential transactions. | Reduces market impact by hiding large orders. |

| Regulatory Oversight | Emerging frameworks; compliance possible with transparency tools. | Regulated but subject to criticism over lack of transparency. |

| Use Cases | Blockchain and DeFi platforms requiring secure transaction proofs. | Institutional investors seeking to trade large volumes discreetly. |

| Execution Speed | Depends on blockchain network; potentially slower due to proof generation. | Typically fast, similar to traditional exchanges. |

Which is better?

Zero knowledge proof trading offers enhanced privacy by enabling transaction validation without revealing underlying data, making it ideal for secure and transparent asset exchanges. Dark pool trading, on the other hand, provides anonymity by executing large orders off public exchanges to minimize market impact but lacks the cryptographic assurance of zero knowledge proofs. For traders prioritizing security and verifiable privacy, zero knowledge proof trading is superior, while dark pools better serve those seeking discreet liquidity for large-volume trades.

Connection

Zero knowledge proof trading enhances Dark pool trading by enabling confidential transaction verification without revealing trade details, thus preserving anonymity and data integrity. Dark pools rely on privacy-preserving technologies to minimize market impact and prevent information leakage, where zero knowledge proofs ensure compliance and trust without compromising sensitive information. This synergy strengthens secure, private trading environments essential for institutional investors seeking discretion in large asset trades.

Key Terms

Anonymity

Dark pool trading ensures anonymity by allowing large-block trades to occur away from public exchanges, minimizing market impact and revealing minimal participant information. Zero knowledge proof trading leverages cryptographic techniques, enabling verification of transaction validity without exposing underlying data, offering a higher degree of privacy and security in trading activities. Explore the distinctions between these methods to understand their impact on confidential trading.

Transaction transparency

Dark pool trading reduces transaction transparency by keeping large trades private to minimize market impact, often limiting information to select participants. Zero knowledge proof trading enhances transparency by allowing verification of transaction validity without revealing the underlying data, ensuring privacy while maintaining trust. Explore how zero knowledge proofs can revolutionize trading transparency in comparison to traditional dark pools.

Regulatory oversight

Dark pool trading operates in private financial markets with limited regulatory oversight, raising concerns about transparency and market manipulation. Zero knowledge proof trading utilizes cryptographic techniques to enhance privacy while maintaining compliance with regulations through verifiable, secure transactions. Explore the evolving regulatory frameworks shaping the future of private and privacy-preserving trading methods.

Source and External Links

Dark pool - Wikipedia - Dark pools are private forums for trading large blocks of securities anonymously to avoid market impact, primarily used by institutional investors; however, they reduce market transparency and may harm overall market efficiency.

Dark Pool - Overview, How It Works, Pros and Cons - Dark pools enable large trades to be executed discreetly without public exposure, thus minimizing price slippage and front-running risk, but they are criticized for lack of regulatory oversight and potential unfair advantages for certain investors.

Dark Pool Transactions | How to See Dark Pool Trades - Bookmap - Dark pools allow institutional investors to trade large volumes without affecting market prices, providing anonymity and reducing slippage, but they obscure true supply and demand, diminishing market transparency for retail traders.

dowidth.com

dowidth.com