Perpetual contracts offer continuous trading without expiration dates, allowing traders to hold positions indefinitely while leveraging price movements in assets like cryptocurrencies. Binary options involve predicting the price direction of an asset within a fixed timeframe, providing all-or-nothing payouts based on simple yes/no outcomes. Explore the nuances of perpetual contracts and binary options to enhance your trading strategy.

Why it is important

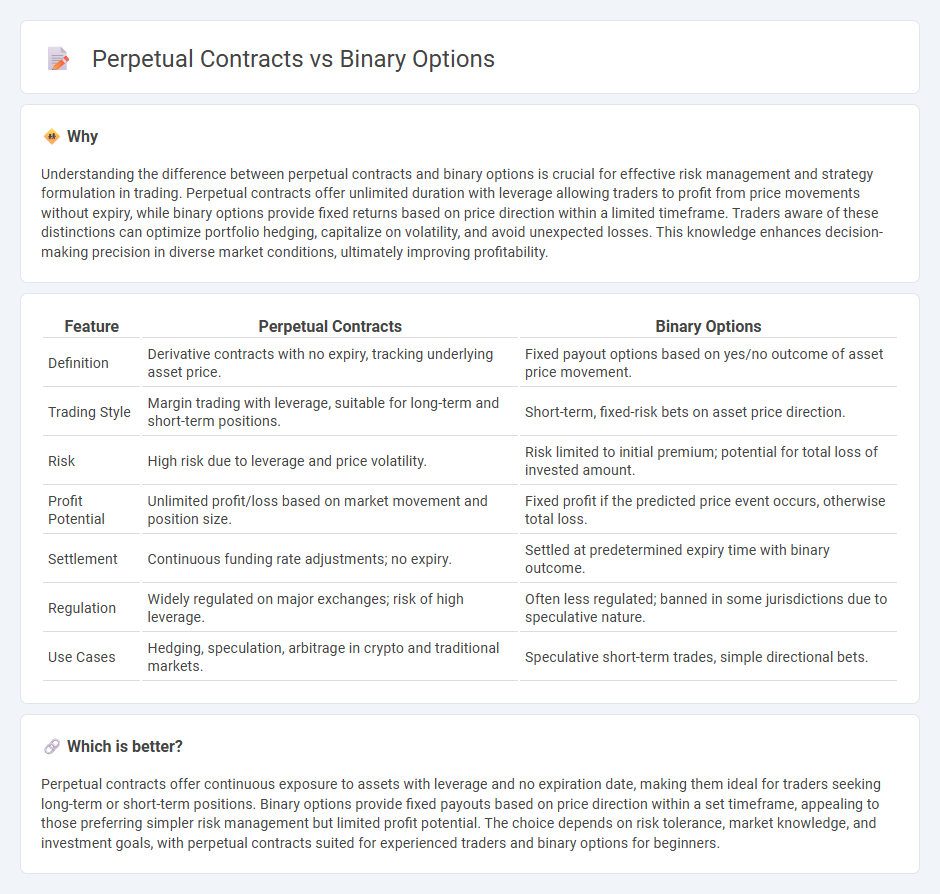

Understanding the difference between perpetual contracts and binary options is crucial for effective risk management and strategy formulation in trading. Perpetual contracts offer unlimited duration with leverage allowing traders to profit from price movements without expiry, while binary options provide fixed returns based on price direction within a limited timeframe. Traders aware of these distinctions can optimize portfolio hedging, capitalize on volatility, and avoid unexpected losses. This knowledge enhances decision-making precision in diverse market conditions, ultimately improving profitability.

Comparison Table

| Feature | Perpetual Contracts | Binary Options |

|---|---|---|

| Definition | Derivative contracts with no expiry, tracking underlying asset price. | Fixed payout options based on yes/no outcome of asset price movement. |

| Trading Style | Margin trading with leverage, suitable for long-term and short-term positions. | Short-term, fixed-risk bets on asset price direction. |

| Risk | High risk due to leverage and price volatility. | Risk limited to initial premium; potential for total loss of invested amount. |

| Profit Potential | Unlimited profit/loss based on market movement and position size. | Fixed profit if the predicted price event occurs, otherwise total loss. |

| Settlement | Continuous funding rate adjustments; no expiry. | Settled at predetermined expiry time with binary outcome. |

| Regulation | Widely regulated on major exchanges; risk of high leverage. | Often less regulated; banned in some jurisdictions due to speculative nature. |

| Use Cases | Hedging, speculation, arbitrage in crypto and traditional markets. | Speculative short-term trades, simple directional bets. |

Which is better?

Perpetual contracts offer continuous exposure to assets with leverage and no expiration date, making them ideal for traders seeking long-term or short-term positions. Binary options provide fixed payouts based on price direction within a set timeframe, appealing to those preferring simpler risk management but limited profit potential. The choice depends on risk tolerance, market knowledge, and investment goals, with perpetual contracts suited for experienced traders and binary options for beginners.

Connection

Perpetual contracts and binary options both belong to the derivatives trading market, offering traders ways to speculate on asset price movements without owning the underlying asset. Perpetual contracts provide unlimited time exposure through futures that do not expire, allowing continuous long or short positions, while binary options offer fixed payouts based on a yes/no outcome within a set timeframe. These instruments share similarities in leveraging price volatility for profit but differ in payoff structures and risk profiles.

Key Terms

Expiry Time (Binary Options)

Binary options feature a fixed expiry time at which the option either expires in-the-money or out-of-the-money, determining the trader's profit or loss instantly. Perpetual contracts, in contrast, have no expiry date, allowing traders to hold positions indefinitely while paying or receiving funding rates periodically. Explore the impact of expiry timings on risk management and trading strategies to enhance your market approach.

Leverage (Perpetual Contracts)

Perpetual contracts offer high leverage, often up to 100x, allowing traders to control large positions with minimal initial capital, unlike binary options which typically have fixed payouts and no leverage. This leverage amplifies both potential profits and risks, requiring effective risk management strategies. Explore detailed comparisons to understand how leverage impacts trading outcomes in perpetual contracts versus binary options.

Settlement Mechanism

Binary options settle with a fixed payout upon expiration, where the outcome is determined by a simple yes/no condition based on asset price relative to a strike price. Perpetual contracts use a continuous funding rate system to anchor the contract price to the underlying asset's spot price without a fixed expiration date, enabling ongoing settlement adjustments. Explore detailed mechanisms and strategies for both instruments to optimize trading decisions.

Source and External Links

What are Binary Options and How to Trade ... - Binary options are a form of trading where you predict if the price of an asset will be above or below a certain price at a specified future time; a correct prediction yields a fixed payout, while an incorrect one results in loss of the investment.

Binary options - A binary option is a financial contract with a payout that depends solely on a yes/no outcome regarding an asset's price relative to a specified level, automatically exercised at expiration with either a fixed amount or nothing.

Binary option - Wikipedia - Binary options are exotic financial options where payoff is all or nothing depending on whether an underlying asset is above or below a set price at a specific time, trading like bets on price direction with fixed maximum payout.

dowidth.com

dowidth.com