Modular blockchains trading leverages scalable, layer-separated architectures to enhance transaction speed and flexibility across decentralized platforms, while Over-the-counter (OTC) trading involves direct asset exchange between parties, minimizing market impact and providing privacy for large-volume transactions. This contrast highlights the efficiency and transparency benefits of modular blockchain solutions against the tailored confidentiality and negotiation advantages of OTC deals. Explore more to understand how these trading methods shape the future of digital asset exchange.

Why it is important

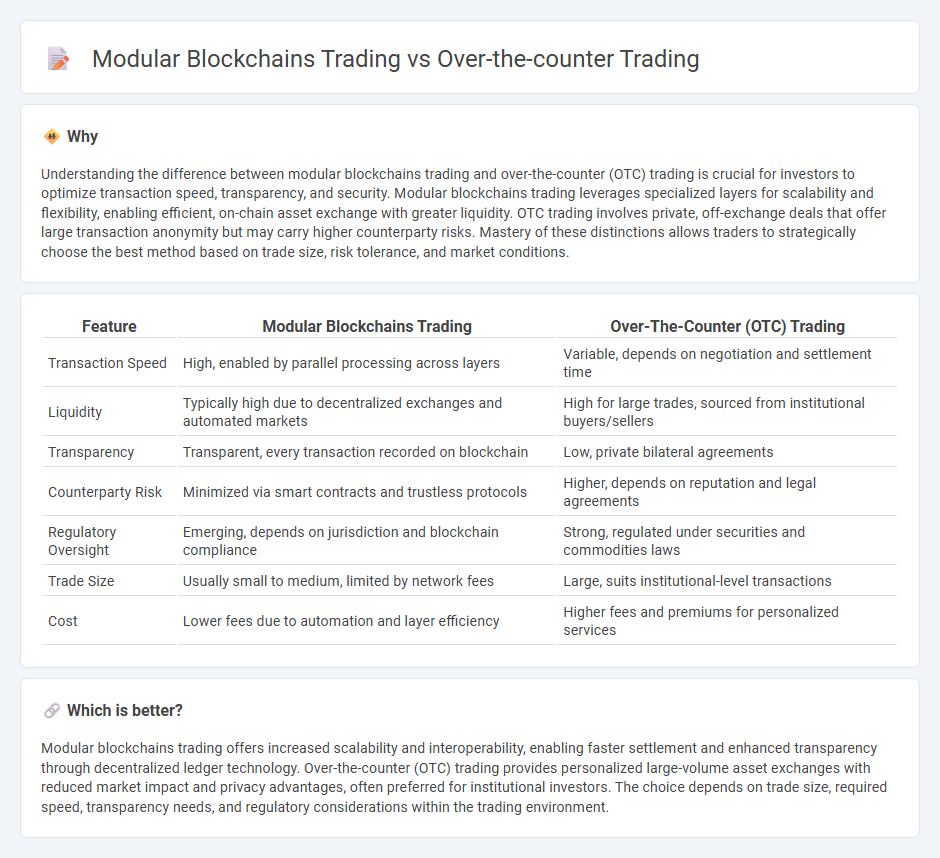

Understanding the difference between modular blockchains trading and over-the-counter (OTC) trading is crucial for investors to optimize transaction speed, transparency, and security. Modular blockchains trading leverages specialized layers for scalability and flexibility, enabling efficient, on-chain asset exchange with greater liquidity. OTC trading involves private, off-exchange deals that offer large transaction anonymity but may carry higher counterparty risks. Mastery of these distinctions allows traders to strategically choose the best method based on trade size, risk tolerance, and market conditions.

Comparison Table

| Feature | Modular Blockchains Trading | Over-The-Counter (OTC) Trading |

|---|---|---|

| Transaction Speed | High, enabled by parallel processing across layers | Variable, depends on negotiation and settlement time |

| Liquidity | Typically high due to decentralized exchanges and automated markets | High for large trades, sourced from institutional buyers/sellers |

| Transparency | Transparent, every transaction recorded on blockchain | Low, private bilateral agreements |

| Counterparty Risk | Minimized via smart contracts and trustless protocols | Higher, depends on reputation and legal agreements |

| Regulatory Oversight | Emerging, depends on jurisdiction and blockchain compliance | Strong, regulated under securities and commodities laws |

| Trade Size | Usually small to medium, limited by network fees | Large, suits institutional-level transactions |

| Cost | Lower fees due to automation and layer efficiency | Higher fees and premiums for personalized services |

Which is better?

Modular blockchains trading offers increased scalability and interoperability, enabling faster settlement and enhanced transparency through decentralized ledger technology. Over-the-counter (OTC) trading provides personalized large-volume asset exchanges with reduced market impact and privacy advantages, often preferred for institutional investors. The choice depends on trade size, required speed, transparency needs, and regulatory considerations within the trading environment.

Connection

Modular blockchains trading enhances Over-the-counter (OTC) trading by providing scalable, customizable layers that improve settlement speed and privacy. OTC trading benefits from modular blockchain architecture through optimized transaction validation processes and secure, off-exchange asset transfers. This integration supports increased liquidity and reduced counterparty risk in decentralized finance markets.

Key Terms

Liquidity

Over-the-counter (OTC) trading offers enhanced liquidity through direct, private transactions between parties, reducing market impact and slippage. Modular blockchains trading leverages specialized layers for settlement, execution, and consensus, enabling scalable and efficient liquidity aggregation across decentralized networks. Explore deeper insights into how liquidity dynamics differ in OTC and modular blockchain trading ecosystems.

Counterparty risk

Over-the-counter (OTC) trading involves direct transactions between parties, exposing participants to significant counterparty risk due to the lack of intermediaries and transparency. In contrast, modular blockchains trading leverages distinct layers for execution, consensus, and data availability, enhancing security and reducing counterparty risk through decentralization and cryptographic guarantees. Explore in-depth how modular blockchain architecture mitigates counterparty risk compared to traditional OTC markets.

Interoperability

Over-the-counter (OTC) trading offers direct asset exchanges between parties, limiting interoperability due to isolated liquidity pools and bespoke agreements. Modular blockchains trading enhances interoperability by enabling seamless asset transfers and smart contract interactions across multiple chains through specialized layers. Explore how modular blockchain architecture revolutionizes trading efficiency and cross-chain asset management.

Source and External Links

What is the Over The Counter (OTC) market? - StoneX - The OTC market is a decentralized trading system where financial instruments like stocks and derivatives are traded directly between parties through dealer networks and electronic platforms, rather than on centralized exchanges, offering flexibility but with less transparency and higher volatility risk.

Over-the-Counter (OTC) - Understand How OTC Trading Works - OTC trading involves securities transactions executed outside formal exchanges via dealer networks, allowing customization of derivatives and access to capital markets for companies not listed on major exchanges, thus increasing overall market liquidity.

What is OTC trading? How to trade securities over-the-counter - OTC trading occurs through brokers connected to networks like the OTC Markets Group, enabling investors to buy and sell over 11,000 securities electronically without directly transacting on an exchange, with regulatory oversight varying by instrument to balance safety and risk.

dowidth.com

dowidth.com