Airdrop farming involves strategically collecting free tokens distributed by blockchain projects to maximize potential gains without significant capital investment. Swing trading focuses on capturing short- to medium-term price movements in cryptocurrencies by analyzing market trends and technical indicators. Explore the distinct advantages and strategies of airdrop farming versus swing trading to optimize your trading portfolio.

Why it is important

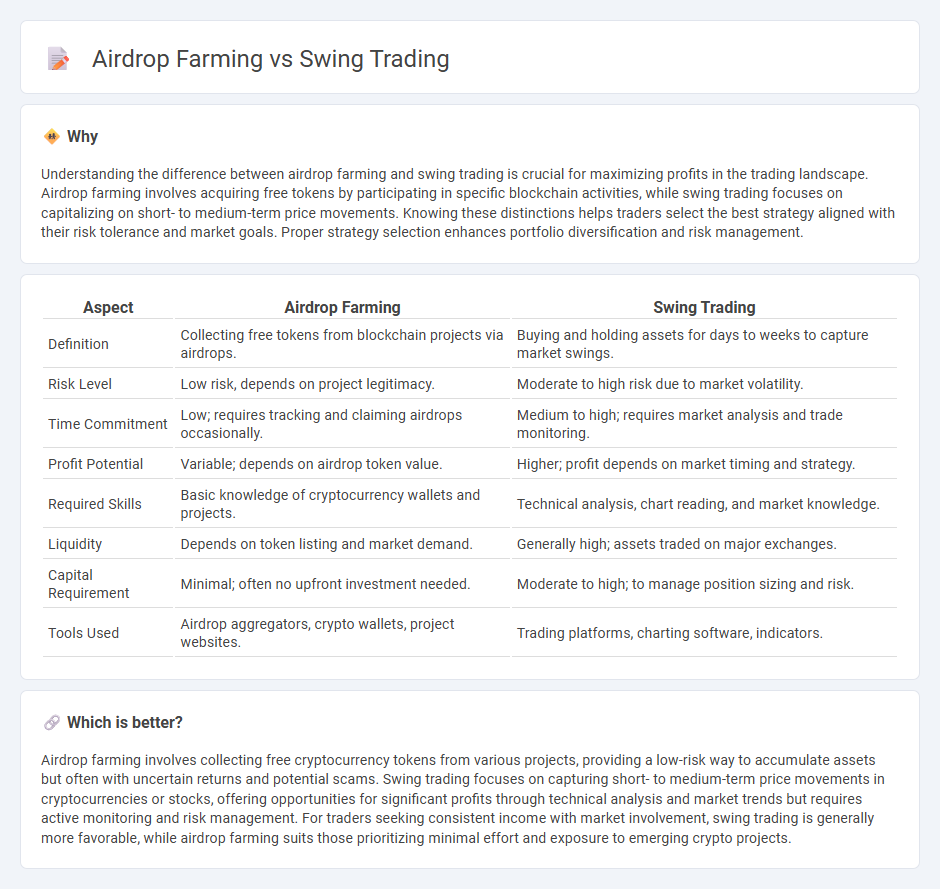

Understanding the difference between airdrop farming and swing trading is crucial for maximizing profits in the trading landscape. Airdrop farming involves acquiring free tokens by participating in specific blockchain activities, while swing trading focuses on capitalizing on short- to medium-term price movements. Knowing these distinctions helps traders select the best strategy aligned with their risk tolerance and market goals. Proper strategy selection enhances portfolio diversification and risk management.

Comparison Table

| Aspect | Airdrop Farming | Swing Trading |

|---|---|---|

| Definition | Collecting free tokens from blockchain projects via airdrops. | Buying and holding assets for days to weeks to capture market swings. |

| Risk Level | Low risk, depends on project legitimacy. | Moderate to high risk due to market volatility. |

| Time Commitment | Low; requires tracking and claiming airdrops occasionally. | Medium to high; requires market analysis and trade monitoring. |

| Profit Potential | Variable; depends on airdrop token value. | Higher; profit depends on market timing and strategy. |

| Required Skills | Basic knowledge of cryptocurrency wallets and projects. | Technical analysis, chart reading, and market knowledge. |

| Liquidity | Depends on token listing and market demand. | Generally high; assets traded on major exchanges. |

| Capital Requirement | Minimal; often no upfront investment needed. | Moderate to high; to manage position sizing and risk. |

| Tools Used | Airdrop aggregators, crypto wallets, project websites. | Trading platforms, charting software, indicators. |

Which is better?

Airdrop farming involves collecting free cryptocurrency tokens from various projects, providing a low-risk way to accumulate assets but often with uncertain returns and potential scams. Swing trading focuses on capturing short- to medium-term price movements in cryptocurrencies or stocks, offering opportunities for significant profits through technical analysis and market trends but requires active monitoring and risk management. For traders seeking consistent income with market involvement, swing trading is generally more favorable, while airdrop farming suits those prioritizing minimal effort and exposure to emerging crypto projects.

Connection

Airdrop farming and swing trading intersect through the strategic acquisition and timing of digital assets to maximize profit. Traders participating in airdrop farming accumulate tokens during distribution phases and leverage swing trading techniques to capitalize on market volatility by holding assets for days or weeks. This synergy enhances portfolio growth by combining initial asset acquisition with informed market entry and exit points.

Key Terms

**Swing Trading:**

Swing trading capitalizes on short- to medium-term market momentum, aiming to profit from price swings over days or weeks by analyzing technical indicators and market trends. This strategy requires active monitoring and a solid understanding of market patterns to identify entry and exit points that maximize returns while managing risk. Explore detailed guides and strategies to enhance your swing trading skills and success rate.

Technical Analysis

Swing trading leverages technical analysis by examining price patterns, moving averages, and volume indicators to identify short- to medium-term market trends for potential profit opportunities. Airdrop farming, conversely, relies less on technical analysis and more on strategically participating in blockchain projects and token distributions based on project fundamentals and community engagement. Explore our detailed guide to understand how technical analysis shapes these trading strategies and enhances decision-making.

Entry/Exit Points

Swing trading relies heavily on precise identification of entry and exit points based on technical analysis to capitalize on short- to medium-term market trends, typically holding positions from several days to weeks. Airdrop farming focuses on acquiring free tokens distributed by projects, where entry points coincide with eligibility or snapshot dates but exit strategies depend on token liquidity and market conditions post-distribution. Explore detailed strategies and risk management techniques to optimize both swing trading and airdrop farming outcomes.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where an asset is held for days to profit from price swings, using technical or fundamental analysis with rule-based methods to identify entry and exit points.

What is swing trading & how does it work? - Saxo Bank - Swing trading involves capitalizing on price movements using strategies like breakout trading and trend trading, often guided by technical indicators such as moving averages and volume-weighted averages.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading appeals to trend spotters who hold positions for days or weeks to profit from short-term price changes by using mainly technical analysis and sometimes fundamental analysis.

dowidth.com

dowidth.com