On-chain analytics examines blockchain data to track transaction histories, wallet behaviors, and network activity, providing transparent insights into cryptocurrency market trends. Order flow analysis focuses on the real-time assessment of buy and sell orders in traditional or crypto exchanges, revealing market sentiment and liquidity dynamics. Discover how integrating these methods can enhance your trading strategies.

Why it is important

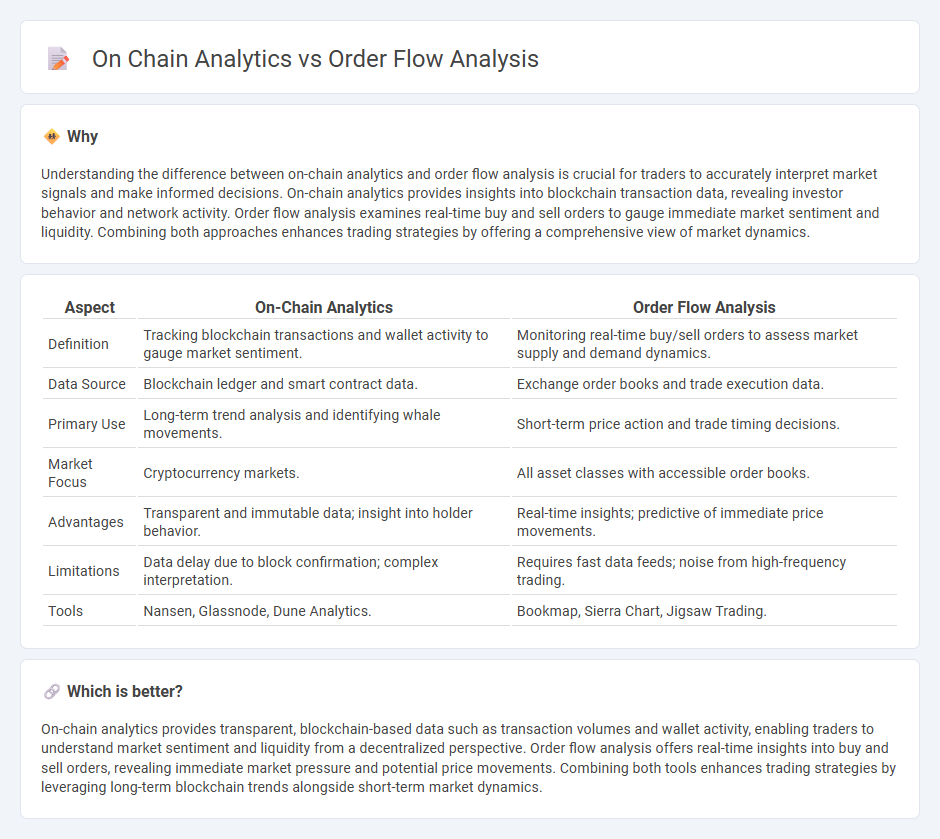

Understanding the difference between on-chain analytics and order flow analysis is crucial for traders to accurately interpret market signals and make informed decisions. On-chain analytics provides insights into blockchain transaction data, revealing investor behavior and network activity. Order flow analysis examines real-time buy and sell orders to gauge immediate market sentiment and liquidity. Combining both approaches enhances trading strategies by offering a comprehensive view of market dynamics.

Comparison Table

| Aspect | On-Chain Analytics | Order Flow Analysis |

|---|---|---|

| Definition | Tracking blockchain transactions and wallet activity to gauge market sentiment. | Monitoring real-time buy/sell orders to assess market supply and demand dynamics. |

| Data Source | Blockchain ledger and smart contract data. | Exchange order books and trade execution data. |

| Primary Use | Long-term trend analysis and identifying whale movements. | Short-term price action and trade timing decisions. |

| Market Focus | Cryptocurrency markets. | All asset classes with accessible order books. |

| Advantages | Transparent and immutable data; insight into holder behavior. | Real-time insights; predictive of immediate price movements. |

| Limitations | Data delay due to block confirmation; complex interpretation. | Requires fast data feeds; noise from high-frequency trading. |

| Tools | Nansen, Glassnode, Dune Analytics. | Bookmap, Sierra Chart, Jigsaw Trading. |

Which is better?

On-chain analytics provides transparent, blockchain-based data such as transaction volumes and wallet activity, enabling traders to understand market sentiment and liquidity from a decentralized perspective. Order flow analysis offers real-time insights into buy and sell orders, revealing immediate market pressure and potential price movements. Combining both tools enhances trading strategies by leveraging long-term blockchain trends alongside short-term market dynamics.

Connection

On-chain analytics provide real-time blockchain data that reveals transaction volumes, wallet activities, and token movements, crucial for understanding market sentiment. Order flow analysis examines the sequence and volume of buy and sell orders, reflecting trader behavior and market liquidity. Integrating on-chain analytics with order flow analysis enhances trading strategies by offering comprehensive insights into market dynamics and potential price movements.

Key Terms

Order flow analysis:

Order flow analysis examines real-time buy and sell orders to identify market sentiment and liquidity, providing traders with actionable insights into price movements and volume dynamics. This method emphasizes tracking transaction data from exchanges, enabling more precise entry and exit timing compared to traditional indicators. Explore order flow analysis in depth to enhance your trading strategies and market understanding.

Order Book

Order flow analysis examines the real-time transactions and order book dynamics within centralized exchanges to identify buy and sell pressures, liquidity shifts, and potential price movements. On-chain analytics, by contrast, tracks blockchain data including wallet activity, transaction volumes, and smart contract interactions to assess market sentiment and asset flows outside traditional order books. Explore deeper insights on how combining order flow analysis with on-chain data enhances trading strategies and market predictions.

Trade Volume

Order flow analysis examines trade volume by tracking real-time buy and sell orders to identify market sentiment and potential price movements. On-chain analytics evaluate trade volume through blockchain data, highlighting transaction counts, wallet activity, and token transfers to assess market trends and investor behavior. Explore deeper insights on how these methodologies impact trading strategies and decision-making.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements, using techniques like reading the order book and volume analysis to identify support and resistance zones.

Order Flow Trading Strategy That Pros Are Using In 2024 - Order flow trading is a type of technical analysis that examines the flow of trading orders and their impact on price, using indicators such as volume profile, order book imbalance, delta, and cumulative delta to identify support and resistance and combine this with price action for trade decisions.

Order Flow Trading & Volumetric Bars | NinjaTrader - This platform offers tools like volumetric bars, volume profile, order flow VWAP, and cumulative delta to visualize buying and selling pressure and trading volume distribution, helping traders identify market trends, reversals, and key support/resistance levels through detailed order flow analysis.

dowidth.com

dowidth.com