Zero knowledge proof trading enhances security and privacy by allowing transactions to be verified without revealing sensitive information, contrasting with traditional trading that requires full transparency of data. This cryptographic method reduces the risk of fraud and protects user anonymity while maintaining trust and compliance. Discover how zero knowledge proof trading transforms market integrity and confidentiality.

Why it is important

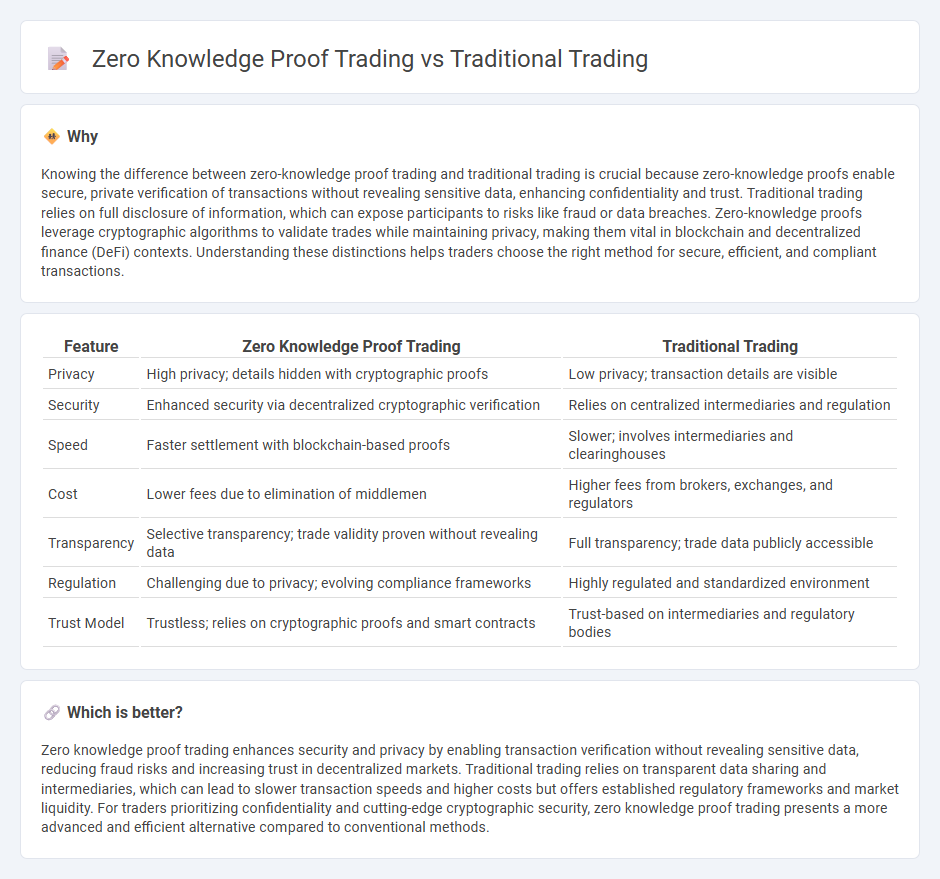

Knowing the difference between zero-knowledge proof trading and traditional trading is crucial because zero-knowledge proofs enable secure, private verification of transactions without revealing sensitive data, enhancing confidentiality and trust. Traditional trading relies on full disclosure of information, which can expose participants to risks like fraud or data breaches. Zero-knowledge proofs leverage cryptographic algorithms to validate trades while maintaining privacy, making them vital in blockchain and decentralized finance (DeFi) contexts. Understanding these distinctions helps traders choose the right method for secure, efficient, and compliant transactions.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Traditional Trading |

|---|---|---|

| Privacy | High privacy; details hidden with cryptographic proofs | Low privacy; transaction details are visible |

| Security | Enhanced security via decentralized cryptographic verification | Relies on centralized intermediaries and regulation |

| Speed | Faster settlement with blockchain-based proofs | Slower; involves intermediaries and clearinghouses |

| Cost | Lower fees due to elimination of middlemen | Higher fees from brokers, exchanges, and regulators |

| Transparency | Selective transparency; trade validity proven without revealing data | Full transparency; trade data publicly accessible |

| Regulation | Challenging due to privacy; evolving compliance frameworks | Highly regulated and standardized environment |

| Trust Model | Trustless; relies on cryptographic proofs and smart contracts | Trust-based on intermediaries and regulatory bodies |

Which is better?

Zero knowledge proof trading enhances security and privacy by enabling transaction verification without revealing sensitive data, reducing fraud risks and increasing trust in decentralized markets. Traditional trading relies on transparent data sharing and intermediaries, which can lead to slower transaction speeds and higher costs but offers established regulatory frameworks and market liquidity. For traders prioritizing confidentiality and cutting-edge cryptographic security, zero knowledge proof trading presents a more advanced and efficient alternative compared to conventional methods.

Connection

Zero-knowledge proof trading enhances traditional trading by enabling secure and confidential transactions without revealing sensitive information, thereby increasing trust and privacy in financial exchanges. Traditional trading relies on transparent data sharing, while integrating zero-knowledge proofs allows verification of trade legitimacy without exposing underlying details. This connection supports more efficient, secure market operations, reducing fraud and maintaining compliance with regulatory standards.

Key Terms

Traditional trading: Order book, Broker, Settlement

Traditional trading relies on an order book to match buy and sell orders, with brokers facilitating transactions between parties. Settlement involves clearing trades through centralized intermediaries, ensuring funds and assets are exchanged securely but often with delays and fees. Explore the mechanics and challenges of traditional trading to understand its foundational role in financial markets.

Zero knowledge proof trading: Privacy, Cryptographic proof, Decentralization

Zero knowledge proof trading offers enhanced privacy by allowing users to prove transaction validity without revealing sensitive data, leveraging advanced cryptographic proofs to secure exchanges. This technology supports decentralization by enabling trustless interactions on blockchain platforms, reducing reliance on centralized intermediaries. Discover how zero knowledge proof trading transforms security and confidentiality in modern digital markets.

Order Book

Traditional trading platforms rely on centralized order books, where buy and sell orders are openly displayed, enabling transparent price discovery but exposing trader information. Zero knowledge proof (ZKP) trading introduces privacy by allowing verification of trades and orders without revealing critical details, ensuring confidentiality while maintaining trust in the order book's integrity. Explore how ZKP can revolutionize order book transparency and privacy in modern trading systems.

Source and External Links

Algo Trading vs Traditional Trading: A Comprehensive Comparison - Traditional trading is a manual approach where human traders make buy and sell decisions based on market data and intuition, without automated algorithms; traders place each order manually and rely heavily on judgment and emotion.

Traditional Investing vs. Algo Trading: Which Strategy is Best for You? - Traditional trading involves buying and selling financial assets like stocks or bonds through established exchanges, typically via brokers, and emphasizes control, flexibility, fundamental analysis, and portfolio diversification without requiring coding knowledge.

Difference Between Online Trading and Offline Trading - Offline trading, also called traditional trading, means placing buy/sell orders through a physical broker by visiting an office or phone, relying on personal interaction and professional guidance but often having higher costs and slower execution than online trading.

dowidth.com

dowidth.com