Option selling wheel strategy involves repeatedly selling cash-secured puts and covered calls to generate consistent income while managing stock ownership. Put selling focuses solely on selling cash-secured puts to collect premium income with the potential to acquire stocks at a lower price point. Explore the advantages and risks of each approach to optimize your option selling tactics.

Why it is important

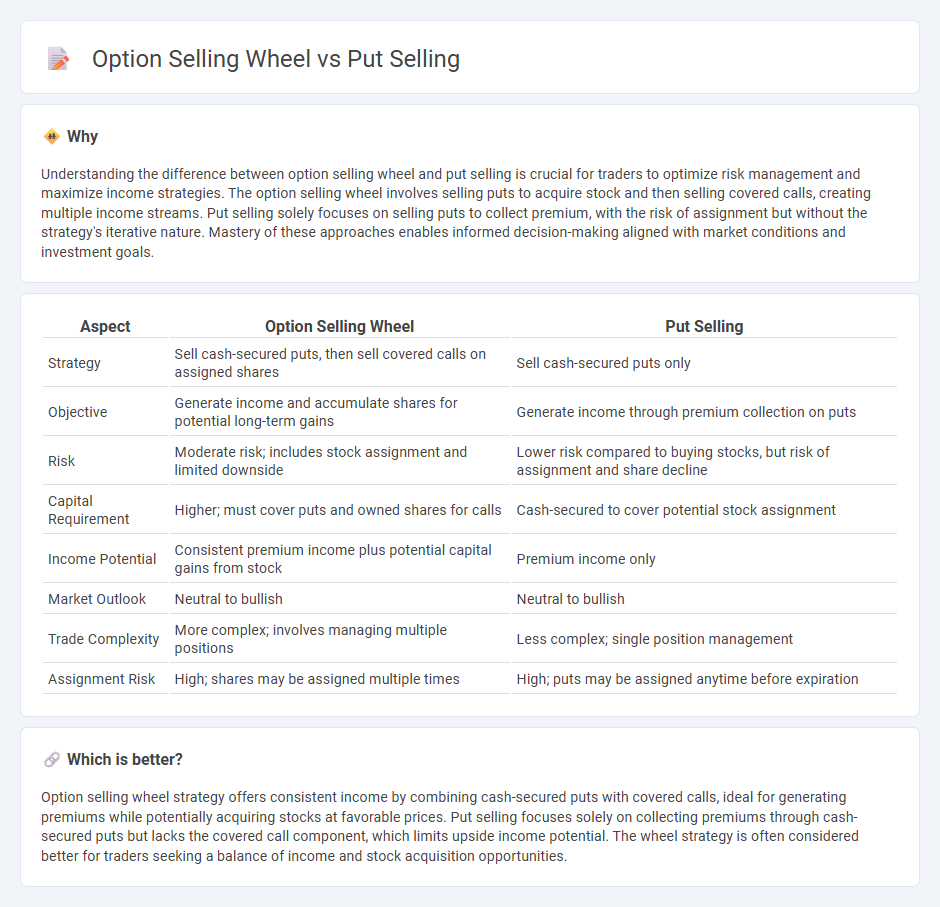

Understanding the difference between option selling wheel and put selling is crucial for traders to optimize risk management and maximize income strategies. The option selling wheel involves selling puts to acquire stock and then selling covered calls, creating multiple income streams. Put selling solely focuses on selling puts to collect premium, with the risk of assignment but without the strategy's iterative nature. Mastery of these approaches enables informed decision-making aligned with market conditions and investment goals.

Comparison Table

| Aspect | Option Selling Wheel | Put Selling |

|---|---|---|

| Strategy | Sell cash-secured puts, then sell covered calls on assigned shares | Sell cash-secured puts only |

| Objective | Generate income and accumulate shares for potential long-term gains | Generate income through premium collection on puts |

| Risk | Moderate risk; includes stock assignment and limited downside | Lower risk compared to buying stocks, but risk of assignment and share decline |

| Capital Requirement | Higher; must cover puts and owned shares for calls | Cash-secured to cover potential stock assignment |

| Income Potential | Consistent premium income plus potential capital gains from stock | Premium income only |

| Market Outlook | Neutral to bullish | Neutral to bullish |

| Trade Complexity | More complex; involves managing multiple positions | Less complex; single position management |

| Assignment Risk | High; shares may be assigned multiple times | High; puts may be assigned anytime before expiration |

Which is better?

Option selling wheel strategy offers consistent income by combining cash-secured puts with covered calls, ideal for generating premiums while potentially acquiring stocks at favorable prices. Put selling focuses solely on collecting premiums through cash-secured puts but lacks the covered call component, which limits upside income potential. The wheel strategy is often considered better for traders seeking a balance of income and stock acquisition opportunities.

Connection

The option selling wheel strategy involves selling put options to acquire stock at a desired price and then selling covered calls on the acquired shares, efficiently combining put selling and call selling to generate income. Put selling is integral to the wheel strategy as it initiates the process by potentially obligating the trader to buy shares if the option is exercised. This connection allows traders to systematically generate premium income while managing stock acquisition and exit points within the trading cycle.

Key Terms

Premium

Put selling involves selling put options to collect premium income, capitalizing on the time decay and stable or rising underlying asset prices. Option selling wheel strategy combines selling puts and calls sequentially to maximize premium collection while managing risk through assignment and writing covered calls. Discover how these premium-focused strategies can enhance income generation and risk management in your trading portfolio.

Assignment

Put selling involves selling put options to collect premiums, with the risk of being assigned to purchase the underlying stock at the strike price if the option is exercised. Option selling wheels combine selling puts and calls in a repetitive strategy, aiming to generate income while managing assignment risk through rolling contracts. Explore the nuances of assignment processes in both strategies to optimize risk and reward effectively.

Expiration

Put selling involves selling put options to collect premiums, hoping the stock price stays above the strike price until expiration to avoid assignment. Option selling wheel combines selling puts and then selling covered calls on assigned stocks, maximizing income through premiums at multiple expiration cycles. Explore how expiration timing impacts premiums and risk management in both strategies for optimized returns.

Source and External Links

Sell a Put Option: What It Is and How to Trade Them - Bullish Bears - Put selling involves selling to open a put option to collect premiums, aiming to profit if the stock stays above the strike price, and is used as an alternative to buying calls with specific exit plans if the stock falls below the strike.

What Are Put Options And How Do They Work? - tastylive - Selling a put means taking the short position in a put option, where the seller collects the premium and may be obligated to buy the underlying stock at the strike price if the put is exercised.

Selling Puts: How to Write a Put Option - NerdWallet - Investors sell puts to generate income from premiums, often to buy stocks at a discount or earn income if the stock remains stable or rises, benefiting from higher premiums in volatile or bearish markets.

dowidth.com

dowidth.com